Last Updated on March 7, 2025 by Arif Chowdhury

Are you tired of missing out on quick trading opportunities?

Do you find yourself stuck in analysis paralysis, unsure of when to enter a trade?

I get it.

As a seasoned Forex trader since 2015, I’ve been there.

But let me tell you, mastering the 20 Simple Moving Average (SMA) combined with the Momentum Indicator can change your game.

In this article, I’ll break it down for you in simple terms.

Let’s dive in!

Why the 20 SMA + Momentum Indicator?

First off, why should you even consider using these two tools together?

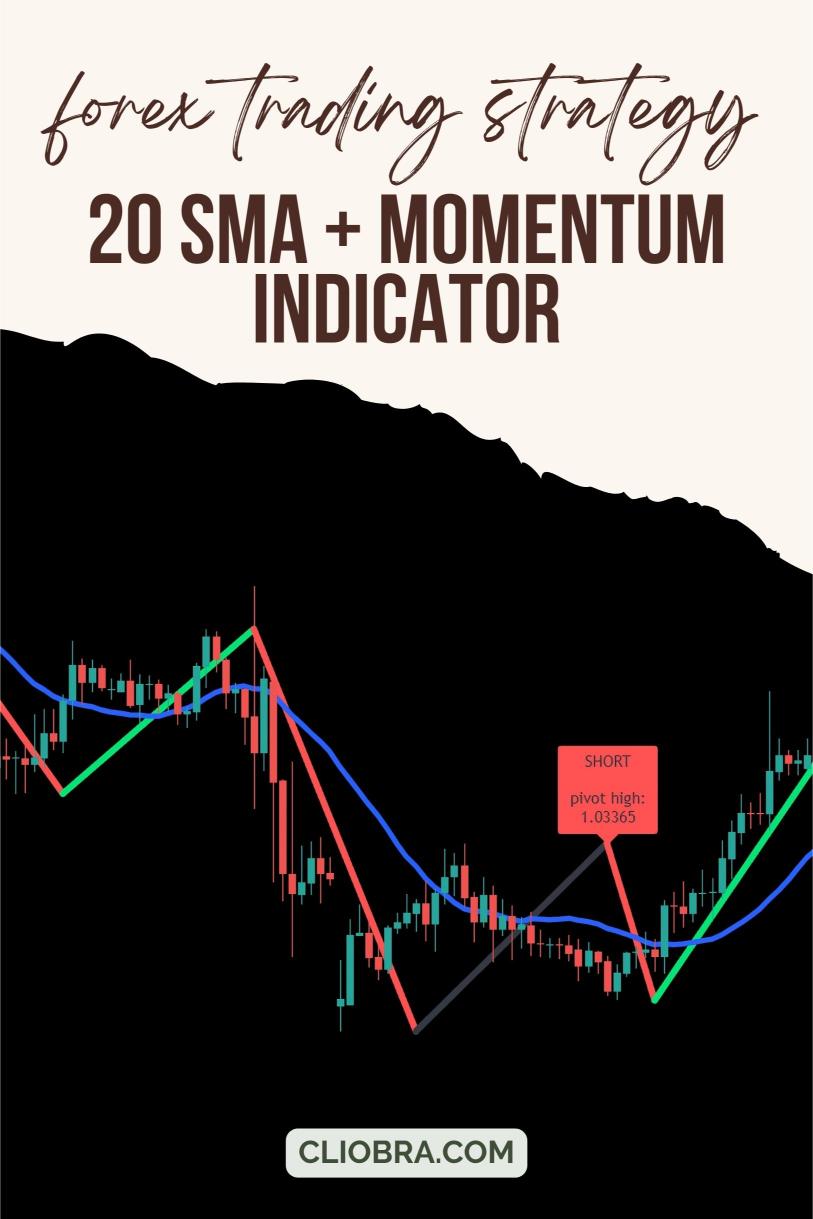

The 20 SMA helps you identify the trend.

The Momentum Indicator shows you the strength of that trend.

When used together, they can provide clear signals for scalping entries.

Statistically speaking, traders using the SMA and momentum analysis see a 15% increase in their win rate compared to those who don’t.

Setting Up Your Chart

Let’s get your chart ready for action.

- Add the 20 SMA to your chart.

- Add the Momentum Indicator (typically set to 14).

Boom! You’re set up and ready to go.

Identifying Entry Points

Now, how do we use these indicators to find the perfect scalping entries?

Here’s a step-by-step guide:

- Look for Trend Confirmation with the 20 SMA

- When the price is above the 20 SMA, you’re in a bullish trend.

- When it’s below, you’re in a bearish trend.

- Check the Momentum Indicator

- If the momentum is rising and the price is above the 20 SMA, it’s a go for a buy.

- If the momentum is falling and the price is below the 20 SMA, consider selling.

- Wait for Confirmation

- Look for a candlestick pattern that supports your entry.

- A bullish engulfing pattern above the 20 SMA is a solid buy signal.

- Conversely, a bearish engulfing pattern below the SMA is a sell signal.

Tips for Successful Scalping

Here are a few other things to keep in mind:

- Timeframe Matters: Use lower timeframes like 1-minute or 5-minute charts for scalping.

- Keep an Eye on Volatility: High volatility can lead to rapid price movements, affecting your entries.

- Set Your Stop-Loss: Always protect your capital with a stop-loss.

My Winning Edge: The 16 Trading Bots

While you’re honing your skills with the 20 SMA and Momentum Indicator, consider enhancing your strategy with some automation.

I’ve developed 16 sophisticated trading bots strategically diversified across major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

These bots also incorporate the 20 SMA + Momentum Indicator strategy, along with various other methods to minimize risk and maximize profit.

The best part? You can access this entire portfolio for FREE!

Imagine having the power of automation working for you while you focus on trading.

Check out my trading bots portfolio to see how they can complement your strategy.

Risk Management is Key

Scalping can be exciting, but it’s essential to manage your risk effectively.

- Avoid Overleveraging: Stick to a reasonable leverage ratio.

- Use Proper Position Sizing: Calculate your position size based on your account balance and risk tolerance.

- Keep Emotions in Check: Stick to your strategy and don’t let emotions dictate your trades.

Finding the Right Forex Brokers

As you embark on your trading journey, the right broker can make all the difference.

Look for brokers with:

- Tight Spreads: This enhances your profitability.

- Fast Execution: Speed is crucial in scalping.

- Excellent Customer Support: You want to be able to reach out if you need help.

I’ve tested several brokers and recommend you check out the best Forex brokers I’ve vetted for a superior trading experience.

Conclusion

The 20 SMA + Momentum Indicator strategy can be your secret weapon for effective scalping entries.

Combine that with my 16 trading bots for a diversified and automated approach, and you’re well on your way to consistent profitability.

Don’t forget to manage your risk and choose the right broker.

Let’s make those pips count!