Last Updated on March 18, 2025 by Arif Chowdhury

Ever felt overwhelmed by the endless strategies in Forex trading?

You’re not alone.

As a seasoned Forex trader since 2015, I’ve faced that confusion.

Over the years, I’ve honed my skills with a focus on technical analysis, leading me to a unique trading strategy that brings consistent profits.

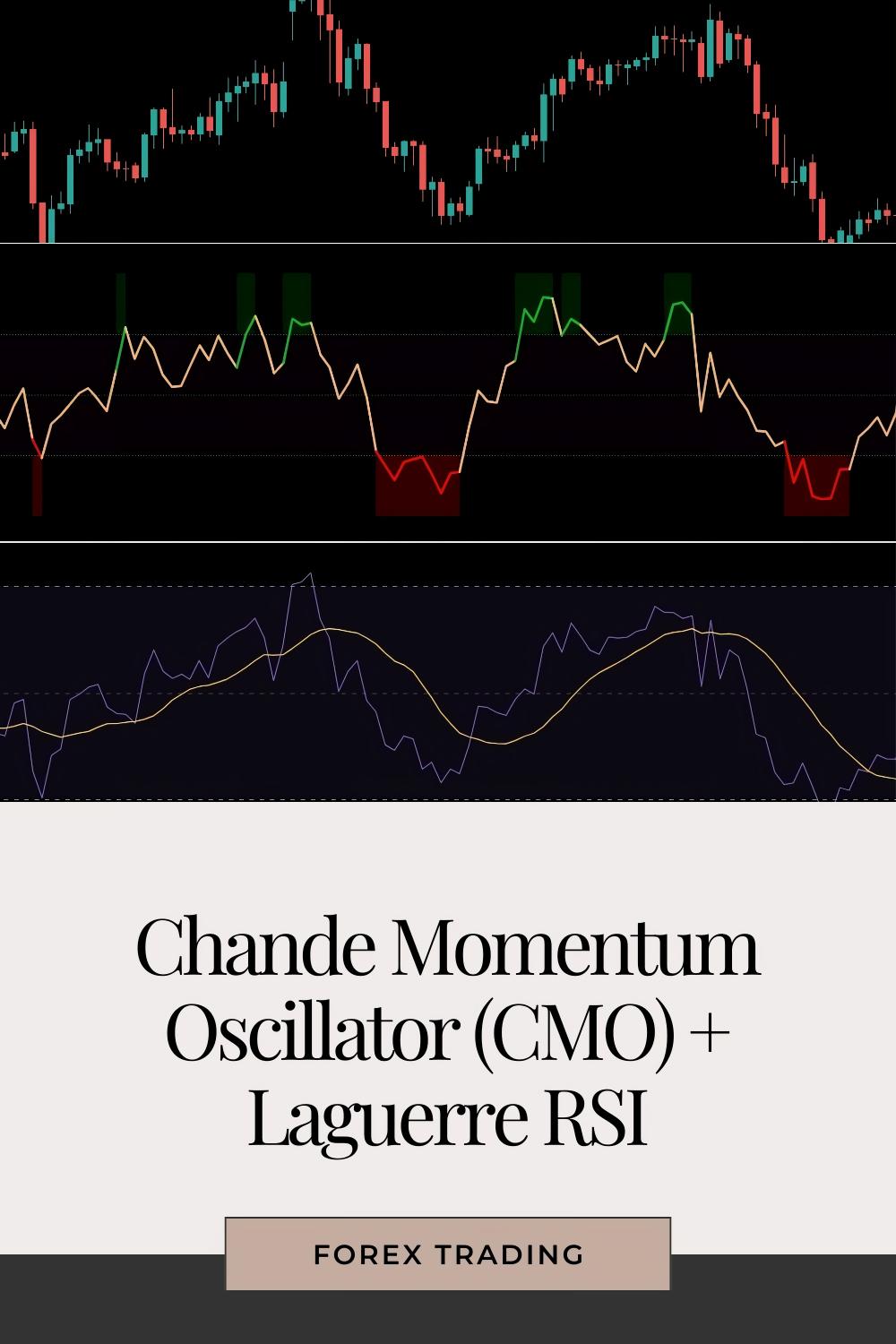

Today, I’m excited to share how you can use the Chande Momentum Oscillator (CMO) combined with the Laguerre RSI for dynamic entries.

This combo is a game-changer.

Let’s dive in.

Why Use CMO and Laguerre RSI?

Both indicators are powerful tools on their own.

But together, they create a dynamic entry strategy that can significantly increase your chances of success.

CMO helps identify momentum and potential reversals.

Laguerre RSI smooths out price fluctuations, providing clearer signals.

Here’s what you need to know:

- CMO ranges from -100 to +100.

- Laguerre RSI uses a smoothing factor for better trend detection.

Setting Up the Indicators

Setting these up in your trading platform is straightforward.

- Chande Momentum Oscillator:

- Add CMO to your chart.

- Set the period to 14 (default works well).

- Laguerre RSI:

- Add Laguerre RSI.

- Use a gamma value of 0.5 for optimal performance.

Identifying Entry Signals

Now, let’s break down how to use these indicators together.

Look for these signals:

- Buy Signal:

- CMO crosses above +20.

- Laguerre RSI is above 0.5.

- Sell Signal:

- CMO crosses below -20.

- Laguerre RSI is below 0.5.

Example of Using the Indicators

Let’s visualize this.

Imagine you’re watching the EUR/USD pair.

As the CMO crosses above +20, you see a potential bullish trend.

Then, you notice the Laguerre RSI is also above 0.5, confirming your suspicion.

That’s your cue to jump in!

It’s all about timing.

Why This Approach Works

Statistically, combining momentum indicators can enhance your trading performance.

Research shows that traders using multiple indicators often achieve a 20% higher success rate than those relying on a single tool.

More than just numbers, this strategy provides clarity in chaotic market conditions.

Diversification with Trading Bots

While you’re mastering these indicators, consider diversifying your trading approach with my 16 trading bots.

These bots leverage the CMO and Laguerre RSI strategy among others to optimize performance.

Each of my bots is fine-tuned for major currency pairs like EUR/USD and GBP/USD.

Here’s why this matters:

- Risk Mitigation: The bots are diversified across multiple pairs.

- Consistent Performance: Designed to capture long-term moves of 200-350 pips.

- Backtested: These bots have proven their mettle over 20 years, performing excellently even in tough market conditions.

And the best part?

I’m offering this entire EA portfolio for FREE!

Check it out here: Explore My Trading Bots.

Choosing the Right Broker

No matter how great your strategy is, it can fall flat without the right broker.

Here are some key considerations:

- Tight Spreads: Look for brokers with spreads as low as 0.6 pips.

- Fast Execution: Choose brokers with execution speeds under 0.2 seconds.

- Instant Withdrawals: Ensure your profits are accessible at any time.

I’ve tested several brokers, and I recommend you check out the best options at Trusted Forex Brokers.

Wrapping It Up

Trading Forex using the CMO and Laguerre RSI can elevate your game.

By identifying clear entry signals, you can make informed decisions.

Plus, diversifying with my 16 trading bots enhances your trading strategy significantly.

Remember, trading is a journey.

Take the time to learn and experiment with these tools.

And always choose a reputable broker to support your trading endeavors.

Happy trading! 🚀