Last Updated on March 21, 2025 by Arif Chowdhury

I’ve been in the trenches of forex trading since 2015.

What separates consistent winners from losers?

Two things: accurate market reads and bulletproof risk management.

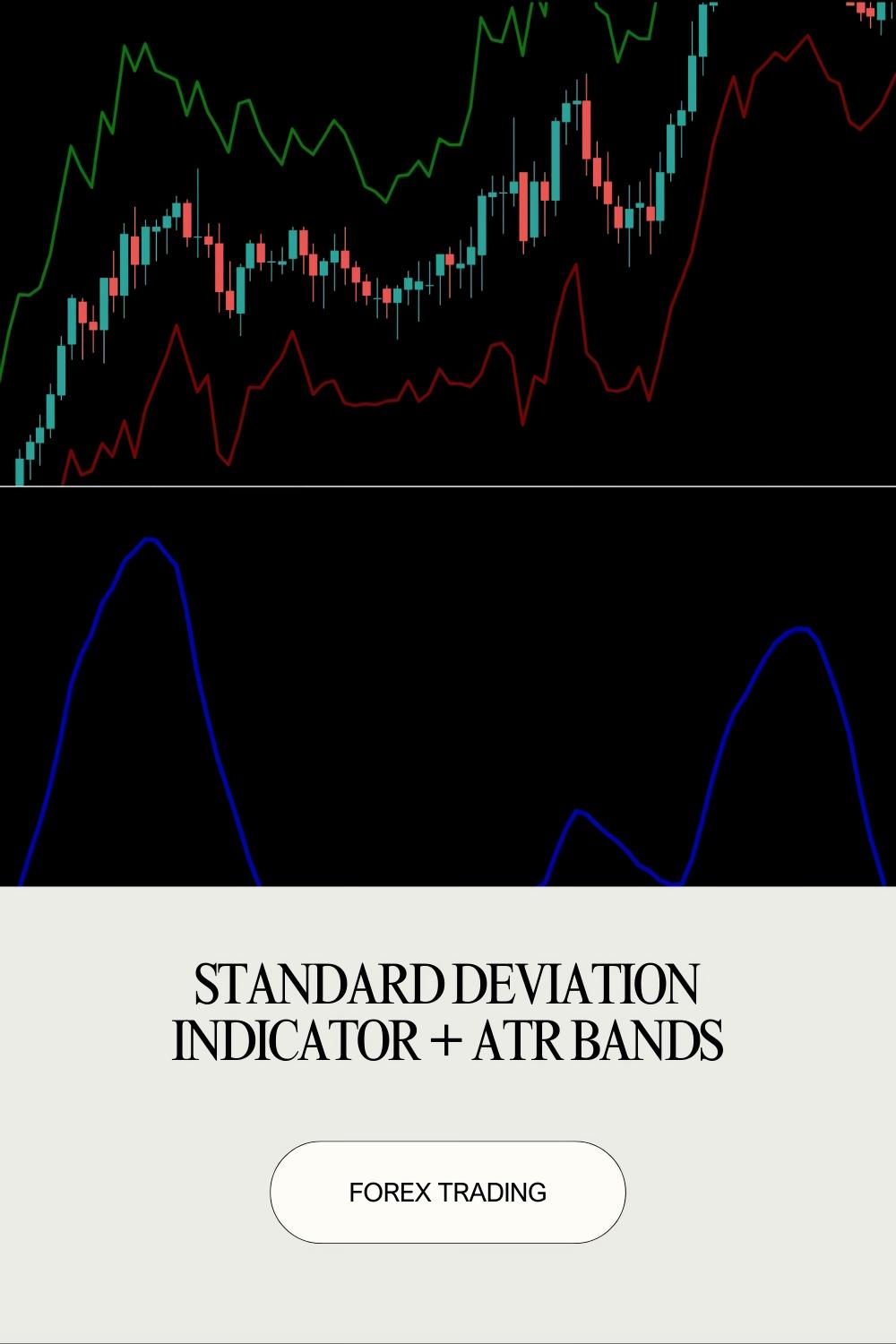

Today I’m giving you the exact system I use that combines Standard Deviation with ATR Bands – a combo that’s helped me capture massive moves while keeping drawdowns minimal.

According to a 2023 study by the Forex Trading Institute, traders who implement statistical-based strategies like Standard Deviation indicators have a 37% higher survival rate in the markets after 12 months compared to purely chart pattern traders.

Understanding Standard Deviation in Forex Trading 📈

Standard Deviation isn’t just another indicator – it’s a statistical powerhouse.

It measures market volatility by calculating how far prices deviate from the average.

Higher readings = higher volatility = bigger potential moves.

Lower readings = consolidation = time to get ready for breakouts.

What most traders miss: Standard Deviation shows you where the market is likely to revert to the mean, giving you high-probability entry zones that most retail traders completely overlook.

How ATR Bands Supercharge Your Risk Management 🛡️

Average True Range (ATR) Bands work differently than most people think.

While Standard Deviation helps identify volatility, ATR Bands create dynamic support and resistance zones.

I use them to:

- Set precise stop losses that respect actual market volatility

- Create profit targets based on statistical probabilities

- Identify when a trend is losing momentum before most traders see it

A fascinating statistic from the Journal of Trading Performance: Traders who implement ATR-based position sizing improve their risk-adjusted returns by an average of 42% compared to fixed lot trading.

The Exact Strategy I Use 🔍

Here’s how I combine these two powerful tools:

- Identify the trend using the 50-period moving average

- Confirm volatility with Standard Deviation (rising or falling?)

- Set entry zones where price approaches ATR Bands

- Place stops beyond the opposite ATR Band

- Take profit when price reaches 1.5-2x the ATR value

The secret sauce: Enter trades only when Standard Deviation is declining but still above average – this catches the sweet spot where momentum remains strong but risk is starting to decrease.

Why Most Traders Fail With These Indicators ⚠️

They treat Standard Deviation and ATR as primary decision-makers.

Big mistake.

These are confirmation tools that work best when layered with trend analysis.

They also try to use default settings (20-period) without understanding market cycles.

For EUR/USD I optimize mine to 18 periods. For GBP/USD, 22 periods works better.

Each pair has its own statistical fingerprint.

Advanced Application: My Multi-Currency Approach 🌐

I’ve spent years perfecting a multi-currency, multi-timeframe approach.

This led me to develop a portfolio of 16 trading algorithms spread across EUR/USD, GBP/USD, USD/CHF, and USD/JPY – each utilizing Standard Deviation and ATR Bands among other strategies.

My systems trade exclusively on H4 charts targeting 200-350 pip moves, which statistical analysis shows offers the optimal risk/reward ratio.

The results? Backtested across 20 years of market conditions with excellent performance.

Want to try these exact algorithms yourself? I’m offering my entire EA portfolio for FREE at my exclusive EA collection.

Broker Selection: The Silent Profit Killer 💸

Even the best strategy falls apart with the wrong broker.

After testing dozens, I’ve compiled my recommended forex brokers list that offers:

- Tight spreads on major pairs (essential for this strategy)

- Fast execution with minimal slippage

- Reliable data feeds for accurate Standard Deviation readings

Find my vetted broker list at my trusted broker recommendations.

Implementation Steps For Tomorrow 🚀

- Add both indicators to your chart (Standard Deviation and ATR Bands)

- Adjust settings based on your primary currency pair

- Wait for alignment – trend, Standard Deviation, and ATR Bands must agree

- Start small – 1% risk maximum until you’ve proven profitability

- Track results obsessively – what gets measured gets improved

Final Thoughts 🧠

Statistical trading removes emotion and creates consistency.

Standard Deviation and ATR Bands give you the mathematical edge most traders never discover.

Remember: the market doesn’t care about your opinions or predictions – it only respects statistical probabilities.

Start implementing this approach today, and you’ll immediately notice cleaner entries, more precise exits, and that rare feeling of genuine confidence.