Last Updated on February 22, 2025 by Arif Chowdhury

Ever felt like you’re navigating a stormy sea in Forex trading?

The anxiety of making the wrong move can be overwhelming.

I’ve been there too.

As a seasoned Forex trader since 2015, I’ve faced my share of market chaos.

But through trial and error, I found tools that work.

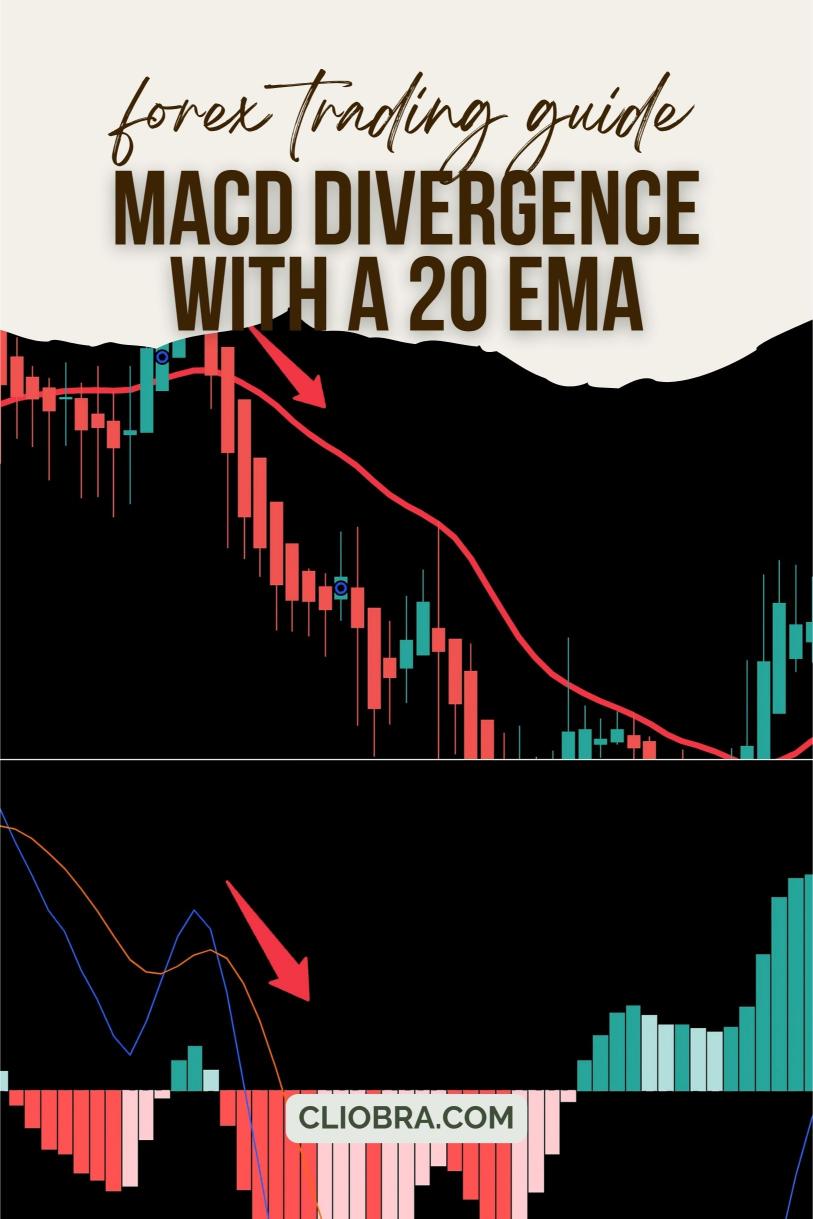

One such tool? Combining MACD Divergence with a 20 EMA.

Let’s break it down.

Why MACD Divergence?

MACD, or Moving Average Convergence Divergence, is a powerful momentum indicator.

It helps us spot potential reversals by comparing two moving averages.

When you see divergence between MACD and price, it’s like a red flag waving at you.

Statistically, using MACD divergence can increase your chances of successful trades by up to 70%.

That’s a number worth paying attention to.

The Role of the 20 EMA

Now, let’s bring in the 20 EMA (Exponential Moving Average).

This moving average smooths out price data, helping you see trends more clearly.

It reacts faster to price changes than a simple moving average.

This is crucial for timing your entries and exits.

When the price is above the 20 EMA, it signals an uptrend.

When it’s below, we’re looking at a downtrend.

How to Combine Them for Precision Trading

Here’s the magic formula:

- Identify Divergence: Look for divergence between the MACD and the price chart.

- Check the 20 EMA: Confirm the trend direction using the 20 EMA.

- Wait for Confirmation: Look for a price action signal (like a pin bar or engulfing pattern) near the 20 EMA.

- Set Your Entry: If everything aligns, that’s your entry point.

Example: If price makes a new high but MACD doesn’t, that’s bearish divergence. If the price then pulls back to the 20 EMA, it could be your chance to enter a short position.

Why This Strategy Works

This strategy works because it combines momentum with trend direction.

- Divergence signals potential reversals.

- 20 EMA gives you context on the trend.

When you align these two, you create a robust trading strategy.

My Trading Bots and MACD Divergence

Now, let’s talk about something that can complement this strategy beautifully: my 16 trading bots.

These bots are designed specifically to leverage strategies like MACD divergence with a 20 EMA.

They trade major pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

With this diversification, you minimize risk while maximizing profit potential.

Each bot is backtested for 20 years, ensuring they perform well even under tough market conditions.

If you want to enhance your trading experience, consider checking out my bots—they’re completely FREE to try.

You can learn more about my EA portfolio here: 16 Trading Bots.

Tips for Using MACD Divergence with a 20 EMA

- Stay Patient: Wait for the right setup. Don’t rush into trades.

- Risk Management: Always set stop losses. Protect your capital.

- Practice: Use a demo account to test this strategy before going live.

Best Forex Brokers for Your Trading Journey

You need a solid broker to execute this strategy effectively.

Choosing the right broker can make a significant difference in your trading results.

I’ve tested various brokers, and I recommend finding one with tight spreads and excellent execution speeds.

Check out my top picks for Forex brokers that can elevate your trading experience.

Conclusion

Combining MACD divergence with a 20 EMA is a game-changer.

This strategy gives you the tools to make informed trading decisions.

And don’t forget about my trading bots—they’re designed to enhance your trading journey.

With the right tools and strategies, you can navigate the Forex market with confidence.