Last Updated on March 7, 2025 by Arif Chowdhury

Are you tired of inconsistent trading results?

Frustrated with missing out on profitable opportunities?

You’re not alone.

As a seasoned Forex trader since 2015, I’ve walked this path and learned invaluable lessons along the way.

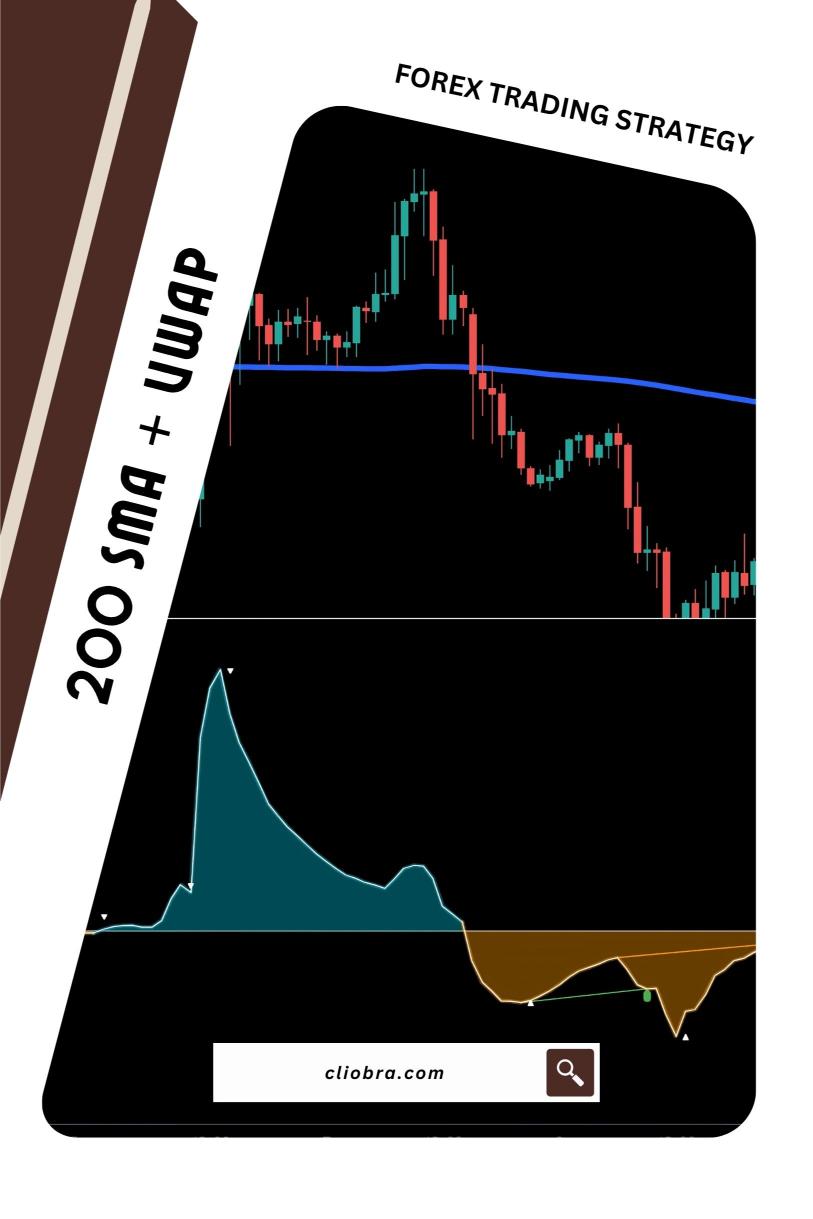

Today, I’m diving into a powerful strategy that has transformed my trading game: using the 200 Simple Moving Average (SMA) and Volume Weighted Average Price (VWAP).

Let’s break this down into actionable steps that can elevate your trading to an institutional level.

Understanding the Basics

First, let’s get clear on what these indicators are:

- 200 SMA: This is a long-term trend indicator. It smooths out price data by creating a constantly updated average price. When the price is above the 200 SMA, it indicates a bullish trend. Below it? A bearish trend.

- VWAP: This gives a weighted average price, factoring in volume. It helps identify whether the price is overvalued or undervalued based on trading volume.

Using these two together can provide a robust framework for your trading strategy.

Why Use 200 SMA + VWAP?

- Identify Trends: The 200 SMA helps you spot the prevailing trend.

- Entry and Exit Points: When the price crosses the VWAP, it can signal potential entry or exit points.

- Risk Management: These indicators help minimize risks by providing a clearer picture of market dynamics.

Research shows that traders using a combination of trend-following and volume indicators can improve their win rates by up to 25%.

Setting Up Your Charts

Getting started is simple. Follow these steps:

- Step 1: Open your trading platform and select your preferred currency pair.

- Step 2: Add the 200 SMA to your chart.

- Step 3: Overlay the VWAP indicator.

- Step 4: Set your time frame to H4 (4-hour) for a balanced perspective.

Now, you’re ready to start analyzing!

Trading Signals with 200 SMA + VWAP

- Bullish Signal:

- Look for the price to be above the 200 SMA.

- Wait for a bullish crossover of the VWAP.

- Consider entering a long position.

- Bearish Signal:

- Price is below the 200 SMA.

- Wait for a bearish crossover of the VWAP.

- This could be a signal to enter a short position.

Example of How This Works in Practice

Imagine you’re watching EUR/USD. The price is hovering above the 200 SMA, and suddenly it crosses the VWAP from below. This is your green light to enter a long position.

Conversely, if the price dips below the 200 SMA and then breaks the VWAP from above, it’s time to consider a short position.

The Power of Diversification

While mastering indicators is crucial, having a reliable trading system can significantly boost your success.

That’s where my 16 trading bots come into play.

These bots are designed to use the 200 SMA + VWAP strategy, among other techniques, to diversify risk and maximize profit.

Each bot is tailored to currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY, ensuring you have a robust trading portfolio.

The beauty of these bots lies in their multi-layered diversification, which minimizes correlated losses.

You can access this powerful EA portfolio for FREE by simply joining through my affiliate link and funding your account. It’s a win-win.

Best Practices for Trading

- Stay Disciplined: Stick to your strategy and avoid emotional trading.

- Keep Learning: Markets evolve, and continuous learning keeps you ahead.

- Use Risk Management: Always set stop-loss orders to protect your capital.

Choosing the Right Broker

Selecting a trustworthy broker is paramount.

I’ve tested several, and I strongly recommend checking out the best forex brokers.

These brokers provide excellent execution speeds, tight spreads, and reliable customer support.

Final Thoughts

Using the 200 SMA + VWAP can bring clarity and precision to your trading.

By combining this strategy with my portfolio of 16 trading EAs, you can navigate the Forex market with confidence.

Ready to elevate your trading game?

Join today, and let’s make profitable trading a reality together!