Last Updated on March 17, 2025 by Arif Chowdhury

Ever feel overwhelmed by the chaos of Forex trading?

You’re not alone.

Many traders struggle with identifying market trends and determining when to jump in or out.

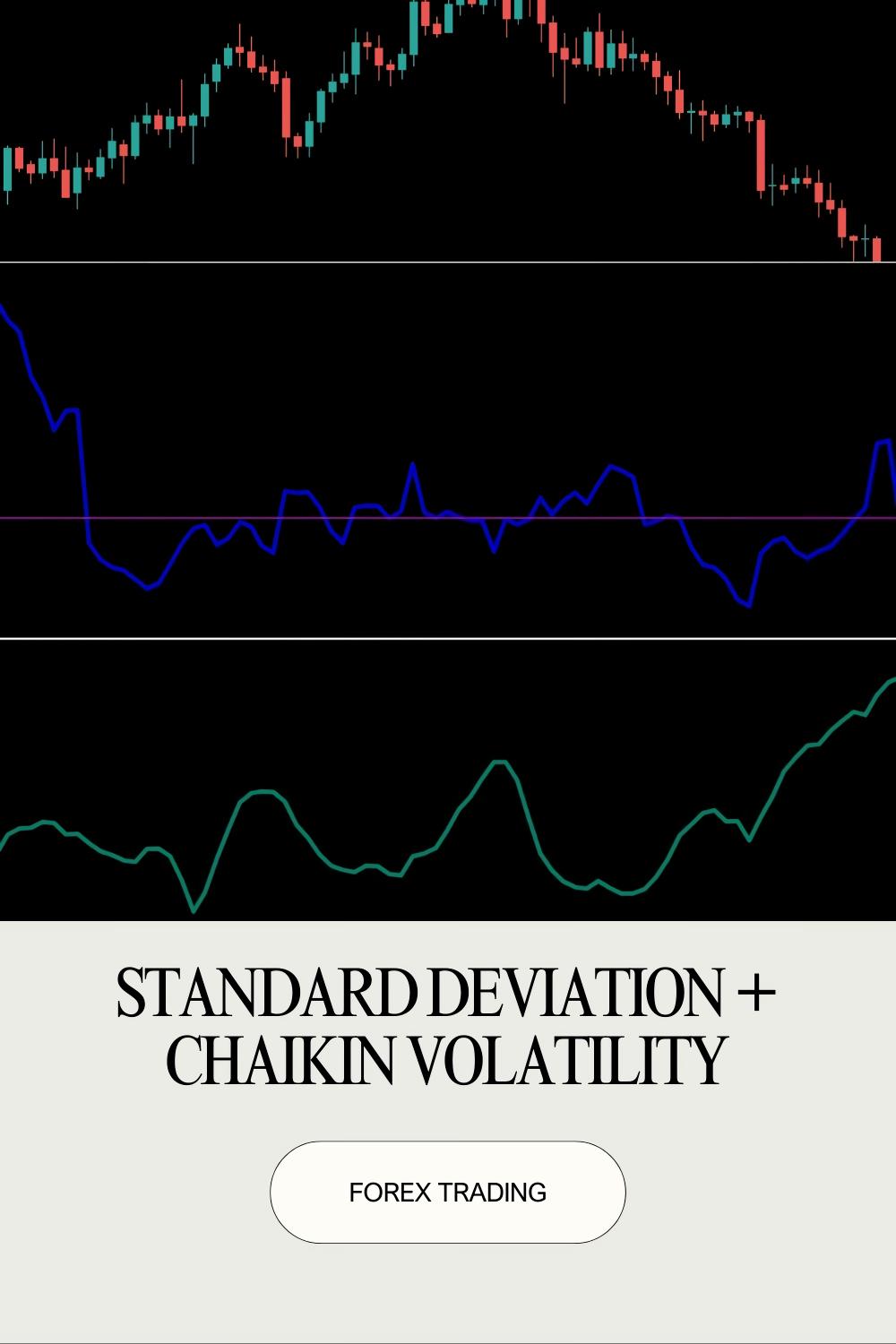

But what if I told you there’s a straightforward way to analyze trend strength using two powerful indicators: Standard Deviation and Chaikin Volatility?

Let’s dive into this and simplify it all.

Understanding Standard Deviation 📉

Standard Deviation measures how spread out prices are from their average.

- Why it matters: It gives you an idea of market volatility.

- Higher values mean greater price fluctuations, while lower values indicate stability.

For example, if you see a high Standard Deviation, that might signal a potential breakout or trend reversal.

Introducing Chaikin Volatility 📊

Chaikin Volatility combines price action and volume, helping us gauge market sentiment.

- How it works: It looks at the difference between the highest and lowest prices over a period, factoring in volume.

- Key insight: A rising Chaikin Volatility indicates increasing price movements, suggesting strong trends are forming.

Combining the Two for Trend Analysis 🔄

Here’s how you can use both indicators together for effective trading:

- Identify Current Market Conditions:

- Use Standard Deviation to spot volatility.

- Check Chaikin Volatility to confirm whether the trend is gaining momentum.

- Set Your Entry and Exit Points:

- Look for high Standard Deviation values indicating potential breakouts.

- Ensure Chaikin Volatility supports your entry—ideally, you want it rising as you place your trades.

- Monitor Regularly:

- Keep an eye on both indicators.

- Adjust your strategy as needed based on their movements.

My Trading Bots and Their Secret Sauce 🤖

Now that you have a handle on these indicators, let me share a little about my trading journey.

Since 2015, I’ve been perfecting my trading strategies, leading to the creation of 16 sophisticated trading bots.

These bots are designed to analyze market conditions, including Standard Deviation and Chaikin Volatility, to make informed trading decisions.

- Diverse Portfolio: Each bot focuses on a specific currency pair—EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

- Risk Mitigation: Internally diversified, they minimize correlated losses, providing a robust trading experience.

And guess what? I’m offering this entire EA portfolio for FREE!

You can check it out here: Explore My Trading Bots.

Practical Tips for Using These Indicators 🚀

- Don’t Overcomplicate: Stick to the basics. Focus on the signals from your indicators without getting lost in too many technicalities.

- Stay Disciplined: Have a clear plan and stick to it. Emotional trading can lead to losses.

- Backtest Your Strategies: Always test your approach before risking real money.

The Importance of Choosing the Right Broker 🏦

As you embark on your Forex trading journey, the choice of broker is crucial.

Not all brokers are created equal.

Look for ones with:

- Tight spreads: This affects your overall profitability.

- Fast execution: You don’t want delays when the market is moving.

- Good customer support: You may need help when things go sideways.

I’ve tested various brokers and can confidently recommend some of the best out there.

Check them out here: Top Forex Brokers.

Final Thoughts 💡

Trading Forex doesn’t have to be daunting.

By leveraging Standard Deviation and Chaikin Volatility, you can gain clarity in your trading decisions.

And with my 16 trading bots, you can automate this process, enhancing your chances of success.

Feel free to take advantage of my FREE EA portfolio and explore the best brokers available.

Happy trading! 🌟