Last Updated on February 23, 2025 by Arif Chowdhury

Ever felt overwhelmed by the Forex market?

Wondering how to pinpoint the best entry and exit points?

You’re not alone.

As a seasoned Forex trader since 2015, I’ve navigated the waves of this market.

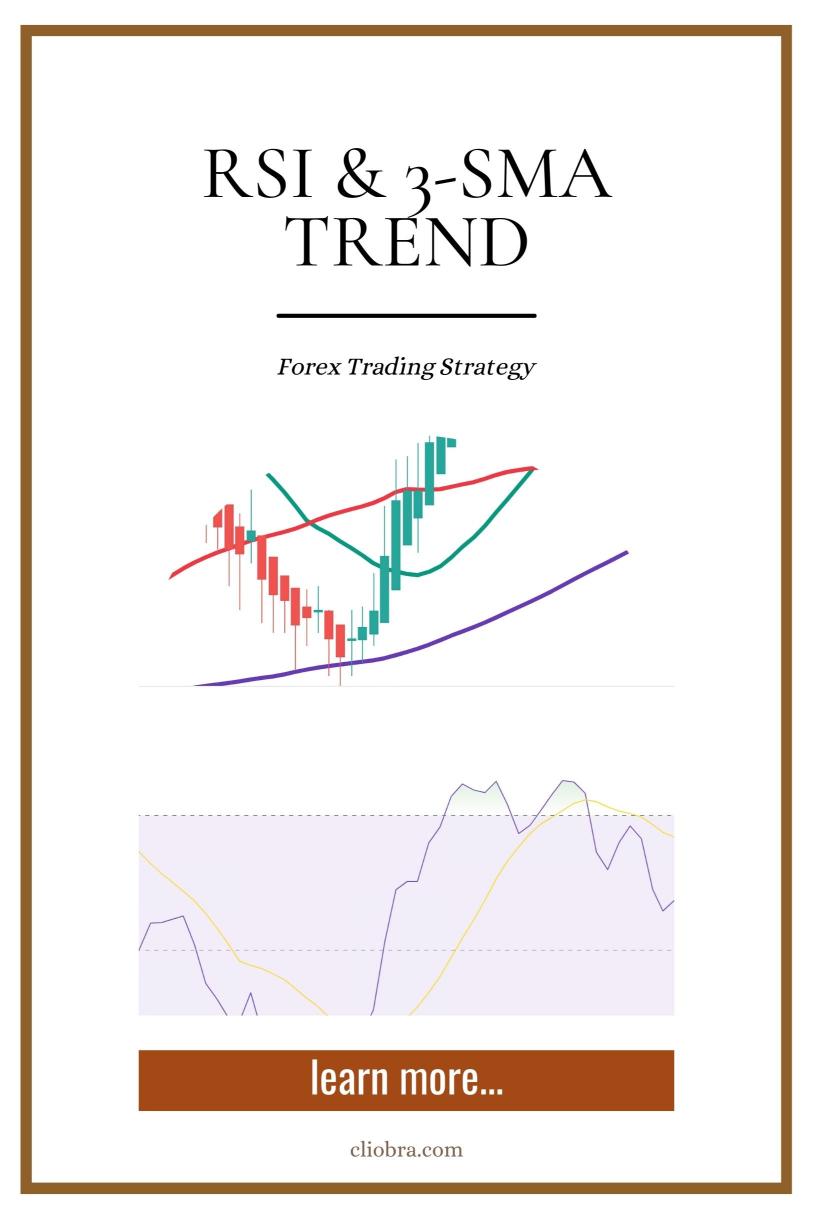

I’ve seen the struggles and victories, and today, I want to share a powerful strategy that has helped me along the way: the RSI & 3-SMA Trend Confirmation Strategy.

What is RSI? 🤔

RSI, or Relative Strength Index, is a momentum oscillator that measures the speed and change of price movements.

It ranges from 0 to 100, helping traders understand whether a currency pair is overbought or oversold.

- Overbought: RSI above 70

- Oversold: RSI below 30

Understanding the 3-SMA Strategy 📈

The 3-SMA (Simple Moving Average) strategy uses three different SMAs to determine the market trend.

- Short-term SMA: Tracks immediate price changes.

- Medium-term SMA: Offers a broader view of market trends.

- Long-term SMA: Helps identify the overall market direction.

When these SMAs align, it’s a strong indication of a trending market.

Why Combine RSI and 3-SMA? 🌟

Combining these two tools creates a powerful confirmation system.

Here’s how:

- RSI signals when to enter or exit based on momentum.

- SMA alignment confirms the trend direction.

This dual confirmation reduces false signals, increasing your chances of profitability.

Steps to Implement the Strategy 💡

- Set Up Your Chart

- Add the RSI indicator.

- Add three SMAs (e.g., 10-period, 50-period, and 200-period).

- Identify the Trend

- Look for alignment in the SMAs.

- Short-term SMA should cross above the medium-term and long-term for a bullish trend, and vice versa for a bearish trend.

- Check the RSI

- For a buy signal: RSI should be below 30 (oversold) and start to rise.

- For a sell signal: RSI should be above 70 (overbought) and start to fall.

- Place Your Trade

- Enter a trade only when both indicators align.

- Set your stop-loss and take-profit levels based on market volatility.

- Manage Your Trades

- Watch the RSI for exit signals.

- If the RSI reverses direction against your trade, consider closing your position.

Why This Strategy Works 📊

Statistically, about 70% of traders experience losses in Forex.

Why? They often lack a solid strategy.

But with the RSI and 3-SMA combo, you’re not just guessing—you’re making informed decisions backed by data.

Additionally, my exceptional trading bot portfolio uses this strategy among others to maximize profit and minimize risk.

With 16 diverse algorithms tailored for major currency pairs like EUR/USD and GBP/USD, you can leverage these tools without the heavy lifting.

Curious? Check out my trading bots portfolio for FREE.

Tips for Success 🌍

- Stay Disciplined: Stick to your strategy. Don’t chase losses.

- Keep Learning: The market evolves. Stay updated with trends and news.

- Use Reliable Brokers: Your trading experience is only as good as your broker. I’ve tested several and recommend checking out the best Forex brokers for a smooth trading journey.

Final Thoughts 🏁

Trading Forex can be daunting, but with the right tools and strategies, it becomes manageable.

The RSI & 3-SMA Trend Confirmation Strategy offers clarity in decision-making and enhances your trading performance.

By leveraging my 16 trading bots, you can automate your trades and potentially boost your profitability without constant monitoring.

Start your trading journey today, and remember: success in Forex is a blend of strategy, discipline, and the right support.