Last Updated on February 12, 2025 by Arif Chowdhury

Are you tired of waiting for those slow indicators to give you the green light?

Feeling frustrated by missed opportunities because your signals lag behind?

Let’s talk about how you can speed things up with the Zero-Lag MACD.

As a seasoned Forex trader since 2015, I’ve navigated these waters long enough to know the value of quick, reliable signals.

This method has changed the game for me, and I believe it can do the same for you.

What is Zero-Lag MACD?

The Moving Average Convergence Divergence (MACD) is a popular tool in Forex trading.

But the traditional MACD can lag, causing you to miss crucial entry and exit points.

The Zero-Lag MACD fixes this by adjusting the calculations to reduce the lag.

This means you get faster signals without sacrificing accuracy.

Why Use Zero-Lag MACD?

Here are some compelling reasons:

- Faster Signals: Respond to market changes quickly.

- Higher Accuracy: Reduced lag means fewer false signals.

- Better Timing: Capture more profit opportunities.

Did you know that traders who adapt faster to market conditions can increase their profitability by up to 20%?

That’s a significant boost, especially when trading Forex.

Setting Up Zero-Lag MACD

Let’s break down the setup process:

- Choose Your Trading Platform: Make sure you’re using a platform that supports custom indicators.

- Download the Zero-Lag MACD: You can find this indicator on various trading forums or within your trading platform’s marketplace.

- Install the Indicator: Follow the installation instructions provided.

- Adjust the Settings: Set the Fast EMA to 12, Slow EMA to 26, and Signal Line to 9. You can tweak these settings based on your trading style.

- Add to Your Chart: Place it on your preferred currency pair chart.

Interpreting Zero-Lag MACD Signals

Now that you have it set up, how do you read the signals?

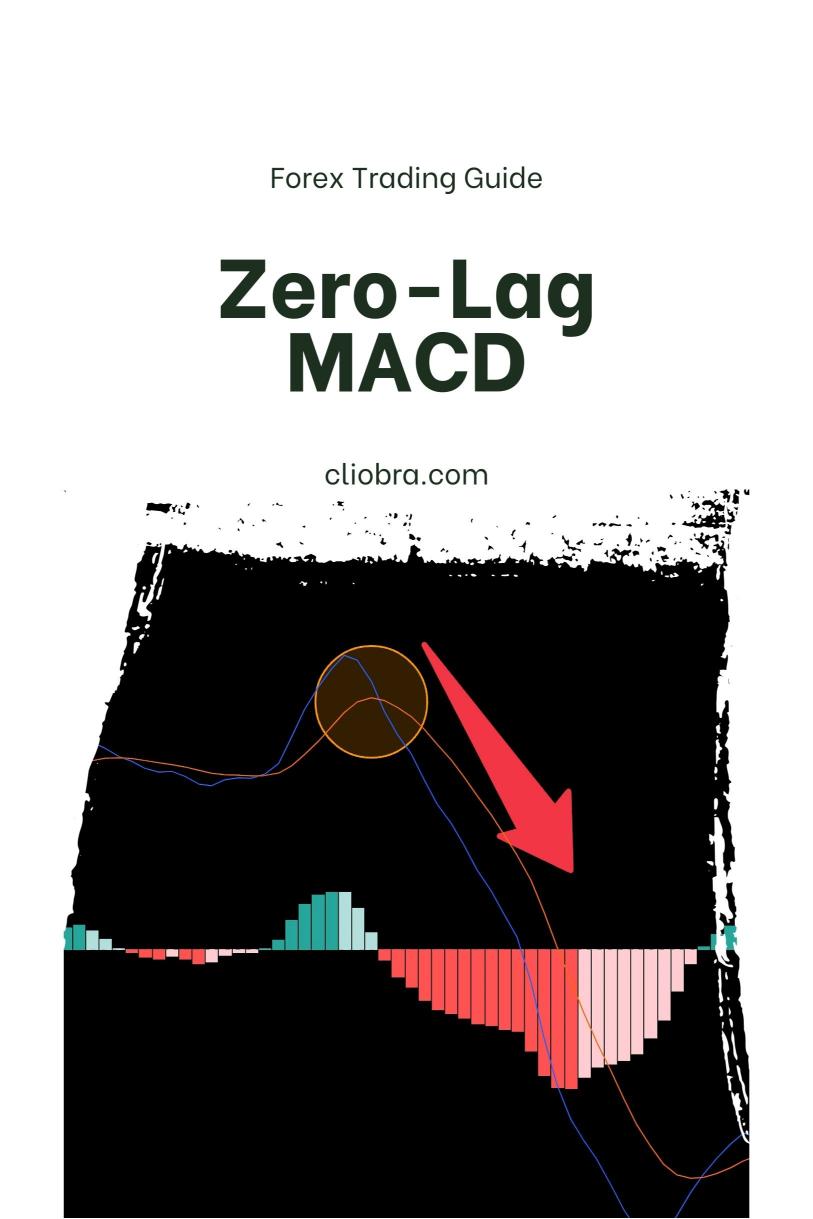

- Buy Signal: When the Zero-Lag MACD line crosses above the signal line, that’s your cue to buy.

- Sell Signal: Conversely, when it crosses below, it’s time to sell.

Keep an eye on the histogram too.

A growing histogram indicates strong momentum, while a shrinking histogram suggests a potential reversal.

My Trading Strategy

Over the years, I’ve developed a unique trading strategy that combines the Zero-Lag MACD with additional analysis techniques.

This has led to creating a portfolio of 16 sophisticated trading bots.

Each bot is strategically diversified across major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

These bots are designed to trade H4 charts, targeting long-term movements of 200-350 pips.

This approach reduces the likelihood of correlated losses and enhances overall profitability.

Why You Should Consider My Trading Bots

- Diversified Algorithms: Each currency pair has 3-4 bots, minimizing risk.

- Proven Performance: Backtested for 20 years, these bots thrive even in harsh market conditions.

- Completely Free: I’m offering my EA portfolio for free to help you succeed.

You can check out my trading bots portfolio here.

Best Practices for Trading with Zero-Lag MACD

- Combine with Other Indicators: Use it alongside trend indicators or support and resistance levels.

- Stay Updated on Market News: Economic events can impact currency movements significantly.

- Practice Risk Management: Always set stop-loss orders to protect your capital.

- Use a Reliable Broker: The execution speed and reliability of your broker can affect your trades.

Make sure to choose a broker that fits your trading style.

I’ve tested various brokers and recommend checking out the best Forex brokers here.

Conclusion

Trading Forex doesn’t have to be a waiting game.

With the Zero-Lag MACD, you can enhance your trading strategy and respond to market changes more swiftly.

By incorporating my 16 trading bots, you can automate your strategy and capitalize on market movements even when you’re away from the charts.

Don’t miss out on the opportunity to take your trading to the next level.

Start utilizing these tools today and watch your trading improve!