Last Updated on March 14, 2025 by Arif Chowdhury

Ever sat there, staring at your charts, wondering how the big players make their moves?

What if I told you there’s a way to tap into that institutional activity?

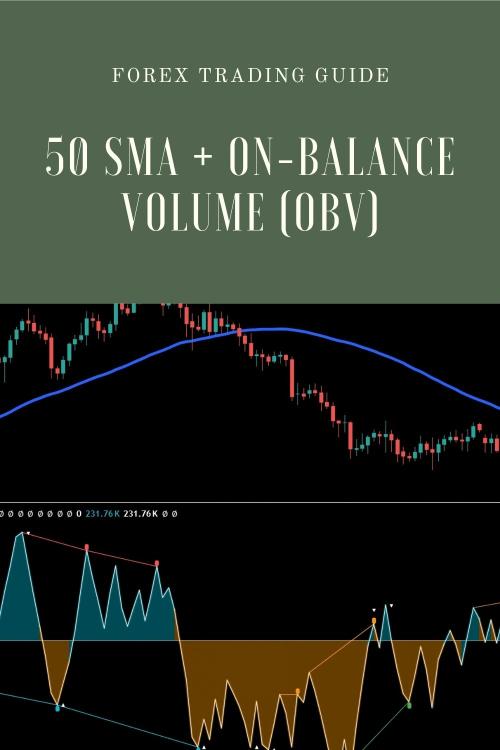

Let’s break it down using the 50 Simple Moving Average (SMA) and On-Balance Volume (OBV).

These tools can help you identify potential market shifts and position yourself like a pro.

Why Focus on the 50 SMA?

The 50 SMA is a reliable indicator for traders.

It smoothens out price action and helps spot trends.

When the price is above the 50 SMA, it indicates an upward trend.

Conversely, if it’s below, the market is in a downtrend.

This gives you a clear visual cue of market sentiment.

But here’s the kicker: it’s not just about the price.

You also need to look at volume.

Understanding On-Balance Volume (OBV)

On-Balance Volume (OBV) is a volume-based indicator that adds or subtracts volume based on price movements.

If the price rises, the volume is added.

If it falls, the volume is subtracted.

This can be a game-changer.

Why?

Because it helps you see if the price movement is supported by volume, which is crucial for confirming trends.

Using 50 SMA and OBV Together

Let’s combine these two indicators for a solid strategy.

- Identify the Trend with 50 SMA

- Check if the price is above or below the 50 SMA.

- This sets the stage for your trades.

- Confirm with OBV

- Look at the OBV line.

- If the OBV is rising while the price is above the 50 SMA, it’s a strong bullish signal.

- If it’s falling while the price is below the 50 SMA, it signals bearish pressure.

- Watch for Divergence

- If price makes a new high but OBV doesn’t, it could mean a reversal is coming.

- Conversely, if the price makes a new low without OBV confirming, watch out for a potential bounce.

By combining the 50 SMA and OBV, you’re not just guessing.

You’re basing your trades on solid statistical evidence.

Why This Matters

Here’s the deal:

- Studies show that 70% of market moves are influenced by institutional traders.

- If you can catch their footsteps, you’re already ahead of the retail crowd.

My Proven Trading Strategy

Since 2015, I’ve been diving deep into these strategies.

And guess what?

I’ve developed a portfolio of 16 sophisticated trading bots that utilize the 50 SMA + OBV strategy among other techniques.

These bots are strategically diversified across major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

This means you’re not just relying on one approach.

You’re leveraging multiple strategies to minimize risks and maximize profits.

Each bot is designed to trade on H4 charts for long-term gains of 200-350 pips.

They’ve been backtested over 20 years and perform excellently even under tough market conditions.

And the best part?

I’m offering this EA portfolio for FREE!

You can check it out here.

How to Get Started

Ready to dive in?

Here’s how you can make the most of these strategies:

- Choose a Reliable Broker

- Make sure your broker supports the tools you need for trading.

- I’ve tested several brokers, and you can find the best options here.

- Set Up Your Charts

- Apply the 50 SMA and OBV indicators.

- Keep an eye on the price action relative to the SMA.

- Monitor Volume

- Always check the OBV.

- Is it confirming your trades?

- Stay Updated

- Market conditions can change quickly.

- Keep learning and adapting your strategy.

Conclusion

Using the 50 SMA + OBV is like having a secret weapon in your trading arsenal.

You’re aligning yourself with institutional activity, which is key to successful trading.

And remember, my 16 trading bots can handle the heavy lifting for you, allowing for a robust and resilient trading experience.

Start your journey today and see how these strategies can elevate your trading game.

Don’t forget to check out the best brokers for your trading needs here.

Happy trading! 🚀