Last Updated on March 15, 2025 by Arif Chowdhury

Are you tired of missing out on profitable trades?

Wondering how to make sense of the market chaos?

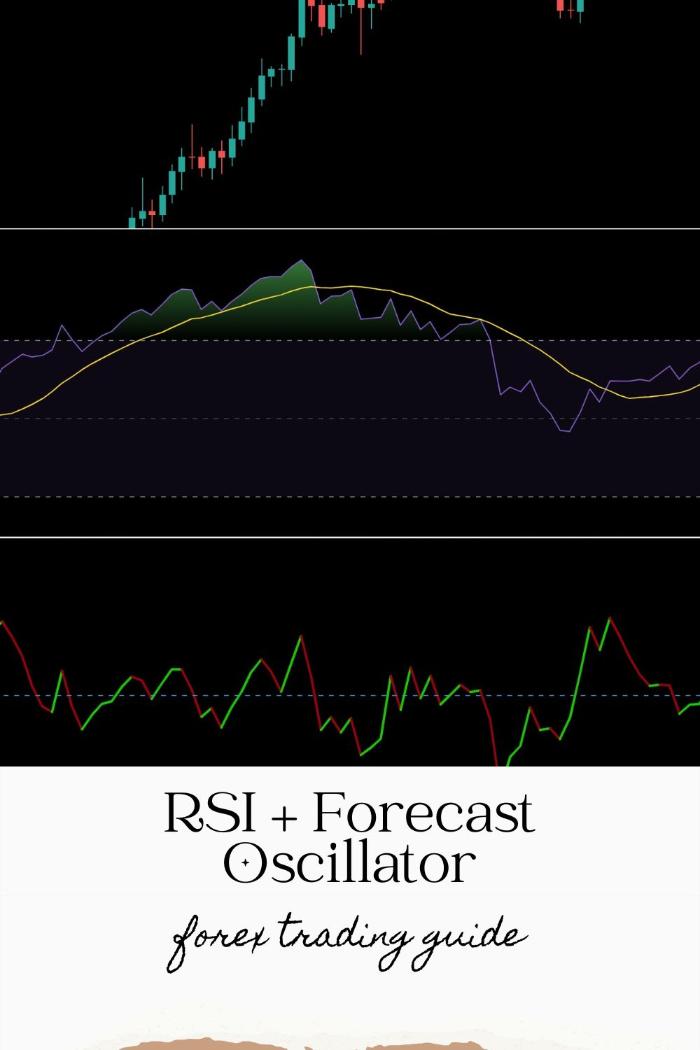

Let’s dive into something that can elevate your trading game: the RSI (Relative Strength Index) and the Forecast Oscillator.

As a seasoned Forex trader since 2015, I’ve spent countless hours sharpening my skills in both fundamental and technical analysis.

Today, I’m sharing insights that can help you enhance your trading strategy and make more accurate market predictions.

What Are RSI and Forecast Oscillator?

RSI is a momentum oscillator that measures the speed and change of price movements.

It ranges from 0 to 100 and helps identify overbought or oversold conditions.

Forecast Oscillator, on the other hand, predicts future price movements based on historical data.

When combined, they create a powerful duo for forecasting market trends.

Why Use RSI + Forecast Oscillator?

- Identify Market Trends:

- RSI can help you spot whether the market is in an uptrend or downtrend.

- The Forecast Oscillator gives you insights into where the market might go next.

- Reduce Risks:

- By confirming signals with both indicators, you can avoid false breakouts.

- This dual approach minimizes the risk of losing trades.

- Enhance Decision-Making:

- Using both indicators helps you make informed choices.

- It’s like having a roadmap in a complex city—much easier to navigate!

How to Use RSI in Your Trading Strategy

- Overbought and Oversold Levels:

- Look for RSI levels above 70 (overbought) and below 30 (oversold).

- These levels indicate potential reversal points.

- Divergence:

- If the price is making new highs while RSI isn’t, it’s a bearish divergence—consider selling.

- Conversely, if the price is making new lows while RSI isn’t, it’s a bullish divergence—think about buying.

How to Use Forecast Oscillator

- Crossovers:

- Monitor when the Forecast Oscillator crosses above or below the zero line.

- A crossover above suggests a bullish trend, while below indicates a bearish trend.

- Signal Confirmation:

- Always use the Forecast Oscillator alongside RSI for stronger signals.

- This combo can help you avoid entering trades prematurely.

Combining RSI and Forecast Oscillator

- Entry Points:

- Look for confirmation between the two indicators before entering a trade.

- For instance, if RSI is oversold and the Forecast Oscillator crosses above zero, that’s a strong buy signal.

- Exit Points:

- If RSI shows overbought conditions and the Forecast Oscillator indicates a bearish crossover, consider taking profits.

My Trading Bot Portfolio

Now, let’s talk about something exciting!

I’ve developed 16 sophisticated trading bots that utilize the RSI + Forecast Oscillator strategy among other techniques.

These bots focus on four major currency pairs: EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Here’s why they stand out:

- Diversification:

- Each currency pair has 3-4 bots, reducing correlated losses.

- This multi-layered approach enhances profitability while minimizing risks.

- Long-Term Focus:

- My bots are designed to trade on H4 charts, targeting 200-350 pips.

- They perform excellently under various market conditions, backed by 20 years of rigorous testing.

- Free Access:

- I’m offering this EA portfolio completely free!

- You just need to check the best Forex brokers and deposit a minimum into your live account.

For more details, check out my trading bots portfolio here.

Getting Started with Forex Trading

Before you jump into trading, it’s essential to choose a reliable broker.

The right broker can make a massive difference in your trading experience.

Here’s what to look for:

- Tight Spreads:

- The lower the spread, the better for your profits.

- Fast Execution:

- You want your trades executed quickly—every second counts!

- Customer Support:

- A responsive support team can help you when issues arise.

I recommend checking out the best Forex brokers I’ve tested.

Final Thoughts

Combining the RSI and Forecast Oscillator can significantly enhance your trading strategy.

The insights they provide can help you make informed decisions and increase profitability.

And don’t forget to explore my 16 trading bots that leverage this strategy for robust results.

Together, we can navigate the Forex market with more confidence and success!