Last Updated on February 9, 2025 by Arif Chowdhury

Ever wondered why some trades feel like a slam dunk while others are a total flop?

You’re not alone.

Many traders struggle to pinpoint where the market is headed.

What if I told you there’s a way to enhance your Forex game using something called ‘dealer ranges’?

Let’s dive into it.

What Are Dealer Ranges?

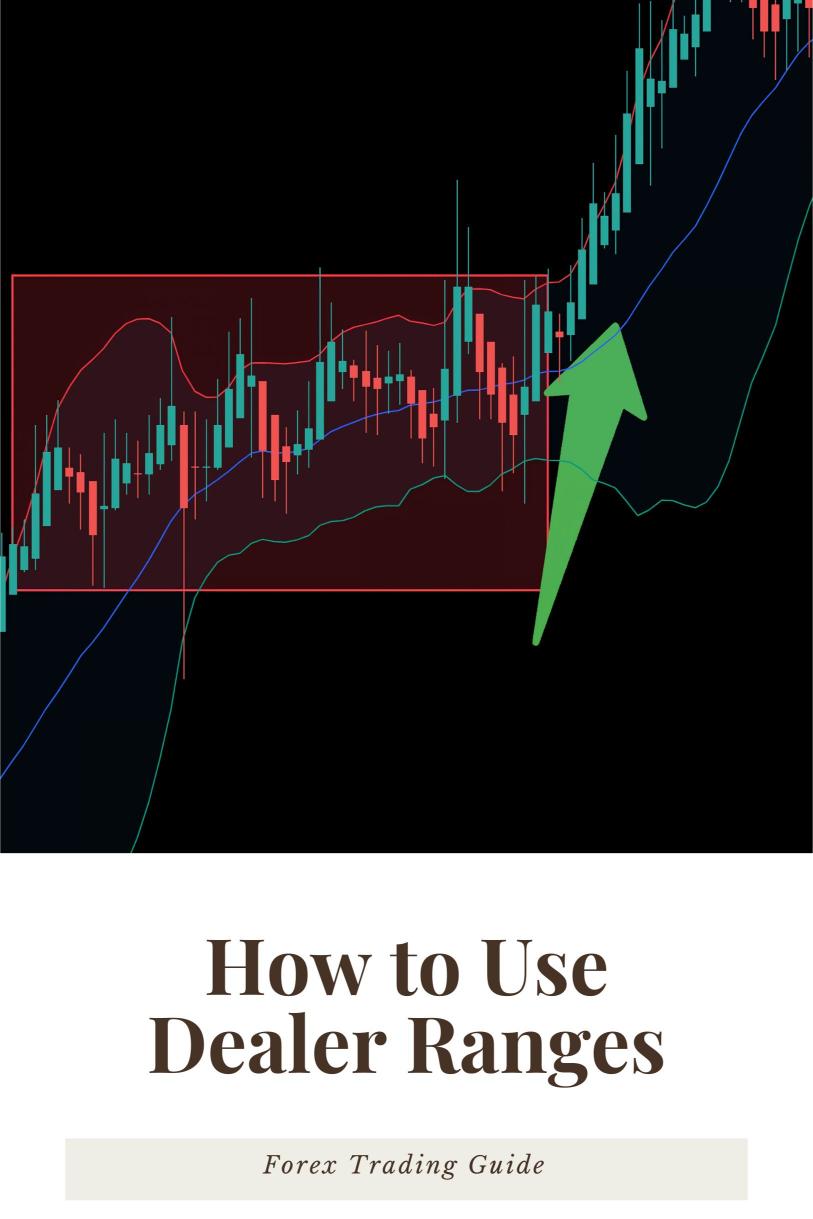

Dealer ranges are price levels where market makers (or dealers) usually operate.

These are the zones where liquidity is high, and big players step in to trade.

Understanding these ranges can give you a serious edge.

By using dealer ranges, you can identify areas of support and resistance that the market is likely to respect.

Why Should You Care?

Here are a few reasons why dealer ranges can impact your trading:

- Increased Accuracy: Using these ranges can help you make more accurate predictions.

- Reduced Risk: You’ll have clearer entry and exit points, minimizing emotional trading.

- Higher Probability Setups: Trading within these ranges often leads to better outcomes.

Did you know that around 70% of traders fail due to lack of a solid strategy?

Using dealer ranges can be a game-changer.

How to Identify Dealer Ranges

Identifying these ranges isn’t rocket science.

Here’s how to do it:

- Look for Consolidation:

- Identify periods where the price is moving sideways.

- A tight price range indicates that dealers are accumulating positions.

- Check Volume:

- High volume during a consolidation phase usually signals dealer interest.

- Pay attention to spikes in volume; they often precede significant price moves.

- Use Support and Resistance:

- Mark key support and resistance levels.

- These levels often align with dealer ranges.

- Analyze Price Action:

- Watch how the price reacts at these levels.

- If you see a bounce or a rejection, you’re likely in a dealer range.

Trading Strategy Using Dealer Ranges

Now that you know how to identify dealer ranges, let’s talk strategy.

- Entry Points:

- Enter trades when the price approaches the top or bottom of the dealer range.

- Stop-Loss Placement:

- Place your stop-loss just outside the dealer range.

- This protects you from false breakouts.

- Take Profit:

- Aim for the opposite side of the range.

- You’re looking for a risk-to-reward ratio of at least 1:2.

Real-World Application

Imagine you’ve identified a dealer range on the EUR/USD pair.

You see the price bouncing off support.

You enter the trade when the price hits the resistance level.

You’ve set your stop-loss just beyond the support level and aim for a take profit at the next resistance.

This is how you leverage dealer ranges for high-probability setups.

Why Use This Approach?

Using dealer ranges helps you avoid the emotional rollercoaster of trading.

You’re not guessing; you’re making informed decisions based on solid price action.

And let’s face it, who doesn’t want to trade with confidence?

Tools to Enhance Your Trading

If you’re serious about improving your trading, consider using my 16 trading bots.

These bots are designed to operate within the same currency pairs you’ll be analyzing with dealer ranges.

With my bots, you’re getting a diversified portfolio that minimizes risk and maximizes returns.

Plus, I’m offering this EA portfolio completely FREE!

Finding the Right Brokers

To maximize your success, you need a reliable broker.

I’ve tested some of the best out there.

Check out my recommendations at Most Trusted Forex Brokers.

These brokers provide the right environment for you to trade effectively.

Final Thoughts

Dealer ranges are vital for identifying high-probability Forex setups.

By incorporating them into your trading strategy, you’ll not only increase your accuracy but also your overall profitability.

So, what are you waiting for?

Start using dealer ranges today and watch your trading improve.

Trade smart and let those dealer ranges guide you to success!