Last Updated on February 26, 2025 by Arif Chowdhury

Ever felt like you’re staring at a chart, and the market just doesn’t make sense?

You’re not alone.

Many traders struggle with knowing when to jump in or step back.

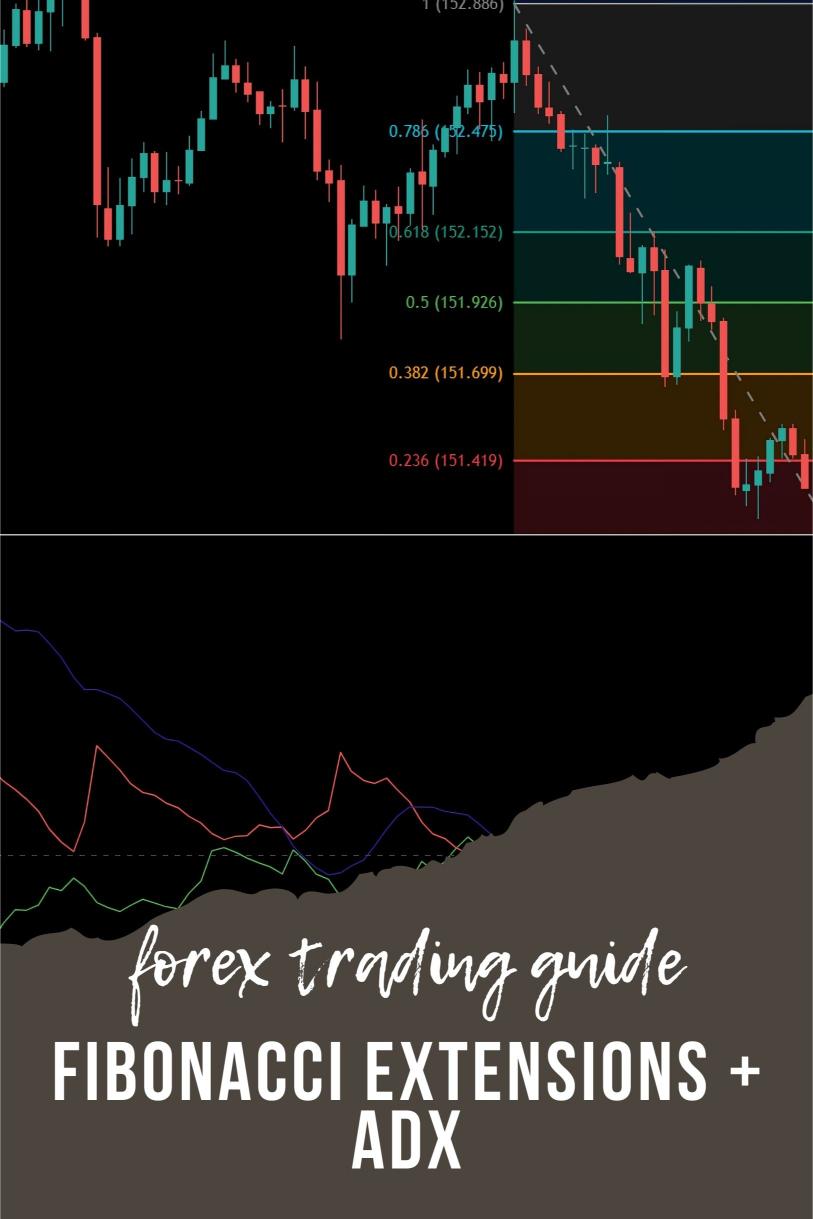

That’s where the Fibonacci Extensions and the Average Directional Index (ADX) come into play.

They’re like your trusty compass in the unpredictable world of Forex.

Understanding Fibonacci Extensions

Let’s break it down.

Fibonacci Extensions help you identify potential price targets after a market move.

Here’s how they work:

- Identify the swing high and low.

- Draw the Fibonacci retracement from the low to the high.

- Extend it beyond the high to find potential resistance or support levels.

Why use Fibonacci?

Statistically, about 61.8% of the time, prices tend to reverse at Fibonacci levels.

That’s a pretty solid reason to have them in your toolkit.

Getting Cozy with the ADX

Now, let’s talk about the Average Directional Index (ADX).

This indicator measures the strength of a trend, not its direction.

Here’s how to use it:

- ADX below 20 means a weak trend.

- ADX above 20 indicates a strong trend.

- ADX above 40 shows a very strong trend.

Think of it as your trend strength meter.

Combining these two powerful tools can help you pinpoint strong market moves.

The Combo Strategy

Here’s the magic formula:

- Use Fibonacci Extensions to set targets.

- Check the ADX to confirm trend strength.

If the ADX is above 20 and you see a Fibonacci level, you’ve got a potential winner.

This strategy is about aligning price action with trend strength.

My Proven Trading Approach

As a seasoned Forex trader since 2015, I’ve explored countless strategies.

What works for me? A unique blend of technical analysis, including Fibonacci and ADX.

Through rigorous backtesting, I’ve developed a robust trading strategy.

And here’s the kicker: I’ve created 16 sophisticated trading bots that utilize this approach.

Each bot is diversified across major pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

This diversification minimizes correlated losses while maximizing overall profitability.

Why You Should Consider My Trading Bots

These aren’t just any bots.

They’re designed to trade long-term, aiming for 200-350 pips.

I’ve backtested these bots over 20 years, and they perform excellently, even under harsh market conditions.

What’s more? I’m offering this entire EA portfolio for FREE!

Curious?Check out my trading bots here.

Putting It All Together

So, how do you use Fibonacci Extensions + ADX together?

- Identify swing highs and lows.

- Draw Fibonacci levels.

- Check the ADX for trend strength.

- Set your targets based on Fibonacci levels.

This combo can give you a clearer picture of where the market is heading.

Best Brokers to Use

Now that you’ve got the strategy down, you need a solid broker to execute your trades.

I’ve tested numerous Forex brokers and found the best ones that offer tight spreads and excellent customer support.

If you’re looking for a reliable broker, check out my top recommendations here.

Final Thoughts

In the ever-changing world of Forex, having the right tools is crucial.

The Fibonacci Extensions and ADX are two of those tools that can help you navigate the markets confidently.

Remember, a well-crafted strategy combined with the right broker can make all the difference.

Want to level up your trading game?

Explore my 16 trading bots and find the perfect broker to support your journey.

With the right approach, you can turn market moves into profitable opportunities.