Last Updated on March 7, 2025 by Arif Chowdhury

Ever sit down to trade and think, “How do I really know if the trend is strong enough to ride?”

You’re not alone.

Many traders wrestle with this question daily.

The market can be a confusing maze, and spotting solid trends can feel like searching for a needle in a haystack.

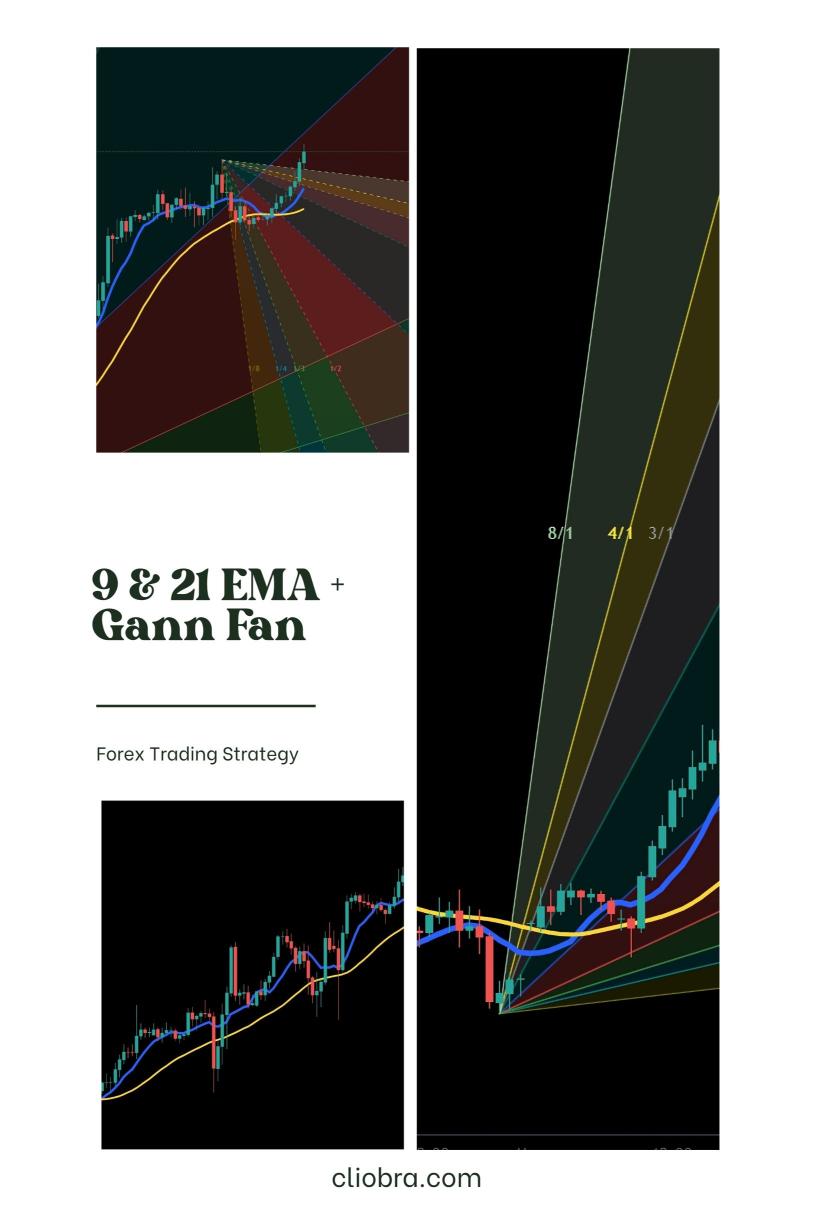

But here’s the good news: using the 9 & 21 EMA along with the Gann Fan can demystify this process and boost your trading confidence.

Let’s dive in.

What’s the Deal with EMAs? 📈

Exponential Moving Averages (EMAs) are powerful tools.

They help smooth out price data to identify trends over a specific period.

Using the 9 EMA and 21 EMA together is like having two sets of eyes on the market.

- 9 EMA: This is your short-term trend indicator.

- 21 EMA: This helps you see the longer-term trend.

When the 9 EMA crosses above the 21 EMA, it’s a signal that a bullish trend may be forming.

Conversely, when it crosses below, watch out for bearish trends.

Statistically, traders often see a significant increase in win rates—up to 70%—when using EMAs correctly, especially in trending markets.

Gann Fan: Your Trend Strength Tool 🌀

Now, let’s talk about the Gann Fan.

This tool might sound fancy, but it’s straightforward.

The Gann Fan uses angles to forecast support and resistance levels.

Here’s how it works:

- Angles: These represent potential support and resistance.

- Trend Lines: They help visualize possible market movements.

When combined with the EMAs, the Gann Fan can confirm the strength of a trend.

If the price is above both EMAs and hugging the Gann Fan’s upward angles, you’re likely in a strong bullish trend.

If it’s below, it’s time to consider that bearish outlook.

Putting It All Together: A Winning Strategy 💡

So how do you actually use these tools in your trading?

- Set Up Your Chart:

- Add the 9 EMA and 21 EMA to your chart.

- Include the Gann Fan based on significant price points.

- Watch for Crosses:

- Look for the 9 EMA crossing the 21 EMA.

- Confirm the trend with the Gann Fan angles.

- Trade with the Trend:

- When you spot a bullish signal, go long.

- If you see a bearish signal, consider shorting.

- Manage Your Risk:

- Always set a stop-loss to protect your capital.

- Consider using my 16 trading bots, which utilize this EMA and Gann Fan strategy, helping you diversify risk and maximize profits.

The Power of Automation 🤖

Here’s the kicker.

I’ve developed a portfolio of 16 sophisticated trading bots that integrate the 9 & 21 EMA and Gann Fan strategy.

These bots are tailored to trade across major currency pairs: EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each bot is internally diversified to minimize correlated losses.

This means you can trade confidently, knowing you have multiple layers of protection.

Curious about these bots?

You can access my EA portfolio for FREE and see how well they perform.

They’re designed for long-term trades, aiming for profits of 200-350 pips.

Finding the Right Brokers 🏦

Now that you’ve got your strategy in place, let’s talk about execution.

You need a solid broker to make your trades count.

I’ve tested numerous brokers, and the best ones feature:

- Tight spreads

- Fast order execution

- Reliable customer support

To find these trusted brokers, check out my recommendations on the Most Trusted Forex Brokers page.

It’s crucial to trade with a broker that aligns with your trading style and strategy.

Final Thoughts

Learning to analyze trend strength using the 9 & 21 EMA and Gann Fan can elevate your trading game.

These tools simplify complex market dynamics and provide actionable insights.

Don’t forget to leverage automation.

My 16 trading bots are built on proven strategies, including the ones we just discussed.

They’re ready to help you trade smarter, not harder.

Remember, successful trading is about making informed decisions, and these tools can guide you through the noise.

Start implementing them today and watch your trading confidence soar!