Last Updated on February 9, 2025 by Arif Chowdhury

Ever felt frustrated trying to make sense of market movements?

Wondered how to identify trade setups that actually work?

Let’s talk about the Quasimodo pattern—a gem in the world of Forex trading.

As a seasoned Forex trader since 2015, I’ve seen it all.

From bullish trends to sudden market reversals, the Quasimodo pattern has stood the test of time in my trading toolkit.

So, if you’re ready to dive in, let’s explore how to leverage this pattern for high-probability trades.

What is the Quasimodo Pattern? 🧐

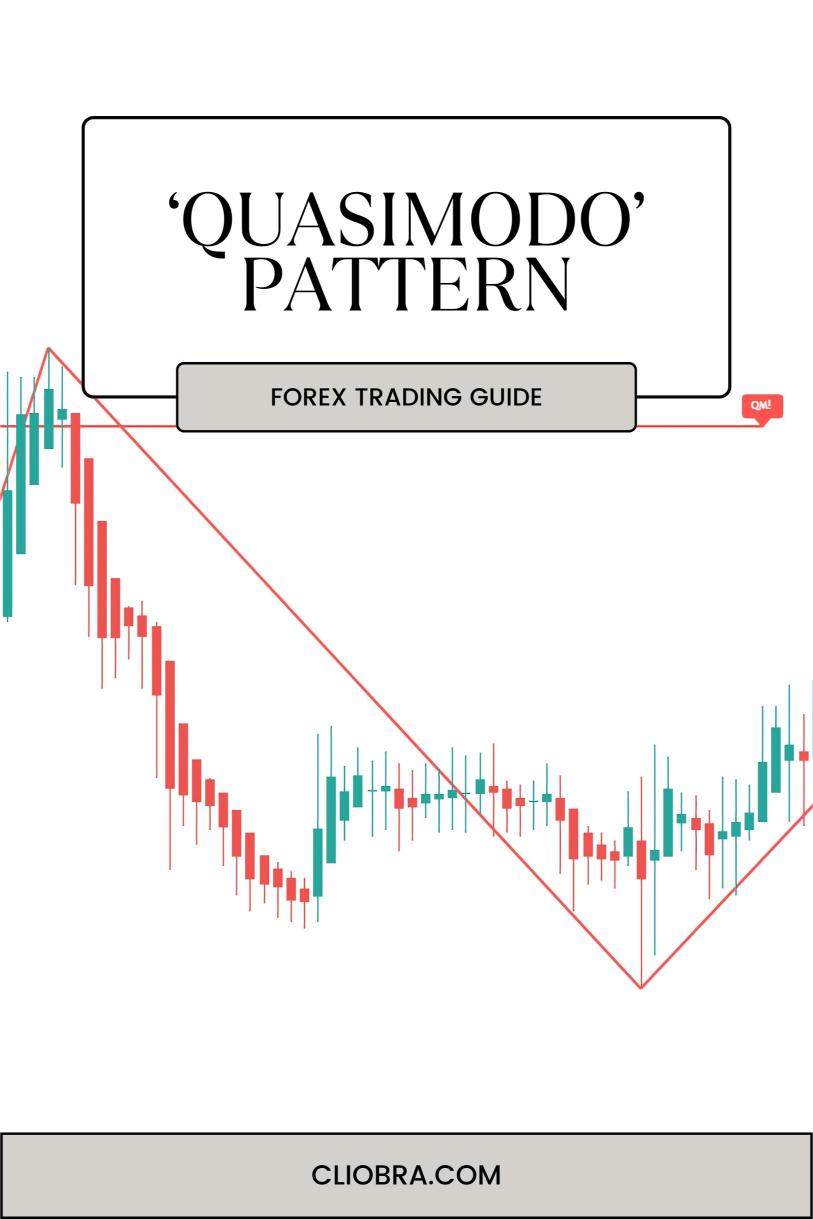

The Quasimodo pattern is essentially a reversal pattern that signals a change in trend.

Key Features:

- Shape: Looks like a head and shoulders but isn’t quite that.

- Structure: Comprises a swing high, followed by a lower high, and then a breakout below the last swing low.

- Market Psychology: Indicates exhaustion of buyers, suggesting sellers are gaining control.

Statistically, patterns like this can yield success rates of 70-80% when applied correctly.

How to Identify the Quasimodo Pattern 🔍

Finding the Quasimodo pattern requires some keen observation.

Steps to Spot It:

- Look for a Swing High: This is the peak before the price starts to drop.

- Identify a Lower High: This next peak should be lower than the previous one.

- Wait for the Breakout: The price must fall below the swing low established between the two highs.

Visualize It:

Think of it as a mountain range. The first peak is tall, the second is a bit shorter, and the valley between them is where the action happens.

How to Trade the Quasimodo Pattern 💹

Now that you can identify it, let’s talk about how to trade it.

Entry Points:

- Sell Order: Once the price breaks below the swing low, it’s time to enter a sell position.

- Confirmation: Look for additional confirmation through volume or other indicators to increase your chances.

Stop Loss & Take Profit:

- Stop Loss: Place it just above the last swing high. This protects you from unexpected reversals.

- Take Profit: Aim for a risk-to-reward ratio of at least 1:2. This can significantly boost your profitability.

Why Use the Quasimodo Pattern? 🌟

This pattern isn’t just another signal. It’s a strategy rooted in market psychology.

Advantages:

- High Probability: As mentioned, success rates can soar up to 80% with proper execution.

- Clear Structure: The pattern provides clear entry and exit points—no guesswork.

- Versatile: Works across various time frames and currency pairs.

Combine with Robust Tools 🤖

While the Quasimodo pattern is powerful, don’t underestimate the value of tools in your trading arsenal.

I’ve developed 16 sophisticated trading bots that operate across major currency pairs like EUR/USD and GBP/USD.

These bots are designed to trade for longer moves, targeting 200-350 pips.

By utilizing the Quasimodo pattern along with these bots, you can enhance your trading strategy.

You can check out my FREE EA portfolio here.

Best Practices for Trading the Quasimodo Pattern 🛠️

- Stay Disciplined: Follow your trading plan. Don’t let emotions dictate your moves.

- Backtest: Always backtest your strategies. My bots have been tested over 20 years and have performed excellently in various market conditions.

- Choose the Right Broker: A solid broker can make or break your trading experience. I’ve tested several, and you can find the best ones here.

Conclusion

The Quasimodo pattern is a powerful tool in the Forex trader’s toolkit.

It allows for high-probability trades when executed correctly.

Combine this pattern with robust tools like my trading bots, and you’re setting yourself up for success.

Don’t forget to stay disciplined and keep learning.

Your journey in Forex trading can be rewarding if you know what to look for.