Last Updated on February 22, 2025 by Arif Chowdhury

Ever felt stuck watching the markets, unsure of when to jump in?

Or maybe you’ve tried trading breakouts but found yourself on the wrong side of the trade?

Trust me, I’ve been there.

As a seasoned Forex trader since 2015, I know the struggle.

But let me share something that has transformed my trading game: the 20 EMA and Bollinger Bands.

These tools can signal powerful breakouts if you know how to use them right.

What Are the 20 EMA and Bollinger Bands?

First off, let’s break this down.

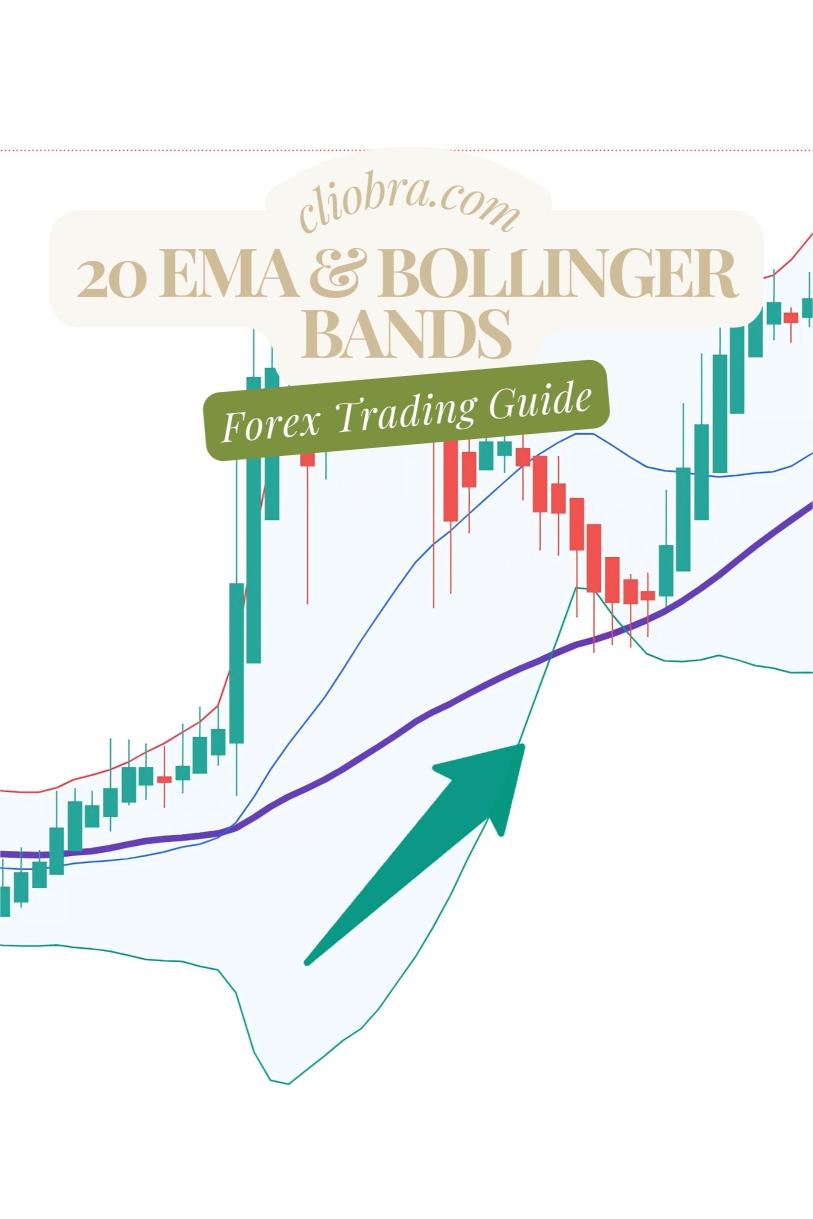

The 20 EMA (Exponential Moving Average) smooths out price data to highlight the trend.

It’s responsive and helps you spot the direction fast.

Bollinger Bands, on the other hand, consist of three lines:

- The middle band (20 SMA)

- The upper band (20 SMA + 2 standard deviations)

- The lower band (20 SMA – 2 standard deviations)

These bands expand and contract based on market volatility.

When the price touches the upper band, it might be overbought.

When it hits the lower band, it might be oversold.

Why Use Them Together?

Combining these tools can enhance your breakout strategy.

Why? Because they each provide unique insights:

- 20 EMA indicates trend direction.

- Bollinger Bands highlight volatility and potential reversal points.

When used together, they create a powerful trading signal.

Setting Up Your Chart

- Add the 20 EMA to your chart.

- Add Bollinger Bands with default settings (20 periods, 2 standard deviations).

- Focus on H4 charts for clearer signals.

Identifying Breakouts

Here’s how to spot those breakouts:

- Look for price action near the bands.

- A strong close above the upper band suggests a bullish breakout.

- A solid close below the lower band indicates a bearish breakout.

Tips for Trading Breakouts

- Wait for confirmation.

Look for additional indicators or candlestick patterns to confirm the breakout. - Set your stop-loss just outside the bands.

This protects you from false breakouts. - Use the 20 EMA as a dynamic support/resistance level.

If the price pulls back to the EMA after a breakout, it can be a great entry point.

Why It Works

Statistically, about 70% of trending markets will retrace before continuing in the same direction.

Using the 20 EMA and Bollinger Bands helps you catch these moves effectively.

My Trading Strategy

Now, let’s talk about how I’ve taken this strategy further.

I’ve developed a portfolio of 16 sophisticated trading bots that use a variety of strategies, including the 20 EMA and Bollinger Bands approach.

These bots are designed for long-term trading, targeting 200-350 pips.

With each currency pair, I’ve diversified the bots to minimize risk.

This multi-layered approach has led to consistent profitability.

In fact, I backtested these bots over the past 20 years, and they’ve performed excellently even in tough market conditions.

You can access my trading bots portfolio for FREE.

Check it out here: 16 Trading Bots.

Final Thoughts

Trading breakouts can be tricky, but with the right tools, you can enhance your chances of success.

Remember to always keep an eye on the 20 EMA and Bollinger Bands.

And if you’re looking for a reliable broker, I’ve tested some of the best.

Check them out here: Top Forex Brokers.

Using these strategies, I’ve been able to create a robust trading system.

I hope you find this approach as valuable as I have.

Let’s navigate the Forex waters together!