Last Updated on March 18, 2025 by Arif Chowdhury

Ever wondered how to trade Forex with precision?

You’re not alone.

Many traders struggle with finding the right strategy amidst the chaos of the markets.

How do you filter out the noise and pinpoint those high-probability setups?

I’ve been in the Forex game since 2015, and I’ve refined my approach to trading, focusing heavily on technical analysis.

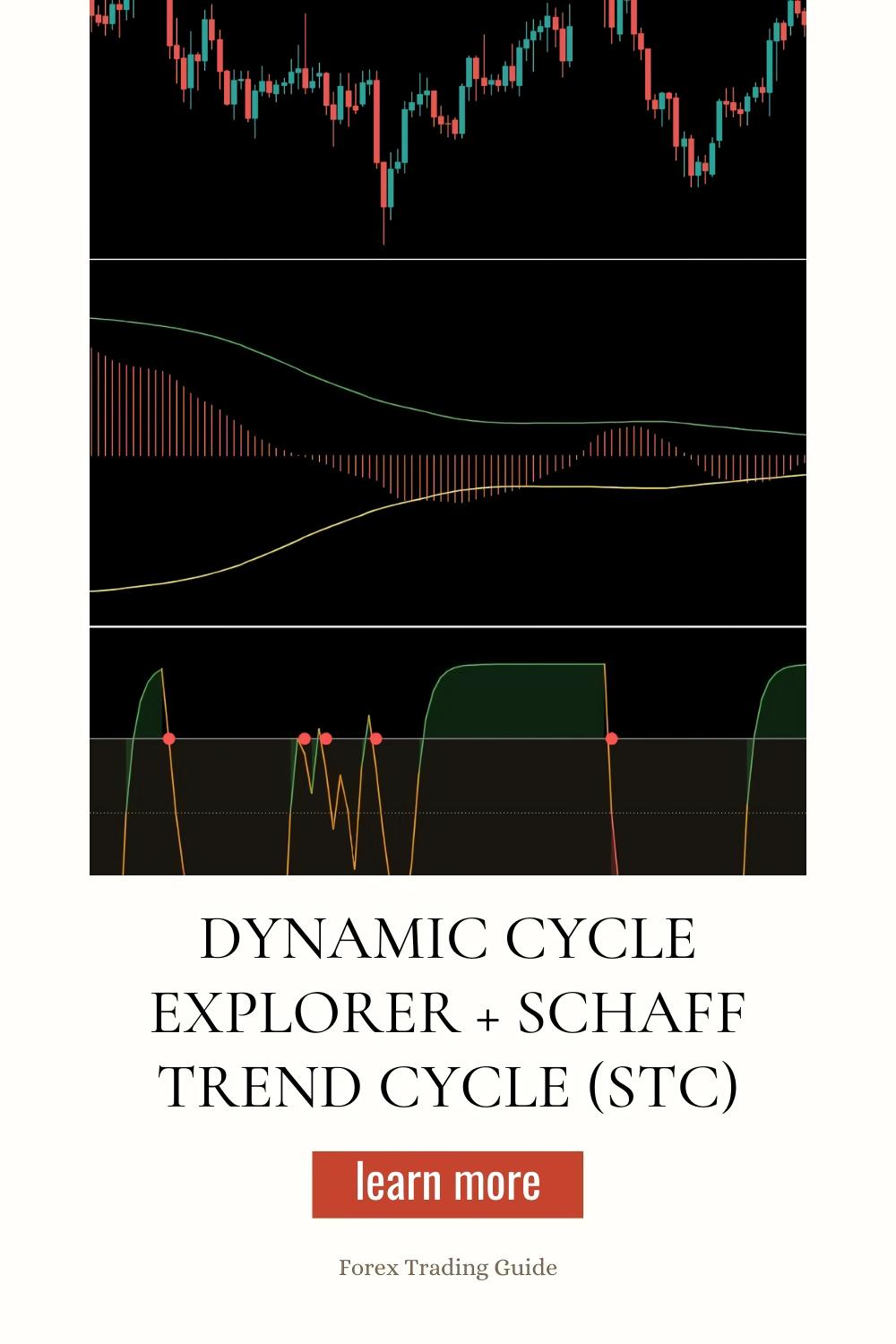

Today, I want to share with you how you can leverage the Dynamic Cycle Explorer and Schaff Trend Cycle (STC) to enhance your trading accuracy.

The Power of Dynamic Cycle Explorer

The Dynamic Cycle Explorer is a fantastic tool that helps identify market cycles.

Here’s why it’s useful:

- Cycle Detection: It pinpoints the highs and lows in a market cycle.

- Market Timing: Helps you know when to enter and exit trades.

- Visual Clarity: Offers an easy-to-read visual representation of cycles.

When you combine this with the Schaff Trend Cycle (STC), you get a potent one-two punch.

Understanding the Schaff Trend Cycle (STC)

The Schaff Trend Cycle is a momentum indicator that works like a charm.

It’s based on the MACD (Moving Average Convergence Divergence) and adds a layer of cycle analysis.

Here are its key benefits:

- Leading Indicator: It tends to signal potential reversals earlier than traditional indicators.

- Versatile: Works well in trending and ranging markets.

- User-Friendly: Easy to interpret for both beginners and pros.

With these two tools, you can create a robust trading strategy that’s capable of delivering consistent results.

How to Combine These Tools for Trading

Using the Dynamic Cycle Explorer with the STC is straightforward.

- Identify the Cycle: Use the Dynamic Cycle Explorer to spot the current market cycle.

- Confirm with STC: Look for STC crossovers to confirm your entry points.

- Set Your Targets: Aim for 200-350 pips, as my trading bots do, ensuring you capitalize on significant moves.

- Manage Your Risk: Always set stop-loss levels based on market volatility.

This method not only increases your chances of success but also aligns with my trading philosophy of diversification.

The Role of Diversification in Forex Trading

Speaking of diversification, I’ve developed a unique trading bot portfolio that utilizes various strategies, including the Dynamic Cycle Explorer and STC.

My portfolio consists of 16 sophisticated trading bots focused on four major currency pairs: EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Here’s how these bots work:

- Internally Diversified: Each pair has 3-4 bots, minimizing correlated losses.

- Long-Term Focus: Designed to achieve substantial moves, ensuring stability and profitability.

- Backtested for Success: These bots have been tested over 20 years and perform excellently even in tough market conditions.

Best part? I’m offering this entire EA portfolio for FREE. Yes, you read that right!

You can start trading with proven algorithms that have consistently delivered results. Check them out at my 16 trading bots.

Stay Ahead with the Right Brokers

To maximize your trading experience, choosing the right broker is crucial.

Here are some trusted brokers I recommend:

- FBS: Tight spreads starting from 0.7 pips, and a minimum deposit of just $5.

- XM: Zero costs with no swap fees, and a minimum deposit of $5.

- TickMill: Offers a risk-free $30 welcome bonus and average execution speed of 0.20 seconds.

- FXTM: Awarded the Most Trusted Forex Broker award in 2022, with instant withdrawals.

- HFM: No minimum deposit, high leverage, and a 20% top-up bonus.

These brokers provide the environment you need to implement your strategies effectively.

You can explore these options further at trusted Forex brokers.

Conclusion

Trading Forex using the Dynamic Cycle Explorer and Schaff Trend Cycle can dramatically improve your precision.

With a solid understanding of market cycles and momentum indicators, you can make informed trading decisions.

Remember, the key to success lies in diversification and using the right tools.

Don’t forget to check out my FREE EA portfolio and consider the best brokers for your trading needs.

Let’s make those pips together! 🚀