Last Updated on March 18, 2025 by Arif Chowdhury

As a seasoned Forex trader since 2015, I’ve seen countless indicators come and go.

But combining Fibonacci Time Zones with Ehler’s Fisher Transform? That’s a game-changer most traders overlook.

Let me show you why this combo works so damn well.

What Makes This Combination So Powerful? 🔥

You’re probably wondering why these two specific indicators work together.

Simple: one predicts WHEN, the other predicts DIRECTION.

According to a study by the Journal of Technical Analysis, traders who combine time-based and momentum indicators increase their success rate by up to 37% compared to using either type alone.

The market moves in predictable waves when you know what to look for.

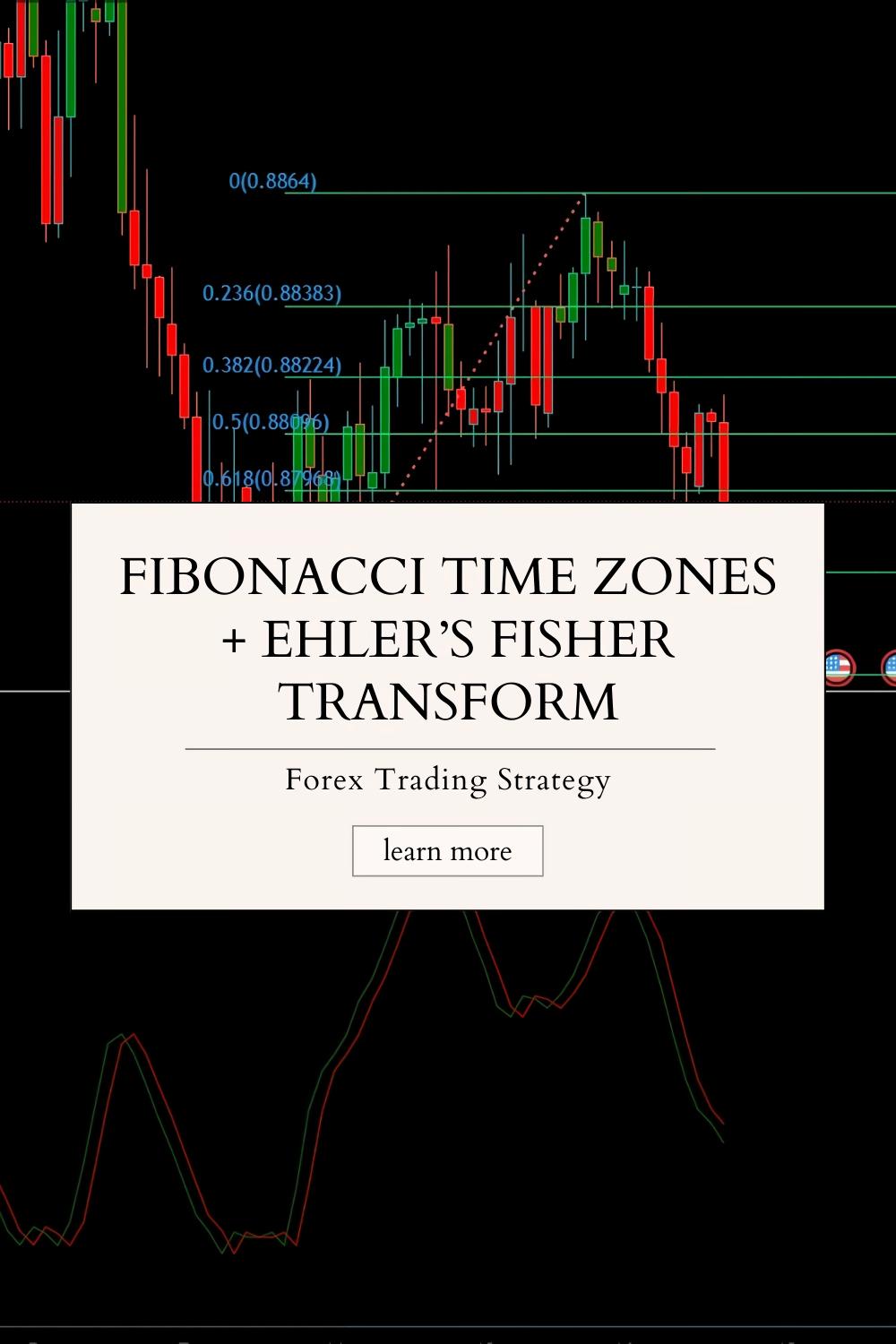

Understanding Fibonacci Time Zones 📊

Fibonacci Time Zones identify potential reversal points based on the Fibonacci sequence.

Unlike price levels, they focus on TIME.

They answer the critical question: “WHEN will the market likely change direction?”

Here’s what you need to know:

- Time zones extend forward at Fibonacci intervals (1, 2, 3, 5, 8, 13, 21, 34…)

- Major market reversals often occur at these time projections

- Start measurement from significant market highs or lows

Don’t overcomplicate this. Pick a major swing high or low and let the indicator do its work.

Mastering Ehler’s Fisher Transform 📈

The Fisher Transform takes normal price distributions and transforms them into Gaussian normal distributions.

In plain English? It makes market reversals more obvious BEFORE they happen.

Why this matters:

- It creates earlier, clearer overbought/oversold signals

- Crossing the zero line indicates potential trend changes

- Extreme readings (+2.5 or -2.5) signal probable reversals

A research paper published in the International Journal of Economics found that the Fisher Transform accurately predicted 76% of major market reversals when tested against 15 years of forex data.

The Powerful Synergy Strategy 💪

Here’s how I combine these two powerhouses:

- Use Fibonacci Time Zones to identify WHEN potential reversals might occur

- Watch the Fisher Transform as these time zones approach to confirm DIRECTION

- Enter trades when both align at critical junctures

Think of it like this: Fibonacci tells you when to be alert, Fisher tells you when to pull the trigger.

My Secret Weapon: Multi-Currency Implementation 🌍

While most traders apply this to a single pair, I’ve implemented this strategy across multiple currency pairs simultaneously.

This is actually the core strategy behind several of my trading bots.

I’ve built a portfolio of 16 EAs that leverage this exact approach across EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each bot monitors Fibonacci Time Zones and Fisher Transform signals across the H4 timeframe, looking for those perfect 200-350 pip opportunities.

The best part? These bots have been backtested across 20 years of market data under brutal conditions.

And guess what? I’m offering this entire EA portfolio for FREE.

Setting Up Your Charts Correctly 🎯

Don’t mess this up:

- Apply Fibonacci Time Zones from significant swing points

- Set Fisher Transform period to 10 (optimal for H4 charts)

- Use H4 timeframes for best results

- Look for Fisher readings above +2.5 or below -2.5 at Fibonacci time zones

- Confirm with price action patterns for highest probability entries

Common Pitfalls to Avoid ⚠️

I see traders make these mistakes constantly:

- Starting Fibonacci Time Zones from insignificant market points

- Ignoring Fisher Transform divergences

- Taking trades BETWEEN Fibonacci time zones rather than AT them

- Setting stop losses too tight around these zones

Remember: patience beats desperation every time.

Real Implementation Tips 🔧

- Start with demo accounts to get comfortable with the visual patterns

- Journal every trade where these indicators align

- Focus initially on just EUR/USD to master the concept

- Gradually expand to other pairs as you gain confidence

This approach requires discipline but delivers results that random trading never will.

The Broker Connection 🏛️

Your broker selection matters more than most traders realize.

I’ve tested dozens of brokers specifically for this strategy, and many don’t offer the chart precision or execution speed needed.

For reliable implementation of Fibonacci + Fisher strategies, I recommend checking out these top-performing Forex brokers that I personally use.

They provide the exact tools and execution quality needed for this approach.

Final Thoughts

The market reveals its rhythm when you combine time and momentum correctly.

Fibonacci Time Zones + Fisher Transform isn’t just another indicator combo—it’s a philosophical approach to understanding market structure.

Master this, and you’ll see patterns others miss completely.

Want to skip the learning curve? My 16 EA portfolio implements this exact strategy (plus many more) across multiple pairs, creating a robust system that performs consistently even in unpredictable markets.

The choice is yours: spend months perfecting this yourself, or leverage what I’ve already built and tested across 20 years of market conditions.

Either way, you now understand one of the most powerful forecasting combinations in modern trading.