Last Updated on March 28, 2025 by Arif Chowdhury

Ever felt frustrated trying to decipher the Forex market?

You’re not alone.

Many traders grapple with understanding price movements and predicting market trends.

How can you gain an edge?

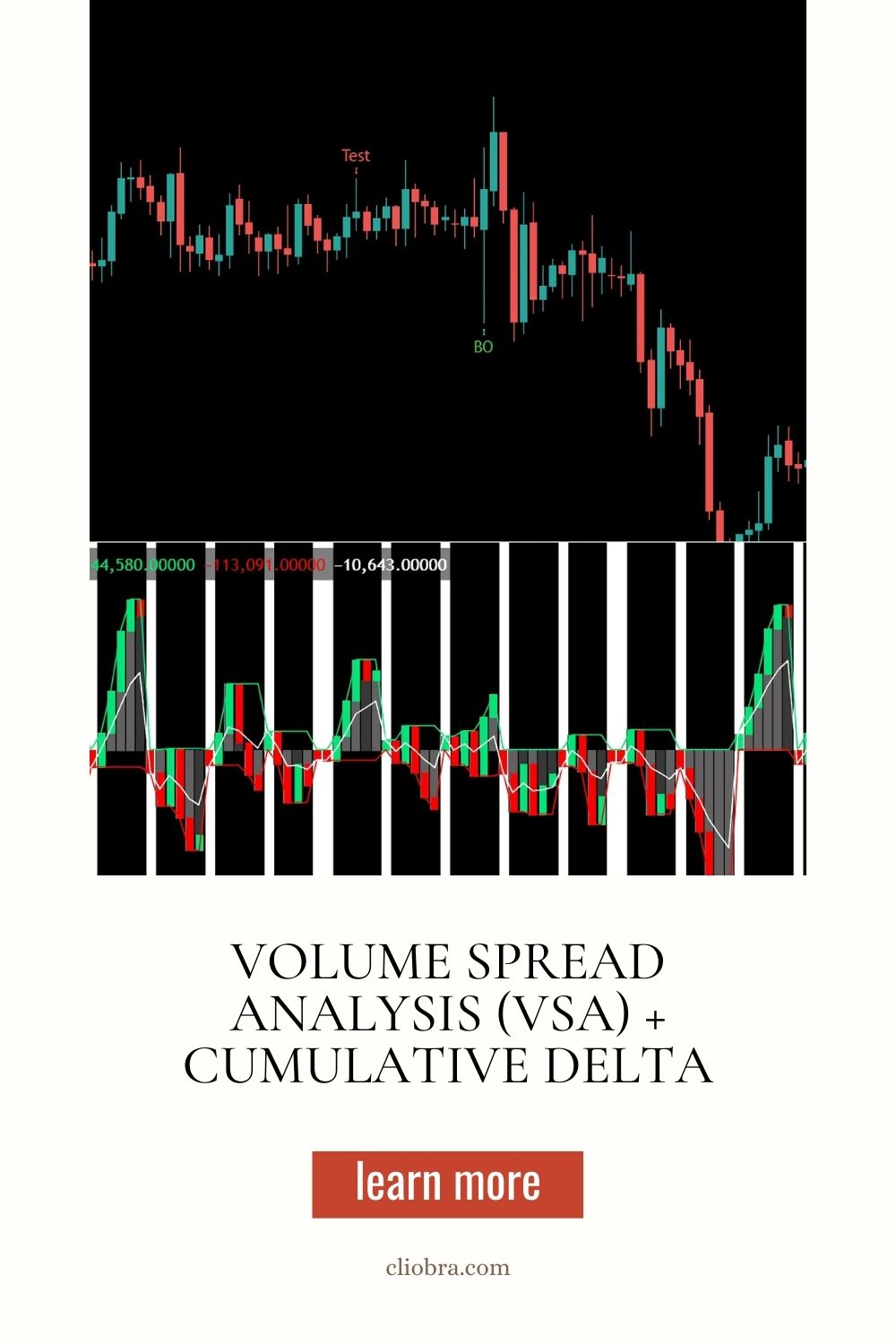

Today, I’m diving into Volume Spread Analysis (VSA) and Cumulative Delta—powerful tools that can reshape your trading approach.

What is Volume Spread Analysis (VSA)?

VSA focuses on the relationship between price movements and trading volume.

Simply put:

- Volume shows the amount of trading activity.

- Spread indicates the range between the highest and lowest prices during a period.

By analyzing these two factors, we can uncover the market’s true intentions.

Key Concepts of VSA

- High volume with rising prices? Could mean strong buying interest.

- High volume with falling prices? Might indicate selling pressure.

- Low volume? Often signifies indecision or a lack of interest.

Understanding Cumulative Delta

Cumulative Delta takes VSA further by tracking the difference between buying and selling volume over time.

It’s like having a pulse on the market’s sentiment.

Why It Matters

- Positive Delta? Indicates more buying pressure.

- Negative Delta? Suggests stronger selling pressure.

This insight helps you make informed trading decisions, especially when combined with VSA.

Why Combine VSA and Cumulative Delta?

Using these two strategies together enhances your trading accuracy.

You can pinpoint potential reversals and continuations with greater confidence.

For instance:

- If VSA shows high volume with price drops, but Cumulative Delta remains positive, it might indicate a buying opportunity.

My Trading Journey

As a seasoned Forex trader since 2015, I’ve spent countless hours mastering both fundamental and technical analysis.

Through trial and error, I developed a unique strategy that relies heavily on VSA and Cumulative Delta.

This approach has led me to create a portfolio of 16 sophisticated trading bots that leverage these techniques.

Each bot is strategically diversified across major currency pairs:

- EUR/USD

- GBP/USD

- USD/CHF

- USD/JPY

By using H4 charts and targeting long-term trades of 200-350 pips, these bots have consistently delivered strong performance—even under harsh market conditions.

Benefits of My Trading Bots

- Diversification: Each currency pair has 3-4 bots, minimizing correlated losses.

- Robust Strategy: The bots use VSA and Cumulative Delta, among other strategies, enhancing profitability.

- Free Access: I offer this entire EA portfolio completely FREE!

If you’re serious about trading, I highly recommend checking out my trading bots.

You can experience the power of automation while you focus on refining your strategy.

Practical Tips for Trading with VSA and Cumulative Delta

- Stay Disciplined: Follow your trading plan without deviation.

- Analyze Regularly: Keep an eye on volume and delta trends before entering trades.

- Use Proper Risk Management: Always set stop-loss orders to protect your capital.

Choosing the Right Forex Broker

All these strategies and tools are useless if you don’t have a reliable broker.

Tight spreads, fast execution, and excellent customer support are crucial.

Here are some brokers I trust:

- FBS: Spreads from 0.7 pips, no commission, and minimum deposit from $5.

- XM: Spreads as low as 0.8 pips, zero costs, and a minimum deposit of $5.

- TickMill: Spreads from 0.7 pips, fast execution, and minimum deposit from $100.

These brokers have stood out for their superior trading experience.

If you’re looking for a trusted partner in your trading journey, check out these best Forex brokers.

Final Thoughts

Trading Forex can be overwhelming, but with the right tools and strategies, you can simplify the process.

By combining Volume Spread Analysis with Cumulative Delta, you’ll gain insights that can significantly improve your trading decisions.

And remember, my 16 trading bots are available for free, ready to help automate your strategy.

Dive in, explore, and don’t hesitate to take your trading to the next level!