Last Updated on February 24, 2025 by Arif Chowdhury

Ever find yourself staring at charts, wondering why your trades aren’t panning out?

You’re not alone.

Many traders grapple with the same issues: inconsistent results, unexpected losses, and the never-ending quest for a reliable strategy.

As a seasoned Forex trader since 2015, I’ve faced these challenges head-on.

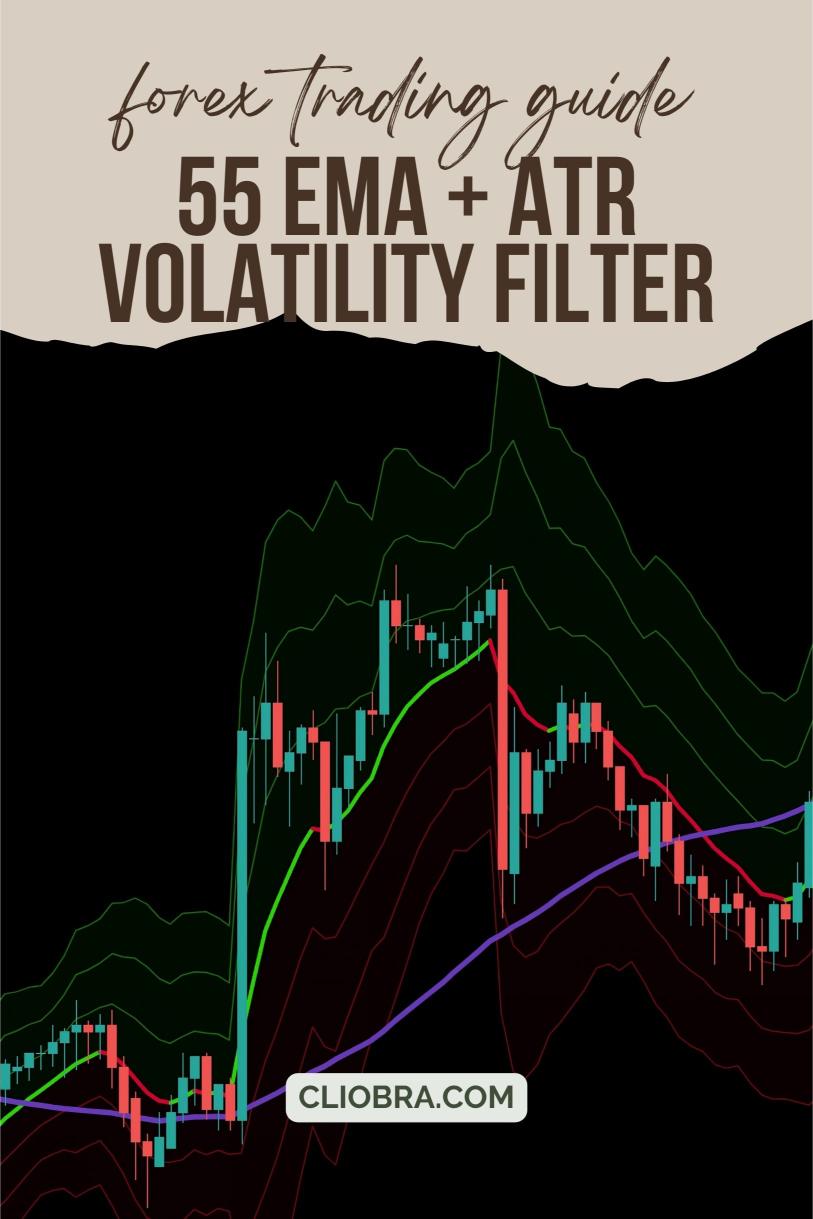

After years of exploration, I crafted a strategy that combines the 55 EMA and the ATR Volatility Filter.

Let’s break it down together and see how you can leverage this powerful duo for your trading success. 🚀

Understanding the Basics

Before diving into the nitty-gritty, let’s clarify what these indicators are.

- 55 EMA (Exponential Moving Average): This moving average gives more weight to recent prices, making it a reactive indicator. It helps identify the trend direction over a medium-term period.

- ATR (Average True Range): This measures market volatility. A higher ATR indicates a more volatile market, while a lower ATR suggests stability.

Why Use the 55 EMA + ATR?

Combining these two indicators allows you to:

- Identify Trends: The 55 EMA provides clear signals on whether the market is trending or ranging.

- Filter Out Noise: The ATR helps you avoid getting caught in low-volatility markets where price action is sluggish.

Here’s how to set it up:

- Chart Setup: Use H4 charts for a broader view.

- Add Indicators:

- Insert the 55 EMA.

- Add the ATR with a default setting of 14.

- Analyze the Setup:

- Look for price crossing above or below the 55 EMA.

- Check the ATR value to confirm volatility.

Trading Signals

Here’s how to use these indicators to generate trade signals:

- Buy Signal:

- Price crosses above the 55 EMA.

- ATR shows increasing volatility (above a certain threshold).

- Sell Signal:

- Price crosses below the 55 EMA.

- ATR indicates decreasing volatility.

Why Does This Matter?

Statistically, over 70% of Forex traders fail within their first year.

A solid strategy can significantly increase your chances of success.

By using the 55 EMA and ATR, you’re not only identifying trends but also timing your entries based on market volatility.

This combo could keep you ahead of the game.

My 16 Trading Bots: The Ultimate Backup

Now, let’s talk about something that could elevate your trading experience even further.

I’ve developed a portfolio of 16 trading bots designed to implement the 55 EMA + ATR Volatility Filter strategy and more.

These bots are strategically diversified across major currency pairs:

- EUR/USD

- GBP/USD

- USD/CHF

- USD/JPY

Each pair has 3-4 bots, minimizing correlated losses.

This means if one bot takes a hit, others can still perform well, creating a robust trading system.

The best part? You can access this entire EA portfolio for FREE.

Just imagine having sophisticated algorithms working for you while you focus on learning and refining your strategy!

Risk Management

Using these indicators is not just about making trades; it’s about managing risk.

Here are a few tips:

- Set Stop-Loss Orders: Always have a stop-loss to protect your capital.

- Adjust Position Sizes: Use the ATR to determine your trade size based on current volatility.

- Diversify Your Trades: Never put all your eggs in one basket. Utilize my trading bots to spread risk across different pairs and strategies.

Final Thoughts

Finding the right Forex brokers is crucial to your success.

I’ve tested several brokers, and you can explore the best ones through this link.

Trading with a reputable broker can make all the difference in execution speed and reliability.

In conclusion, by using the 55 EMA + ATR Volatility Filter, you’ll be on the right path to making informed trading decisions.

Combine this with the support of my 16 trading bots, and you’ll have a powerful arsenal at your fingertips.

Remember, Forex trading is a journey, not a sprint.

Stay patient, keep learning, and let the numbers work for you.