Last Updated on February 28, 2025 by Arif Chowdhury

Ever felt lost in the sea of trading strategies?

Wondering how to spot real trends before they take off?

You’re not alone.

As a seasoned Forex trader since 2015, I’ve faced those same challenges.

But I’ve found a winning combo that’s helped me consistently profit.

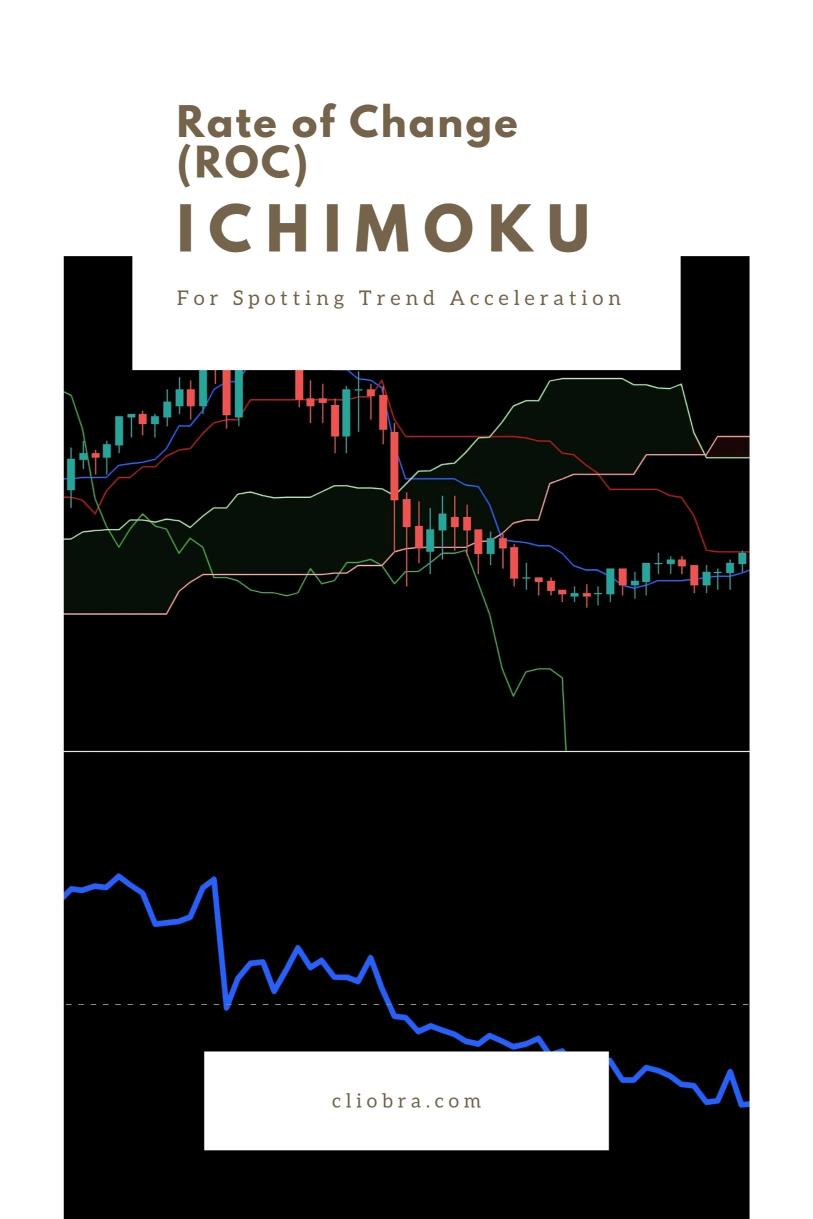

Let’s break down how to use Ichimoku and Rate of Change (ROC) to spot trend acceleration.

What is Ichimoku?

Ichimoku is more than just a fancy chart.

It’s a powerful tool that gives you the full picture of market conditions.

Here’s why I love it:

- Supports and Resistance: It helps identify key levels where price is likely to bounce or break.

- Trends: The cloud (Kumo) shows you whether you’re in a bullish or bearish trend.

- Momentum: Other lines indicate the strength of the trend.

What is Rate of Change (ROC)?

Now, let’s talk about ROC.

This indicator measures how much a price has changed over a specific period.

Think of it as the speedometer of price movement.

When the ROC is increasing, it signals that momentum is building.

When it’s decreasing, the trend might be losing steam.

Why Combine Ichimoku and ROC?

Here’s the magic.

Using Ichimoku and ROC together gives you a clearer view of potential trend accelerations.

- Confirmation: Ichimoku can confirm the trend direction, while ROC shows you if that trend is speeding up.

- Timing: Spotting the right entry and exit points becomes easier.

Setting Up Your Chart

Here’s how to set it up:

- Add Ichimoku: Set the default settings. You’ll see the Tenkan-sen, Kijun-sen, Senkou Span A, Senkou Span B, and Chikou Span.

- Add ROC: Set the period to 14. This is a common setting, but feel free to adjust based on your trading style.

Spotting Trends with Ichimoku

Look for these signals:

- Price Above the Cloud: Bullish trend.

- Price Below the Cloud: Bearish trend.

- Crossovers: Watch for the Tenkan-sen crossing above the Kijun-sen for buying signals.

Analyzing Momentum with ROC

Now, check the ROC:

- Positive ROC: Indicates upward momentum.

- Negative ROC: Indicates downward momentum.

- Divergence: If price makes a new high but ROC doesn’t, it could signal a reversal.

Putting It All Together

Here’s a simple checklist:

- Identify the trend with Ichimoku.

- Confirm momentum with ROC.

- Look for divergence to spot potential reversals.

This method can help you make more informed trading decisions.

And guess what?

My exceptional trading bot portfolio uses this Ichimoku + ROC strategy among other dozens of trading strategies to diversify risk and maximize profit.

Explore my 16 trading bots, designed to trade long-term and capture 200-350 pips consistently.

Each bot is tailored to specific currency pairs, ensuring you have a robust trading system.

The Power of Backtesting

I’ve backtested my bots for over 20 years.

They’ve performed excellently under various market conditions.

This gives you an edge in the unpredictable Forex landscape.

Finding the Right Broker

To make the most of your trades, you need a trusted broker.

The right broker can provide:

- Tight spreads

- Fast execution

- Great customer support

I’ve tested some of the best brokers out there.

Check out my top recommendations on Most Trusted Forex Brokers.

Final Thoughts

Using Ichimoku and ROC can significantly enhance your trading strategy.

It’s about combining tools to get the best results.

Don’t forget to check out my 16 trading bots that incorporate this strategy among others.

These bots are designed to work for you, minimizing risks while maximizing profits.

Happy trading!