Last Updated on February 11, 2025 by Arif Chowdhury

Ever felt like you’re treading water in the vast ocean of Forex trading?

Struggling to figure out how much to risk on each trade?

Or maybe you’re wondering how to scale your positions without losing your shirt?

I’ve been there since 2015, and I’ve got some solid insights for you.

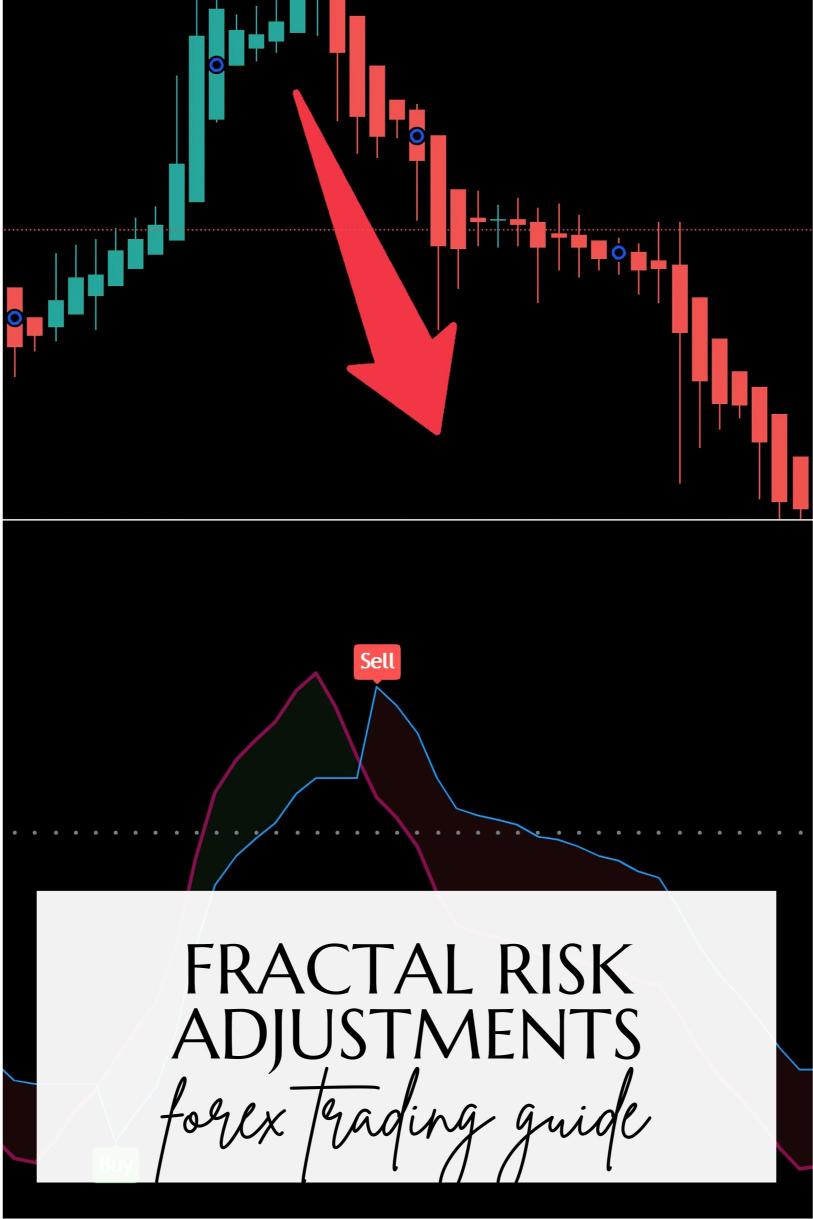

Let’s dive into Fractal Risk Adjustments and see how they can help you scale your positions effectively.

What Are Fractal Risk Adjustments?

Fractal Risk Adjustments are all about understanding market movements at different time frames.

Think of it as a multi-layered approach to risk management.

Instead of just looking at one time frame, you consider multiple fractals—short-term, medium-term, and long-term trends.

This helps in making more informed decisions.

Why Use Fractal Risk Adjustments?

Here’s why they’re a game changer:

- Minimized Risk: By adjusting your position sizes based on fractal analysis, you can limit your exposure to unforeseen market movements.

- Enhanced Profitability: You can identify optimal entry and exit points, leading to better profit margins.

- Flexibility: They allow you to adapt to changing market conditions, making your strategy more robust.

How to Implement Fractal Risk Adjustments

Let’s break it down into actionable steps:

- Identify the Fractals: Start by analyzing different time frames.

- Use H4, H1, and M30 charts.

- Look for patterns that repeat across these time frames.

- Set Your Risk Tolerance: Determine how much you’re willing to risk on each trade.

- A common strategy is to risk 1-2% of your trading capital.

- Adjust Position Sizes:

- Scale up when you see a strong trend.

- Scale down during periods of consolidation or uncertainty.

- Monitor Market Conditions: Keep an eye on economic news and events that may impact your trades.

- Review and Adapt: Regularly assess your strategy.

- If a particular approach isn’t working, don’t hesitate to tweak it.

The Power of Diversification

While we’re on the subject, let’s talk about my 16 trading bots.

They’re designed to complement your trading strategy by leveraging fractal risk adjustments.

These bots specialize in major currency pairs—EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each pair has a unique set of 3-4 bots that are internally diversified.

This means:

- Minimized Correlated Losses: If one bot takes a hit, others can still perform well, cushioning the blow.

- Long-Term Performance: They target 200-350 pips, which is ideal for long-term traders.

- Proven Strategies: They use a variety of strategies, including Bollinger Bands, to maximize profit while minimizing risk.

The best part?

You can access this EA portfolio for FREE.

Curious? Check it out here.

Statistical Insights

Did you know that roughly 70% of Forex traders fail within their first year?

That’s a staggering number.

However, implementing sound risk management strategies like fractional adjustments can significantly improve your chances.

Additionally, traders who diversify their portfolios can enjoy up to a 30% higher return on investment over time.

Best Practices for Using Fractal Risk Adjustments

- Stay Disciplined: Stick to your plan and avoid emotional trades.

- Keep Learning: The Forex market is always evolving.

- Stay updated and adapt your strategies accordingly.

- Utilize Technology: Consider using advanced trading tools or bots to enhance your trading.

Finding the Right Forex Brokers

To maximize your trading success, partner with the best Forex brokers.

I’ve tested several, and you can find reliable recommendations here.

Choosing the right broker can make all the difference in your trading journey.

Wrapping It Up

Fractal Risk Adjustments can be your secret weapon in scaling positions.

They allow you to manage risk effectively while taking advantage of market opportunities.

Combine this strategy with my 16 trading bots, and you’ll have a powerful setup ready to tackle the Forex market.

Don’t forget to explore reliable brokers to elevate your trading experience.

Make informed choices, and you’ll see the results.