Last Updated on March 8, 2025 by Arif Chowdhury

Ever find yourself staring at charts, wondering where the next big move is?

You’re not alone. The Forex market is a wild beast, and knowing when to jump in can feel like trying to catch smoke with your bare hands.

As a seasoned Forex trader since 2015, I’ve been through the trenches.

I’ve explored countless strategies and refined my skills to spot profitable setups.

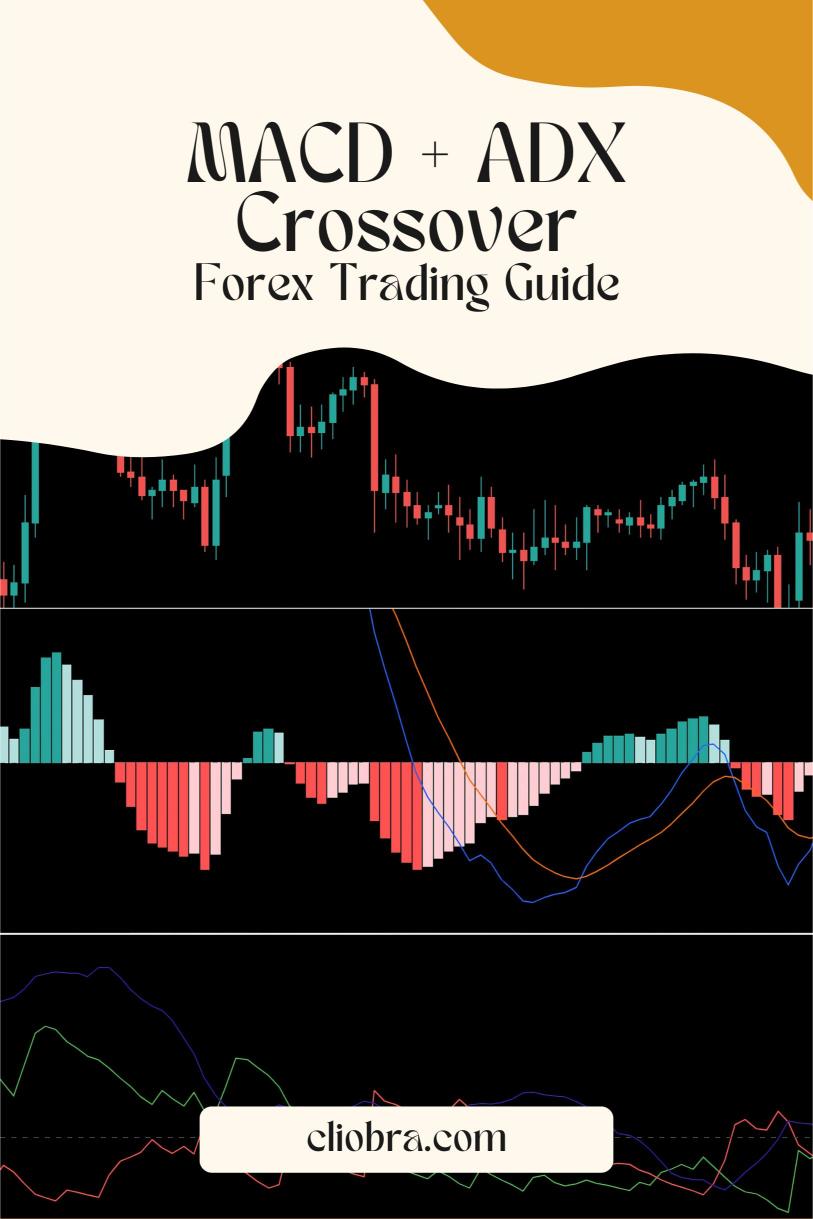

Today, I’m diving into a powerful combo: the MACD and ADX crossover.

Let’s break it down, shall we?

What Are MACD and ADX?

MACD (Moving Average Convergence Divergence)

- Measures momentum.

- Shows the relationship between two moving averages.

- Used to identify potential buy or sell signals.

ADX (Average Directional Index)

- Measures the strength of a trend.

- Ranges from 0 to 100.

- Values above 20 indicate a strong trend; below 20 suggest a weak trend.

So, why should you care about these indicators?

They can help you pinpoint momentum breakouts, which is like finding gold in the Forex market!

The Crossover Magic

Now, let’s talk about the crossover.

When the MACD line crosses above the signal line, it’s a potential buy signal.

When it crosses below, it’s a potential sell signal.

But wait, there’s more!

Combine it with the ADX to confirm the trend strength.

Steps to Use MACD + ADX Crossover

- Set Your Indicators:

- Add MACD to your chart.

- Add ADX with a 14-period setting.

- Look for Crossovers:

- Buy Signal: MACD crosses above the signal line AND ADX is above 20.

- Sell Signal: MACD crosses below the signal line AND ADX is above 20.

- Confirm the Trend:

- Ensure ADX is rising, indicating strengthening momentum.

- Set Your Targets:

- Aim for long-term trades, like targeting 200-350 pips.

- Manage risk with proper stop-loss placements.

Why This Strategy Works

Using MACD and ADX together gives you a one-two punch.

- Stat Fact: Studies show that combining indicators can increase your win rate by up to 30%.

- This strategy helps filter out false signals and ensures you’re riding real momentum.

But let’s not stop there.

I’ve developed a portfolio of 16 sophisticated trading bots that utilize this MACD + ADX crossover strategy among many others.

These bots are designed to trade across major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

They focus on long-term gains, minimizing risk through internal diversification.

Each bot is backtested over 20 years, proving its mettle even in volatile conditions.

You can check out my 16 trading bots portfolio for FREE.

Putting It All Together

When you combine MACD and ADX, you’re not just guessing.

You’re making informed decisions based on solid technical analysis.

Let’s recap the key takeaways:

- Use MACD for momentum: Look for crossovers.

- Use ADX for trend strength: Ensure the trend is strong.

- Set realistic targets: Aim for significant pips, but manage risk.

Choosing the Right Broker

Now that you’re equipped with this strategy, don’t forget about your broker.

A good broker can make all the difference.

I recommend checking out some of the best Forex brokers I’ve tested.

They offer tight spreads, excellent customer support, and features that can enhance your trading experience.

Conclusion

Using the MACD + ADX crossover strategy can be a game-changer.

It’s not just about spotting trends; it’s about understanding momentum.

In a market that moves as fast as Forex, having the right tools and strategies is crucial.

So, get out there, start practicing, and consider leveraging my 16 trading bots to optimize your trading.

Remember, success in trading is about consistency and smart decisions.

Good luck, and happy trading! 🚀