Last Updated on February 26, 2025 by Arif Chowdhury

Are you tired of inconsistent trading results?

Wondering how to leverage technical indicators to boost your Forex game?

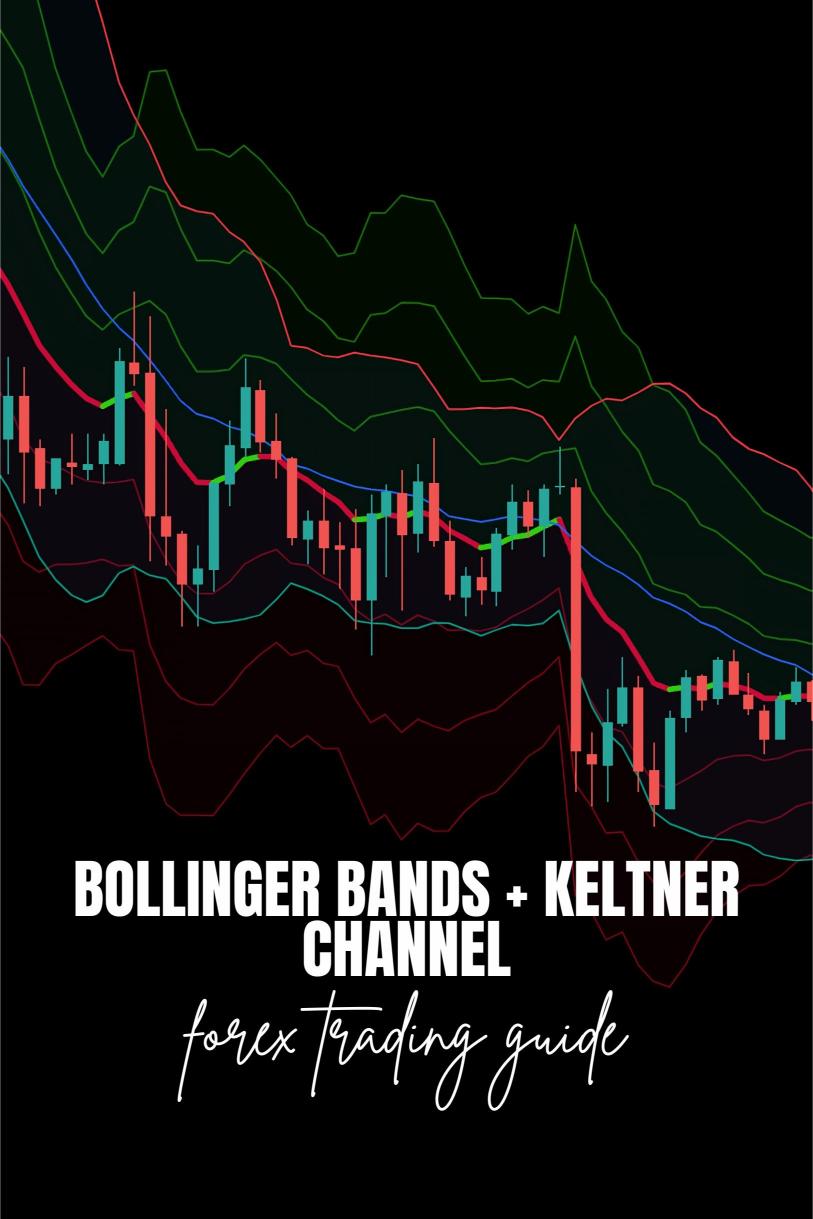

Let’s dive into a strategy that can change the way you trade forever—the Bollinger Bands + Keltner Channel Squeeze.

This strategy is all about harnessing volatility to identify high-probability trades.

As a seasoned Forex trader since 2015, I’ve honed my expertise by exploring various strategies, and this one stands out.

Let’s break it down.

Understanding the Basics

What Are Bollinger Bands?

Bollinger Bands consist of three lines:

- Middle line: A simple moving average (SMA).

- Upper band: SMA plus two standard deviations.

- Lower band: SMA minus two standard deviations.

These bands expand and contract based on market volatility.

What Is the Keltner Channel?

The Keltner Channel also has three lines:

- Middle line: An EMA (Exponential Moving Average).

- Upper channel: EMA plus a multiple of the Average True Range (ATR).

- Lower channel: EMA minus a multiple of the ATR.

The Keltner Channel gives a clearer view of market trends with its focus on volatility.

The Squeeze: A Powerful Setup

The magic happens when the Bollinger Bands squeeze inside the Keltner Channel.

This indicates a period of low volatility, often a precursor to explosive moves in either direction.

Why Does This Matter?

Statistically, about 70% of price movements happen after a squeeze.

That’s a solid chance to catch a big move.

How to Trade the Squeeze

Step-by-Step Guide

- Identify the Squeeze: Look for Bollinger Bands that are tightly compressed within the Keltner Channel.

- Wait for a Breakout: After the squeeze, wait for price to break above the upper band or below the lower band.

- Confirm the Direction: Use additional indicators or price action to confirm the breakout direction.

- Set Your Entry and Stop-Loss: Place your entry just outside the breakout. Set a stop-loss inside the squeeze area to minimize risk.

- Target Your Profit: Aim for a risk-reward ratio of at least 1:2 for optimal gains.

Enhancing Your Trading with EAs

Trading can be complex, but it doesn’t have to be.

That’s where my 16 trading bots come into play.

Each bot is strategically diversified across major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

These bots utilize various strategies, including the Bollinger Bands + Keltner Channel approach.

Why Use My Trading Bots?

- Multi-layered Diversification: Minimizes correlated losses.

- Long-Term Focus: Designed to capture 200-350 pips.

- Proven Performance: Backtested over 20 years.

And guess what? You can get this entire EA portfolio for FREE.

Check it out here and elevate your trading game!

Final Thoughts on Forex Trading

Trading Forex isn’t just about luck; it’s about strategy.

Using the Bollinger Bands + Keltner Channel Squeeze can give you the edge you need.

And to maximize your success, you’ll want to partner with the right brokers.

I’ve tested and vetted the best Forex brokers, and you can find them here.

These brokers provide tight spreads and excellent support, enhancing your trading experience.

A Quick Recap

- Look for a squeeze in the Bollinger Bands.

- Wait for a breakout to confirm your trade.

- Use my FREE trading bots for a diversified approach.

- Choose a reliable broker to enhance your trading journey.

Now, go out there and start trading with confidence!