Last Updated on March 1, 2025 by Arif Chowdhury

Ever felt lost in the sea of trading indicators?

You’re not alone.

As a seasoned Forex trader since 2015, I’ve been there.

Navigating through countless strategies can be overwhelming.

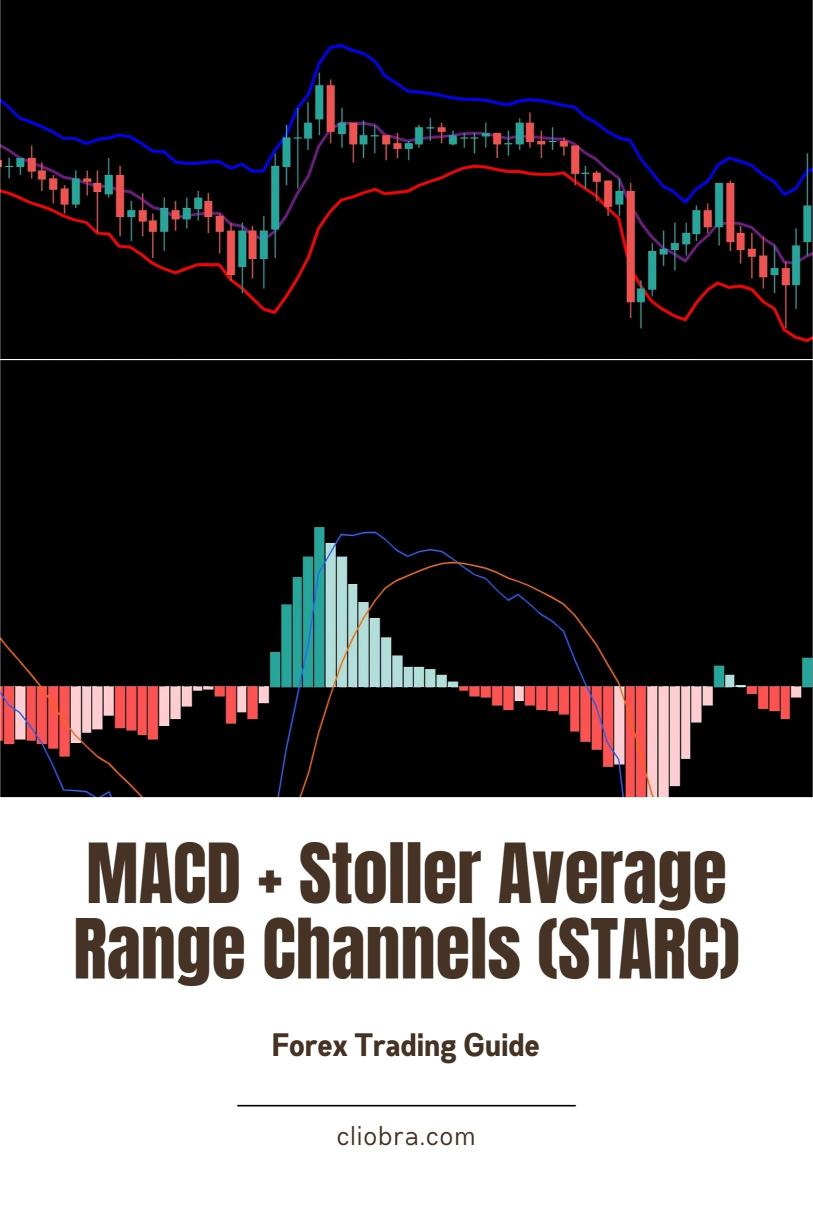

But here’s the good news: using MACD and Stoller Average Range Channels (STARC) together can simplify your approach and enhance your trading results.

Let’s dive in.

Understanding the Basics of MACD and STARC

What is MACD?

The Moving Average Convergence Divergence (MACD) is a momentum indicator that shows the relationship between two moving averages of a security’s price.

- MACD Line: This is the difference between the 12-day and 26-day exponential moving averages (EMAs).

- Signal Line: The 9-day EMA of the MACD line.

- Histogram: The difference between the MACD line and the signal line. It helps visualize momentum shifts.

What are STARC Bands?

STARC Bands are volatility indicators that consist of a moving average and two bands above and below it.

- Upper Band: Moving average + (2 x Average True Range).

- Lower Band: Moving average – (2 x Average True Range).

These bands help you identify potential overbought or oversold conditions.

Why Use MACD + STARC Together?

Combining MACD and STARC gives you:

- Clear Buy/Sell Signals: MACD helps identify trends, while STARC shows potential entry and exit points.

- Reduced Noise: This duo filters out false signals, giving you a cleaner trading experience.

- Enhanced Risk Management: The STARC bands provide clear levels for setting stop losses and take profits.

How to Implement This Strategy

Step 1: Set Up Your Charts

- Select Your Currency Pair: Stick to major pairs like EUR/USD, GBP/USD, USD/CHF, or USD/JPY.

- Time Frame: Use H4 charts for optimal results.

- Add Indicators:

- MACD: Set to default settings.

- STARC Bands: Set according to your trading style.

Step 2: Identify the Trend

- Look for the MACD line crossing above the signal line for bullish trends.

- A cross below indicates a bearish trend.

Step 3: Confirm with STARC

- When the price touches the lower STARC band in a bullish trend, it’s a potential buy signal.

- Conversely, if it touches the upper band in a bearish trend, it’s a potential sell signal.

Step 4: Manage Your Trades

- Set stop losses just outside the STARC bands.

- Take profits when the price approaches the opposite band.

Pro Tip: Use Multiple Strategies

To enhance your trading results, consider diversifying your approach.

That’s exactly what I did.

I developed a portfolio of 16 sophisticated trading bots that incorporate various strategies, including the MACD + STARC method.

These bots are specially designed for major currency pairs and are internally diversified to minimize risks.

This multi-layered approach has led to consistent profitability, even under harsh market conditions.

Statistical Insight

Did you know that around 70% of traders fail to consistently profit in Forex trading?

One reason is the lack of a diversified strategy.

By leveraging both MACD and STARC, and using my 16 trading bots, you’re setting yourself up for greater success.

Best Practices for Trend Trading

- Stay Updated: Market conditions change. Keep an eye on economic news that affects your chosen pairs.

- Avoid Overtrading: Stick to your strategy. Don’t chase every signal.

- Backtest Your Strategy: Use historical data to validate your approach.

Choosing the Right Broker

To implement this strategy effectively, you need a reliable broker.

Here are some things to consider:

- Tight Spreads: Lower spreads mean more profit in your pocket.

- Execution Speed: Fast execution can make a big difference in volatile markets.

- Customer Support: Good support can help resolve issues quickly.

I’ve tested several brokers and highly recommend checking out the best options available.

Conclusion

Using MACD and STARC for trend trading is a powerful combo.

It simplifies your trading approach and helps you manage risks better.

Plus, if you want to take your trading to the next level, consider my 16 trading bots.

They’re designed to work alongside this strategy, offering a diversified and robust trading experience.

Best of luck in your trading journey!