Last Updated on February 25, 2025 by Arif Chowdhury

Ever felt overwhelmed by the chaos of Forex trading?

Wondering how to make sense of it all?

You’re not alone.

I’ve been in the trenches since 2015, and I’ve faced the same questions:

- How do I spot a good entry point?

- When should I pull the trigger on a trade?

- What tools can simplify my decision-making?

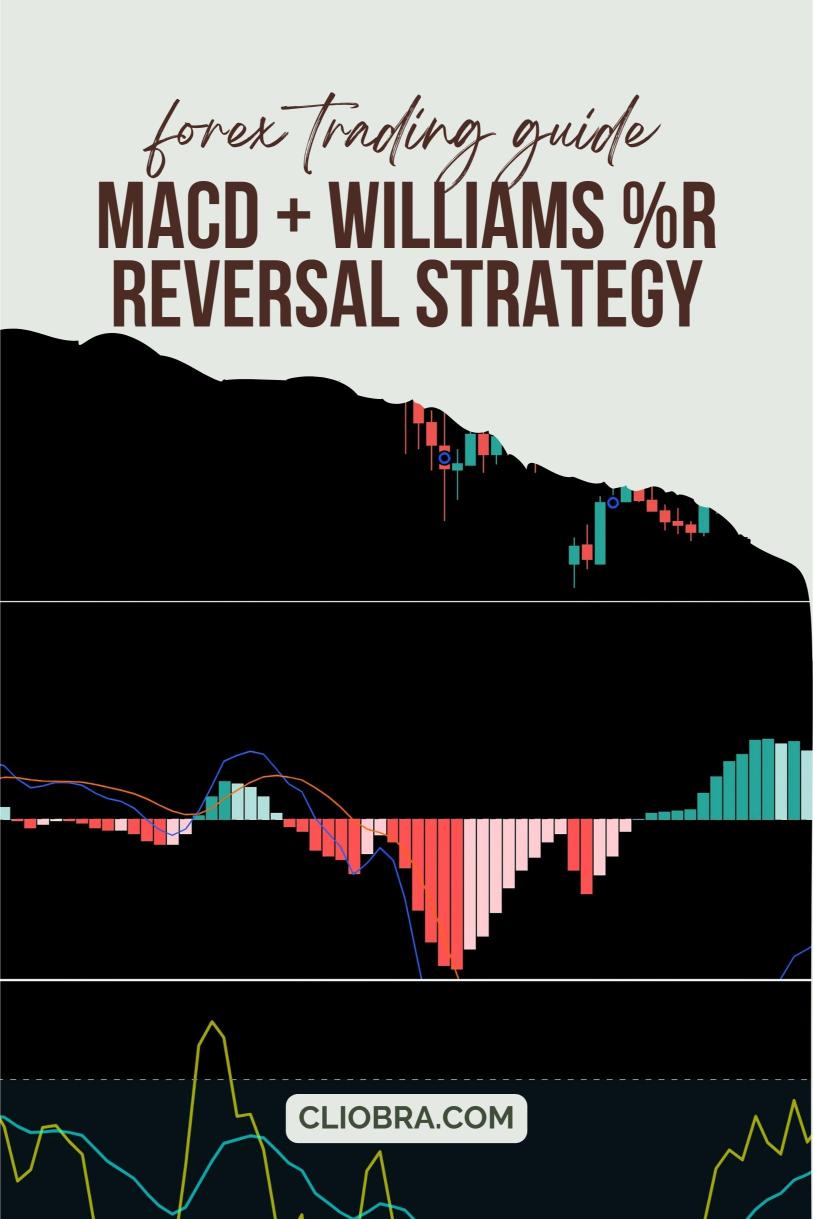

Let’s dive into a strategy that’s helped me navigate these waters with confidence: the MACD + Williams %R Reversal Strategy. 🚀

Understanding the Basics

First, let’s break down the two indicators.

- MACD (Moving Average Convergence Divergence): This is a trend-following momentum indicator. It helps you identify potential buy and sell signals based on the relationship between two moving averages.

- Williams %R: This momentum indicator measures overbought and oversold levels on a scale from 0 to -100. It’s great for spotting potential reversals.

Combining these two can give you a powerful edge in trading.

Setting Up the Indicators

- Add MACD to Your Chart: Most platforms have it by default. Look for the MACD line, signal line, and histogram.

- Add Williams %R: Set this up on a separate chart. You’ll want to keep an eye on the -20 and -80 levels, which indicate overbought and oversold conditions respectively.

How to Use the MACD + Williams %R Strategy

Now, let’s get to the good stuff.

Entry Signals

- Buy Signal:

- Look for the MACD line crossing above the signal line.

- Confirm this with Williams %R moving above -20 (indicating oversold conditions).

- Sell Signal:

- Watch for the MACD line crossing below the signal line.

- Check if Williams %R drops below -80 (indicating overbought conditions).

Exit Signals

- Use MACD divergence as a warning sign that the trend might be reversing.

- If Williams %R reaches extreme levels (near -100 or 0), consider locking in profits.

Why This Strategy Works

According to recent statistics, traders utilizing a combination of indicators often see a 20-30% increase in their win rate. That’s significant!

This strategy is all about confirming your trades, reducing the noise, and increasing your chances of success.

You’re not relying on one indicator alone; you’re stacking the odds in your favor.

My Trading Bots and Their Role

Now, let’s talk about my 16 trading bots.

These aren’t just any bots; they’re designed using a variety of strategies, including the MACD + Williams %R Reversal Strategy.

Each bot specializes in one of the major currency pairs:

- EUR/USD

- GBP/USD

- USD/CHF

- USD/JPY

What’s cool?

I’ve backtested these bots for the past 20 years.

They perform excellently, even in harsh conditions.

Their design focuses on long-term trading, aiming for 200-350 pips, which means they’re built for sustainability rather than quick wins.

And guess what?

I’m offering this entire EA portfolio for FREE.

It’s a fantastic way to start optimizing your Forex trading without any financial commitment. Check it out here: My Trading Bots.

The Importance of the Right Broker

Trading strategies are only as good as the broker you choose.

A reliable broker can offer tight spreads, fast execution, and great customer support.

I’ve tested numerous brokers and have found a few that stand out for a superior trading experience.

If you’re looking for trusted brokers, check out my recommendations here: Best Forex Brokers.

These brokers have everything you need to execute your strategies effectively.

Final Thoughts

Trading Forex doesn’t have to be a lonely road.

With the right tools and strategies, you can enhance your trading game.

The MACD + Williams %R Reversal Strategy is just one way to start.

Utilizing automated trading bots can further bolster your efforts.

Remember, trading is about managing risk and being strategic.

Stay disciplined, keep learning, and don’t hesitate to reach out if you have questions.

Let’s conquer the Forex market together!