Last Updated on March 20, 2025 by Arif Chowdhury

Ever felt lost in the Forex jungle?

You’re not alone.

Many traders struggle with finding the right indicators to pinpoint trends and make profitable trades.

I’ve been trading Forex since 2015, and trust me, I get it.

You want a method that’s reliable and doesn’t leave you second-guessing every move.

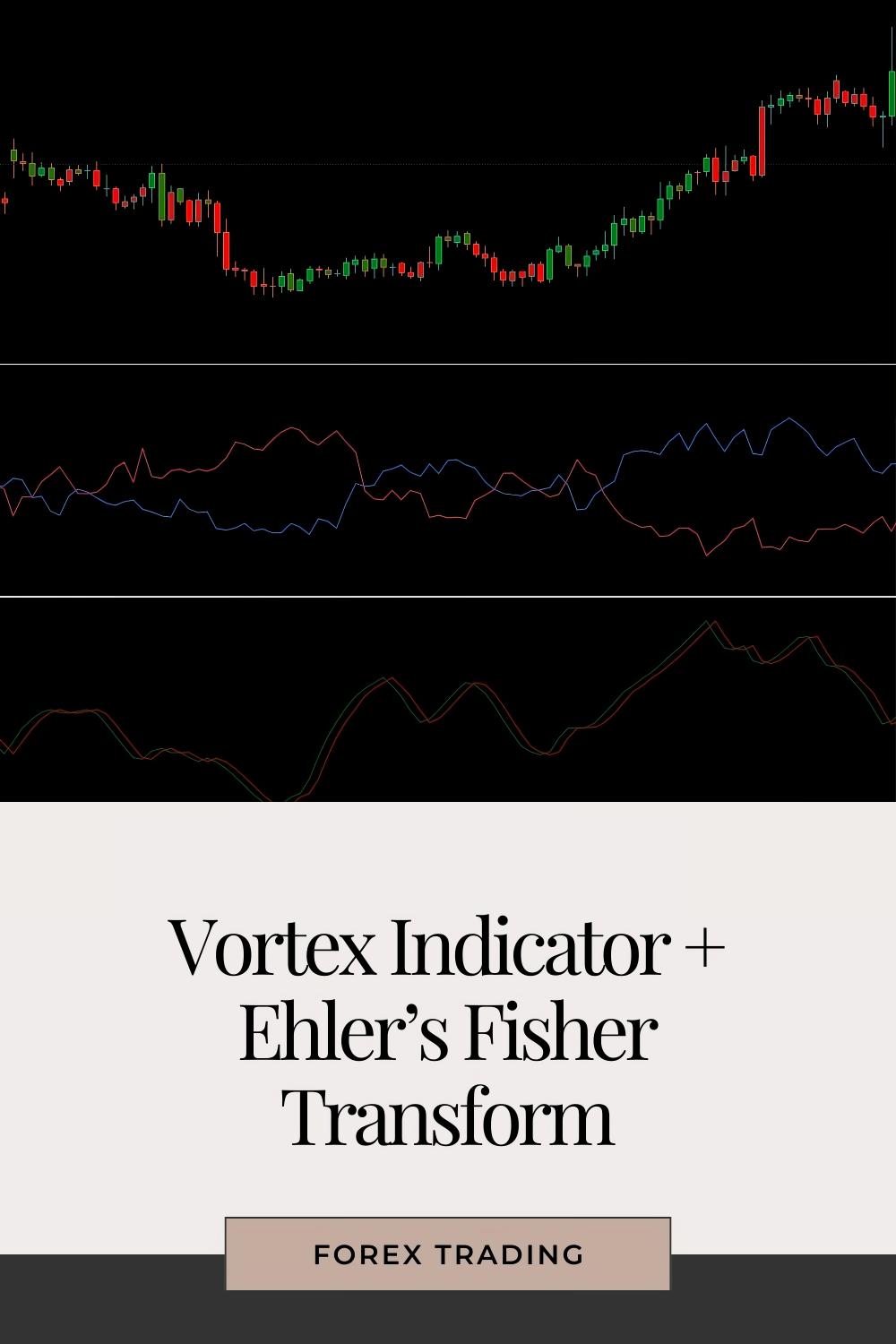

Let’s dive into the Vortex Indicator and Ehler’s Fisher Transform, two powerful tools that can seriously up your trading game.

Understanding the Vortex Indicator

The Vortex Indicator is a trend-following tool that helps identify the direction of the market.

Here’s how it works:

- Two lines: One for upward trends, one for downward trends.

- Crossovers: When the upward line crosses above the downward line, it signals a potential buy. The opposite is true for sells.

This indicator shines in trending markets.

But what if the market is choppy?

That’s where the Ehler’s Fisher Transform comes in.

Ehler’s Fisher Transform Explained

The Ehler’s Fisher Transform converts prices into a Gaussian normal distribution.

In plain English, it smooths out price data to help you identify trends more clearly.

Why use it?

- Reduces noise: It helps filter out the erratic movements that can throw off your analysis.

- Signals: You’ll get clear buy and sell signals when the Fisher line crosses above or below a certain threshold.

Combining these two indicators can give you a robust framework for making decisions.

Using Them Together

Now, let’s piece it all together.

- Identify the trend using the Vortex Indicator.

- Confirm the trend with Ehler’s Fisher Transform.

Example Steps:

- Wait for the Vortex Indicator to show a bullish crossover.

- Check the Ehler’s Fisher Transform to see if it supports that trend.

- If both indicators align, it’s time to consider entering a trade.

Building a Solid Strategy

Now, I know what you’re thinking.

“Okay, but how do I turn this into a winning strategy?”

Here are some key tips:

- Set realistic goals: Aim for 200-350 pips for long-term trades.

- Risk management: Only risk a small percentage of your capital on each trade.

- Backtesting: Always backtest your strategies to see how they perform under different market conditions.

Speaking of strategies, I’ve developed a portfolio of 16 sophisticated trading bots that use the Vortex Indicator and Ehler’s Fisher Transform among other methods.

These bots are designed to minimize risk while maximizing returns, focusing on major pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

The best part? You can access this entire portfolio for FREE.

Why My Trading Bots Stand Out

- Diversity: Each currency pair has a unique set of 3-4 bots, providing internal diversification.

- Long-term focus: These bots are set to capture significant moves over time, ensuring steady growth.

- Proven performance: I’ve backtested them for 20 years, and they hold up even in tough market conditions.

If you’re curious about elevating your trading, check out my trading bots portfolio.

Choosing the Right Broker

Let’s talk about brokers.

Your choice of broker can make or break your trading experience.

Here are a few critical factors to consider:

- Tight spreads: Look for brokers that offer low spreads for better profitability.

- Execution speed: Fast execution can save you from slippage, especially during volatile times.

- Customer support: Reliable support is crucial, especially when you need help.

I’ve tested various brokers, and I recommend checking out the most trusted Forex brokers that I’ve handpicked for you.

Final Thoughts

Trading Forex can be daunting, but with the right tools and strategies, it becomes manageable.

The Vortex Indicator and Ehler’s Fisher Transform are great allies in your trading journey.

Combine them, manage your risks, and consider automating your trades with my 16 trading bots.

They’re designed to take the guesswork out of trading and let you focus on what really matters—growing your account.

Happy trading! 🚀