Last Updated on March 20, 2025 by Arif Chowdhury

As a seasoned Forex trader since 2015, I’ve seen it all.

You know those moments when the market feels like it’s on a rollercoaster? 🎢

You’re not alone in asking:

- How do I spot major market turns?

- What tools can help me predict these moves?

Let’s cut to the chase.

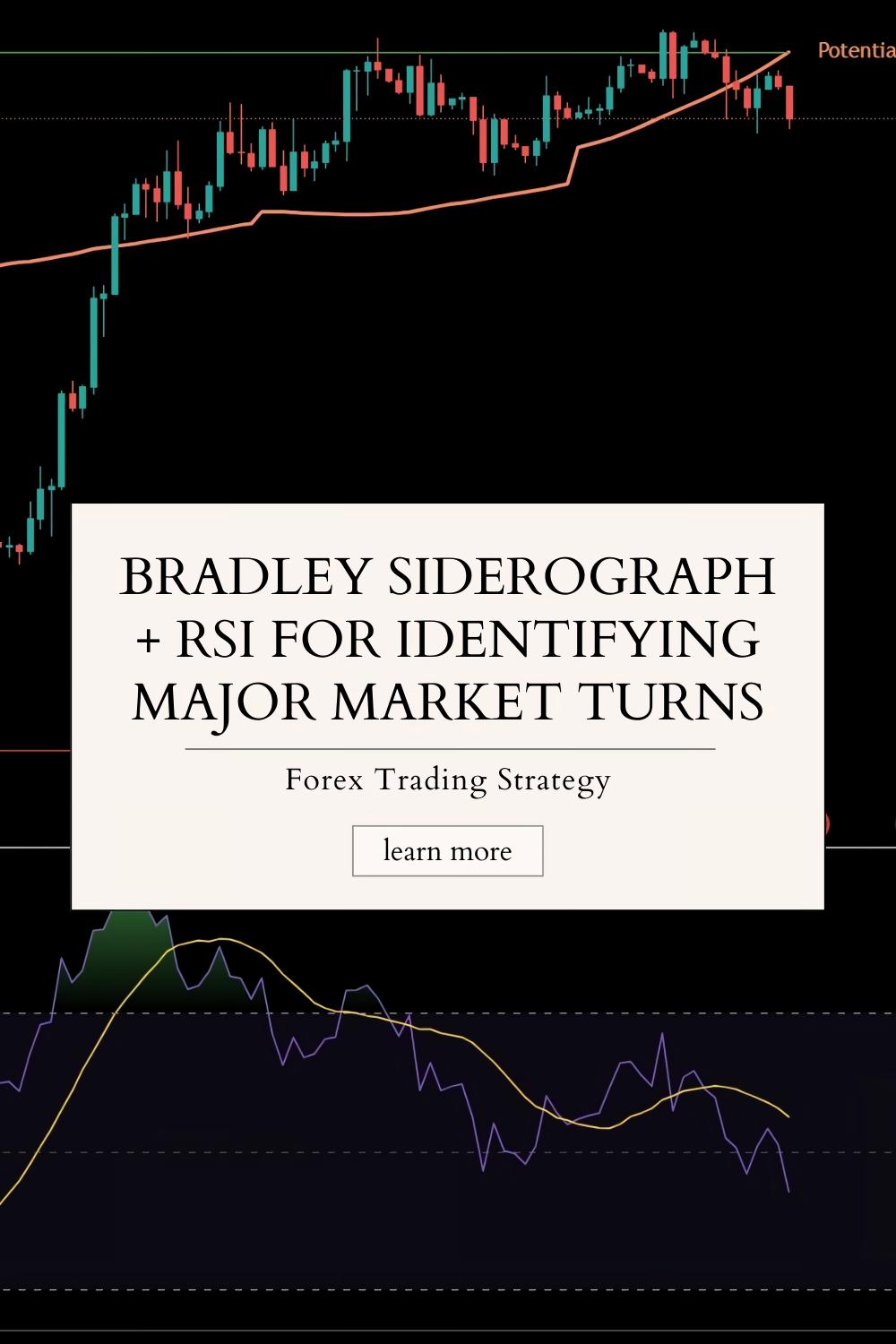

The Bradley Siderograph combined with the Relative Strength Index (RSI) can be your game-changer.

What Is the Bradley Siderograph?

The Bradley Siderograph is a unique tool designed to highlight potential market turns based on astronomical cycles.

Sounds fancy, right?

But here’s the kicker:

- It’s based on historical data: The Siderograph analyzes planetary positions and their historical impact on market trends.

- Timing is everything: It helps identify when the market is likely to reverse direction.

Understanding the RSI

The RSI is another powerful indicator.

It measures market momentum on a scale from 0 to 100.

Here’s how it breaks down:

- Above 70: Overbought territory (possible sell signal).

- Below 30: Oversold territory (possible buy signal).

These thresholds show when the market might be primed for a turn.

Combining the Two

Now, let’s put these two tools together.

- Identify Potential Turns: Use the Bradley Siderograph to spot upcoming market turns.

- Confirm with RSI: Check if the RSI is hitting extreme levels (above 70 or below 30) around the same time.

When both indicators align, you’ve got a solid setup for entering a trade.

Why This Works

Statistically, using multiple indicators can increase your chance of making profitable trades.

For example, studies show that traders who use a combination of tools can improve their success rate by up to 30%.

That’s not just a number; it’s a game-changer.

My Trading Strategy

In my journey, I’ve developed a robust system that incorporates the Bradley Siderograph and RSI among other strategies.

This is part of my 16 sophisticated trading bots portfolio that focuses on the major currency pairs:

- EUR/USD

- GBP/USD

- USD/CHF

- USD/JPY

Each bot is designed to operate on H4 charts, targeting long-term trades of 200-350 pips.

What’s cool?

These bots are internally diversified to minimize correlated losses.

You’re looking at a multi-layered approach that enhances profitability while managing risk effectively.

And the best part?

I’m offering this EA portfolio for FREE.

Imagine having a set of bots that leverage the Bradley Siderograph + RSI strategy to maximize your trading potential.

You can check it out here: My 16 Trading Bots Portfolio.

Tips for Using the Bradley Siderograph + RSI

- Stay Updated: Regularly check the Siderograph for upcoming market turns.

- Monitor RSI: Keep an eye on the RSI levels as the market approaches these turns.

- Be Patient: Wait for confirmation before making a move.

The Importance of Choosing the Right Broker

It’s not just about the tools.

Having the right broker can significantly impact your trading success.

I’ve tested and compiled a list of the most trusted Forex brokers that offer tight spreads, excellent customer support, and exclusive bonuses.

By choosing a reputable broker, you ensure smoother trade execution, which is crucial when using precise strategies like the one we discussed.

Explore the best brokers I recommend here: Most Trusted Forex Brokers.

Final Thoughts

Using the Bradley Siderograph and RSI together is like having a superpower in your trading arsenal.

By combining these two indicators, you’re not just guessing when the market will turn; you’re making informed decisions backed by proven strategies.

Remember, the market can be unpredictable.

But with the right tools and strategies, you can navigate its twists and turns like a pro.

So, gear up, start exploring, and don’t forget to check out my FREE EA portfolio and the best brokers for a seamless trading experience.