Last Updated on February 22, 2025 by Arif Chowdhury

Ever sat down to trade Forex and thought, “Where do I even start?”

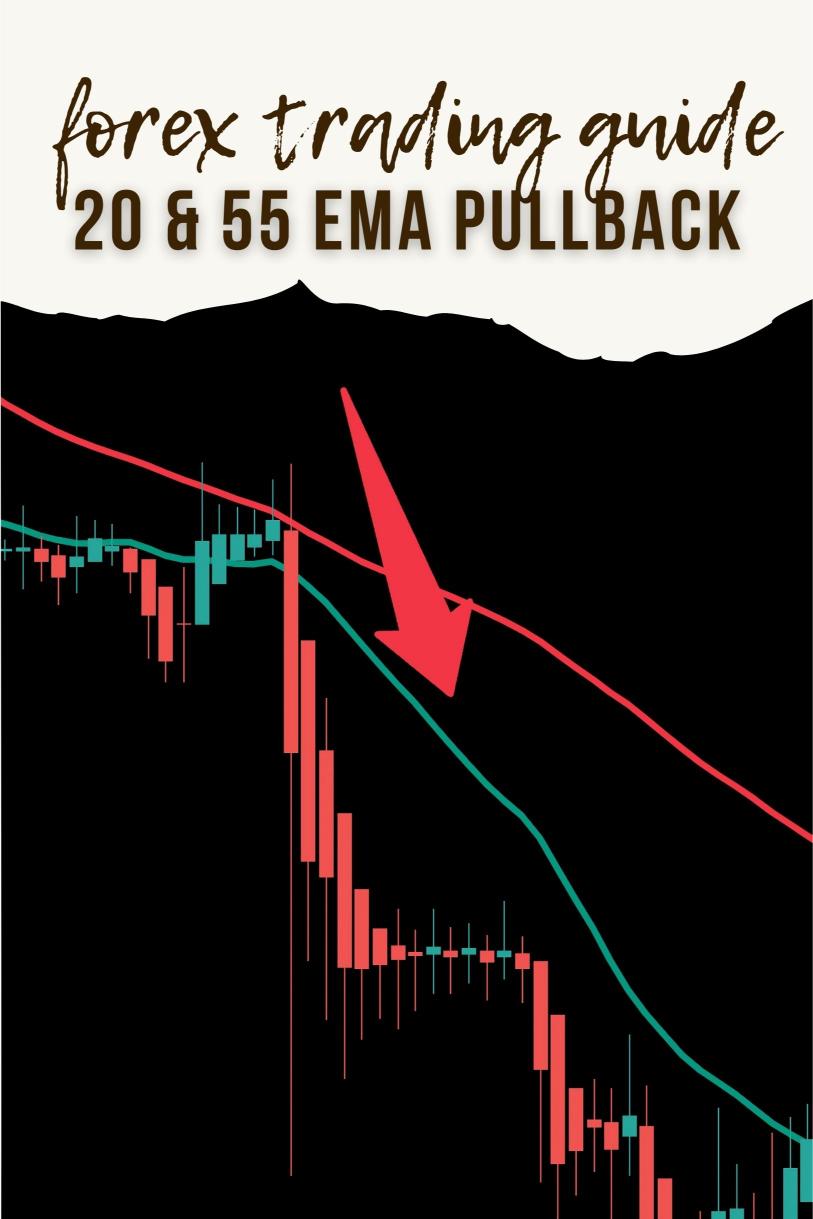

Or maybe you’ve heard about the 20 & 55 EMA pullback strategy but have no clue how it works.

Let’s break it down together.

Understanding the Basics 🔍

First off, EMA stands for Exponential Moving Average.

This tool helps smooth out price data, making trends easier to spot.

The 20 EMA gives you a short-term view, while the 55 EMA provides a broader perspective.

Using both together can give you powerful insights into market movements.

Why Use the 20 & 55 EMA? 📈

- Identify Trends: The crossover of these two EMAs helps you catch trends early.

- Entry Points: Pullbacks to the 20 EMA after a breakout can signal great entry points.

- Risk Management: This strategy helps minimize risk by allowing you to set clear stop-loss levels.

The Strategy in Action 🚀

Here’s how to apply the 20 & 55 EMA strategy step-by-step:

- Set Up Your Chart:

- Add the 20 EMA and 55 EMA to your chart.

- Use H4 charts for a clearer long-term view.

- Wait for a Crossover:

- Look for the 20 EMA to cross above the 55 EMA for a bullish signal.

- If the 20 EMA crosses below the 55 EMA, that’s your bearish signal.

- Look for Pullbacks:

- After a crossover, wait for the price to pull back to the 20 EMA.

- This is your ideal entry point.

- Confirm with Price Action:

- Check for bullish or bearish candles at the 20 EMA to confirm your entry.

- Set Your Stop-Loss:

- Always place your stop-loss below the 55 EMA for buys and above for sells.

- Take Profits:

- Aim for a risk-to-reward ratio of at least 1:2.

My Trading Journey and Bots 🤖

As a seasoned Forex trader since 2015, I’ve tested various strategies.

The 20 & 55 EMA pullback strategy is a key part of my toolkit.

But here’s the kicker: I’ve integrated this strategy into 16 sophisticated trading bots.

These bots are specially designed for major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

They use the 20 & 55 EMA pullback strategy along with other techniques to help diversify risk and maximize profits.

Best of all? I’m offering this EA portfolio for FREE.

This multi-layered approach means that you can trade with confidence, knowing you have a robust safety net.

You can check out my trading bots portfolio to see how these bots can help you.

Statistically Speaking 📊

Did you know that around 70% of retail traders lose money in Forex?

Using a solid strategy like the 20 & 55 EMA pullback can significantly tilt the odds in your favor.

Also, Forex trading is a $6.6 trillion per day market.

That’s a lot of opportunities waiting for savvy traders like you!

Choosing the Right Broker 🏦

Finding a reliable broker is crucial.

You want one with:

- Tight Spreads: Helps you get the best price.

- Fast Execution: Crucial for catching those quick trades.

- Good Customer Support: Because you never know when you’ll need help.

I’ve tested various brokers and found some gems.

Check out the best Forex brokers I recommend to ensure you’re trading with the right partner.

Final Thoughts 💡

Remember, trading isn’t about luck; it’s about strategy and execution.

The 20 & 55 EMA pullback strategy is a powerful tool in your trading arsenal.

Combine it with my 16 trading bots for a diversified approach, and you’re setting yourself up for success.

So grab your charts, get your broker in line, and start trading smart!