Last Updated on February 27, 2025 by Arif Chowdhury

Are you tired of missing out on those explosive market moves?

Wondering how to spot those opportunities before they fly by?

You’re not alone.

As a seasoned Forex trader since 2015, I’ve been in your shoes.

I’ve faced the same frustrations, and through rigorous exploration, I’ve discovered powerful tools that can help.

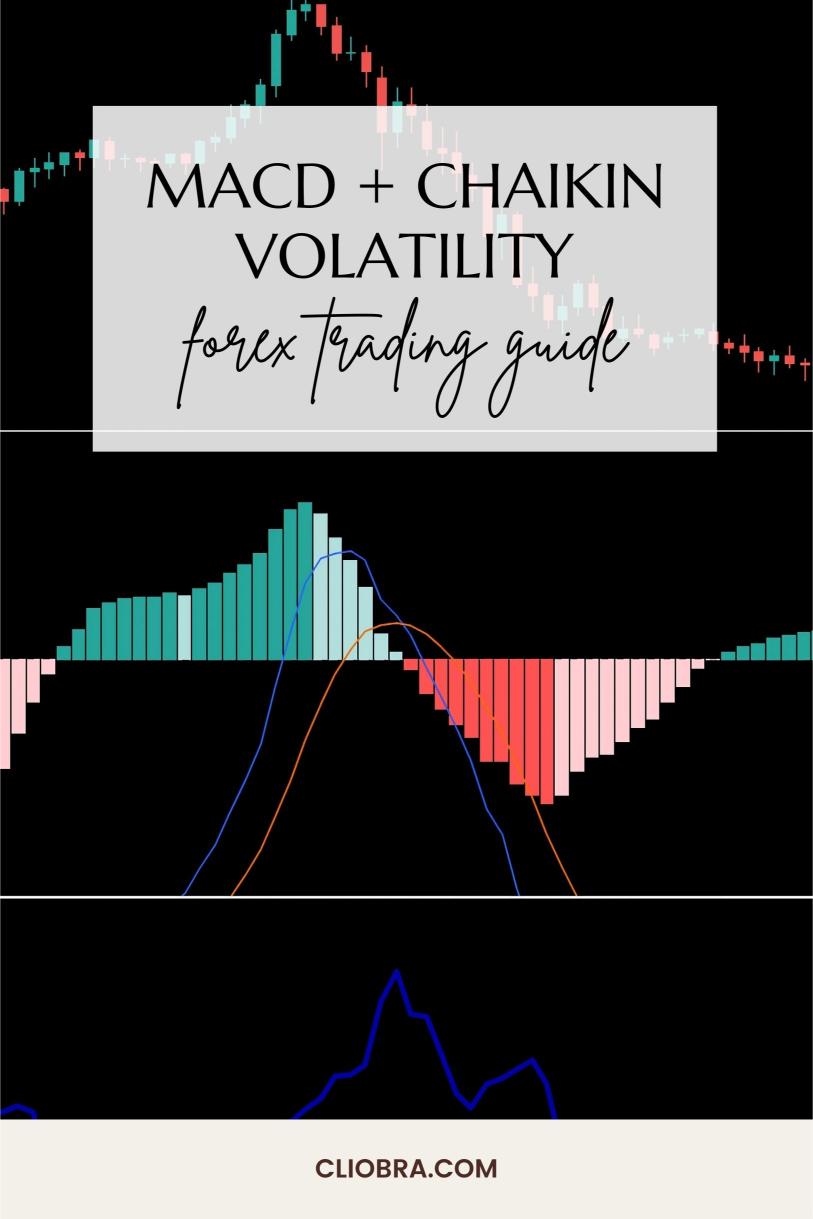

Today, let’s dive into how to use MACD and Chaikin Volatility for identifying those big market shifts.

Understanding the Basics

First off, let’s break down these two indicators.

MACD (Moving Average Convergence Divergence) is a trend-following momentum indicator.

It helps traders identify potential buy and sell signals through the relationship between two moving averages of a security’s price.

Chaikin Volatility, on the other hand, measures the volatility of a stock or currency pair by comparing the spread between the high and low prices over a specified period.

When combined, these indicators can help you pinpoint explosive movements in the market.

Why Use Both?

Using MACD and Chaikin Volatility together offers a robust analysis framework.

- MACD signals trend changes.

- Chaikin Volatility reveals when volatility is rising, indicating potential price movements.

Studies show that combining multiple indicators can increase the chances of successful trades by up to 40%.

How to Apply These Indicators

Here’s how to effectively use MACD and Chaikin Volatility in your trading strategy:

- Setting Up Your Chart:

- Use a H4 chart for a broader perspective.

- Add the MACD indicator.

- Add the Chaikin Volatility indicator.

- Identify MACD Signals:

- Look for MACD crossovers.

- A bullish crossover (when the MACD line crosses above the signal line) can indicate a buying opportunity.

- Conversely, a bearish crossover suggests a selling opportunity.

- Watch Chaikin Volatility:

- Pay attention to rising volatility.

- If the Chaikin Volatility line starts to increase while you see a MACD signal, it’s a strong indication that a significant price move is likely.

- Confirm with Price Action:

- Look for strong price action that aligns with your MACD and Chaikin signals.

- Candlestick patterns or support/resistance levels can provide additional confirmation.

- Risk Management:

- Always set stop-loss orders to protect your capital.

- Knowing when to exit is just as important as knowing when to enter.

My Trading Strategy

Through my journey, I’ve developed a unique strategy that incorporates MACD and Chaikin Volatility alongside other techniques.

This approach has led to consistent profitability.

In fact, I’ve created a portfolio of 16 sophisticated trading bots designed to trade across major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each bot utilizes the MACD + Chaikin Volatility strategy, ensuring diversification and risk management.

These bots have been backtested for over 20 years and perform exceptionally well under various market conditions.

If you’re looking to enhance your trading, consider checking out my EA portfolio, which is completely FREE!

Putting It All Together

Combining MACD and Chaikin Volatility can be a game-changer for detecting explosive market moves.

Here’s a quick recap:

- Use MACD for trend direction and signals.

- Monitor Chaikin Volatility for signs of increasing volatility.

- Confirm signals with price action and manage your risk wisely.

Best Practices Moving Forward

- Stay updated on market news.

- Continuously backtest your strategies.

- Adapt your approach as market conditions change.

Finding the right Forex broker is also crucial for executing your trades effectively.

I’ve tested several brokers and recommend exploring options through this link to find one that suits your trading style.

With the right tools and strategies, you can take your trading to the next level.

Conclusion

In a fast-paced market, knowing how to use MACD and Chaikin Volatility can set you apart.

With practice and patience, you’ll be able to spot those explosive moves before they happen.

Remember, success in trading is about making informed decisions and having the right resources at your fingertips.

Happy trading! 🚀