Last Updated on March 21, 2025 by Arif Chowdhury

Are you tired of missing out on market swings?

Do you feel overwhelmed by the flood of trading strategies available?

Let’s cut through the noise.

As a seasoned Forex trader since 2015, I’ve been through the ups and downs of the market. I’ve honed my expertise through both fundamental and technical analysis.

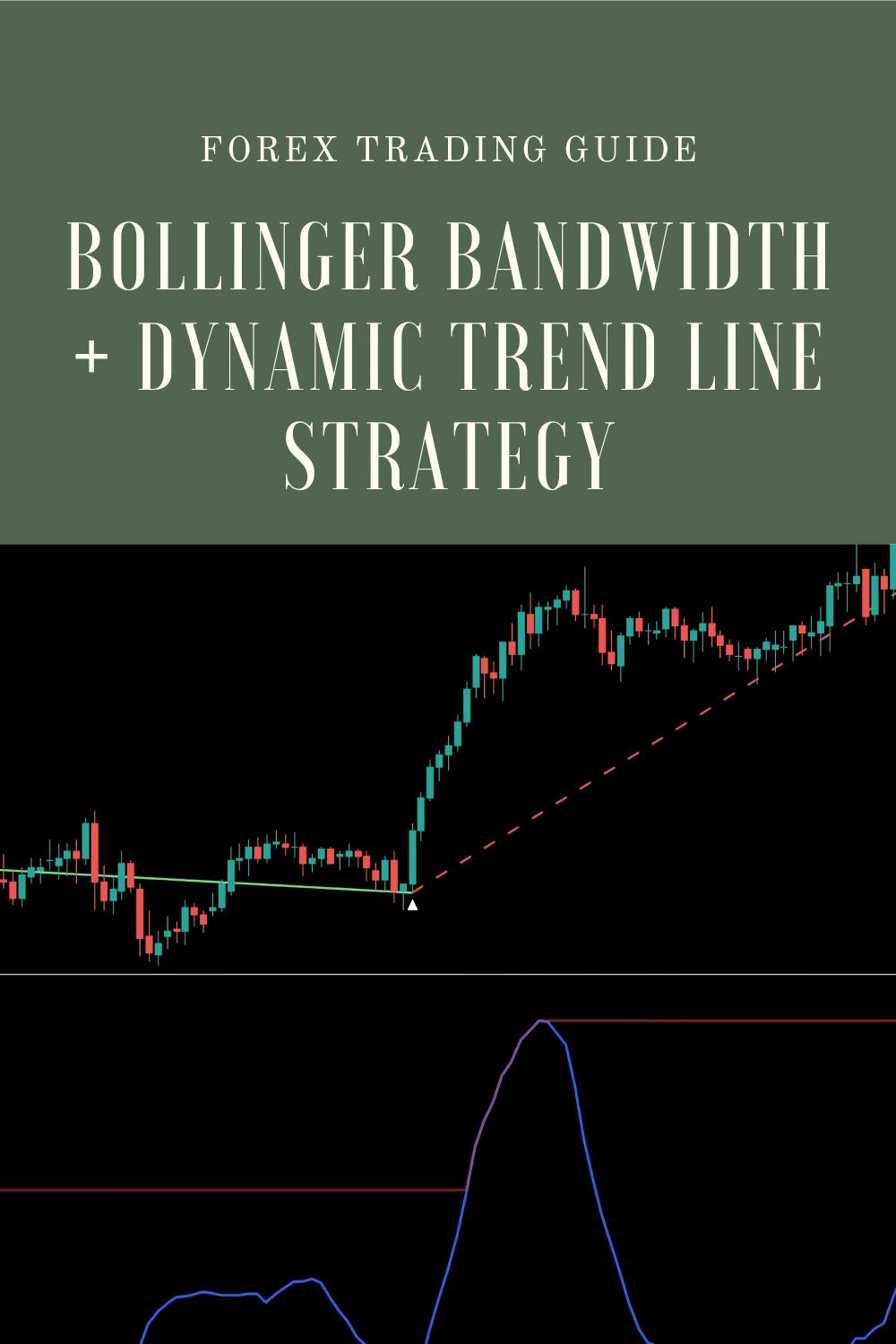

Today, I’ll share a straightforward yet powerful strategy: the Bollinger Bandwidth + Dynamic Trend Line strategy.

This approach has transformed my trading game, and I’ll show you how to leverage it for consistent profits.

Understanding the Basics

Before diving in, let’s clarify a few key concepts.

Bollinger Bands measure market volatility.

They consist of three lines: the middle line is a simple moving average (SMA), while the upper and lower bands are standard deviations away from this average.

Bollinger Bandwidth is the difference between the upper and lower bands, giving us a clear picture of market volatility. A tighter bandwidth means lower volatility, while a wider bandwidth indicates higher volatility.

Dynamic Trend Lines are simply trend lines that adapt as new price data emerges. They help us visualize the market’s direction and identify potential entry and exit points.

Why Use This Strategy?

Using the Bollinger Bandwidth in conjunction with dynamic trend lines can be a game changer.

Here’s why:

- Catch Market Swings: By identifying when the market is potentially ready to swing, you can position yourself for profitable trades.

- Reduce Risk: This strategy helps minimize false signals, allowing you to focus on high-probability trades.

- Statistical Edge: Studies show that about 70% of price movements occur within the Bollinger Bands, making this a reliable tool for traders.

Step-by-Step Guide to the Strategy

Let’s break down how to use this strategy effectively.

Step 1: Setting Up Bollinger Bands

- Choose Your Timeframe: I recommend using H4 charts for longer-term trades. This aligns well with the performance of my 16 diverse trading bots, which also utilize this strategy.

- Set the Parameters: Use a 20-period SMA with 2 standard deviations for the bands.

Step 2: Analyze the Bandwidth

- Assess Volatility: Look at the Bollinger Bandwidth. When it narrows, volatility decreases. This could signal the calm before a market swing.

- Identify Breakouts: A sudden expansion of the bandwidth often precedes significant price movements.

Step 3: Draw Dynamic Trend Lines

- Identify Trends: Use recent highs and lows to draw your trend lines.

- Adjust as Needed: Keep these lines dynamic. If the market breaks a trend line, it’s often a signal to consider entering or exiting a trade.

Step 4: Entry and Exit Points

- Entry: Look for price action to break above the upper band with strong momentum. This is a potential buy signal. Conversely, a break below the lower band can signal a sell.

- Exit: Use the dynamic trend lines to set your profit targets. If the price hits the trend line, consider taking profits or adjusting your stop-loss.

Why My Trading Bots Excel

Now, you might be wondering how all this fits into my trading portfolio.

My 16 trading bots are designed to handle diverse market conditions. They utilize the Bollinger Bandwidth + Dynamic Trend Line strategy, along with several others.

Here’s what makes them stand out:

- Diversification: Each bot is tailored for specific currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

- Risk Mitigation: They are internally diversified to minimize correlated losses, enhancing overall stability.

- Long-Term Focus: My bots aim for trades that yield between 200-350 pips, ensuring better performance over time.

- Backtested: They have been backtested over 20 years, proving effective even in volatile conditions.

And the best part? You can access this EA portfolio for FREE! Just check out my trading bots portfolio.

Final Thoughts and Best Practices

Now that you have the tools to catch market swings, remember a few critical points:

- Stay Disciplined: Stick to your strategy. Avoid emotional trading.

- Use Trusted Brokers: Trading with reliable brokers can significantly impact your success. I’ve tested many and recommend checking out the best forex brokers.

The Bollinger Bandwidth + Dynamic Trend Line strategy can be your ticket to more consistent trading profits.

Take the plunge, refine your strategy, and watch your trading improve!