Last Updated on February 27, 2025 by Arif Chowdhury

Ever wonder why some traders seem to effortlessly navigate the Forex market while others struggle?

Are you tired of missing out on volatility and the profits it can bring?

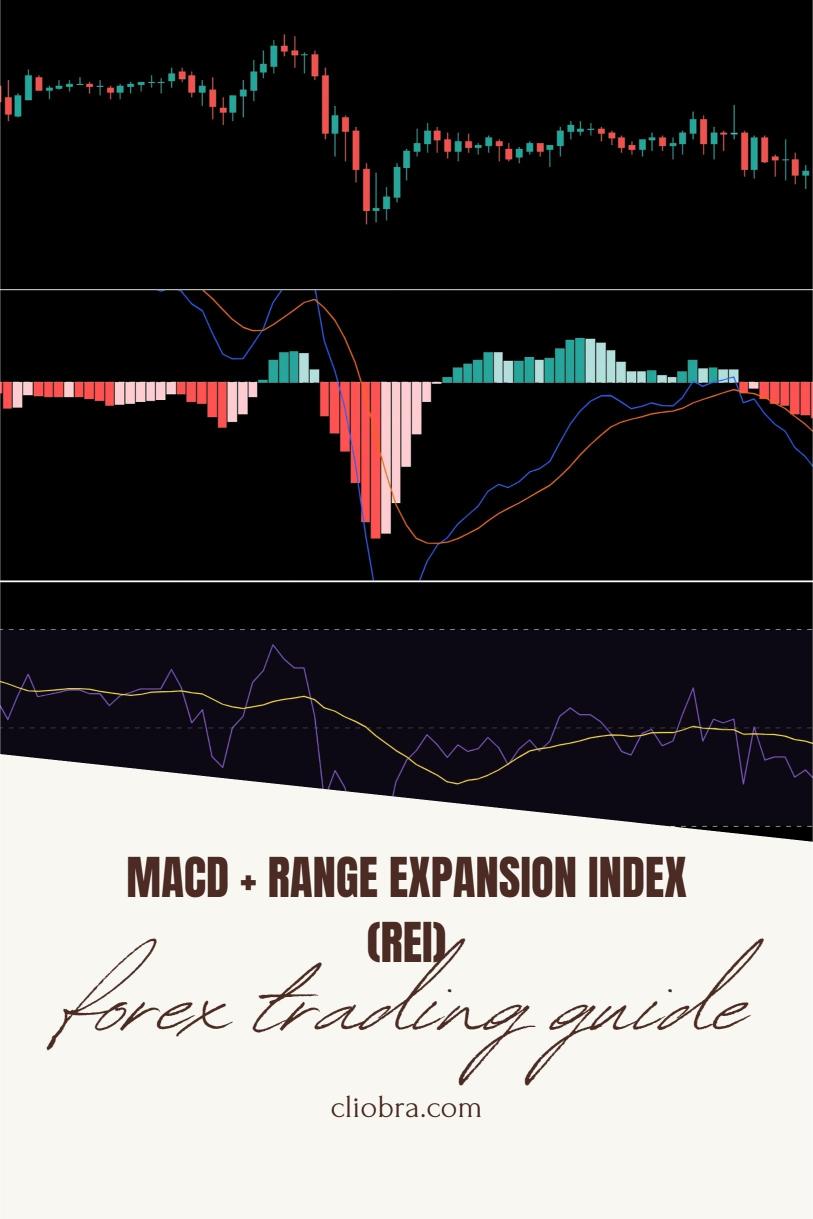

Let’s break down how to use the MACD (Moving Average Convergence Divergence) and Range Expansion Index (REI) to track volatility and make informed trading decisions.

I’ve been trading Forex since 2015, and trust me, mastering these tools has been a game-changer.

Understanding MACD and REI

MACD is like the Swiss Army knife of trading indicators. It helps you identify changes in momentum and potential buy/sell signals.

REI tracks the volatility of price movements, giving you crucial insights into market conditions.

Here’s how they work together:

- MACD shows you the trend direction and momentum.

- REI tells you how volatile the market is.

This combination can improve your trading strategy significantly.

Setting Up Your Trading Chart

- Choose Your Trading Platform: Use a solid Forex broker with a reliable trading platform. I’ve tested some of the best ones, and you can check them out here.

- Add Indicators:

- MACD: Typically set to default values (12, 26, 9).

- REI: Set to a period of 14, which is commonly used.

- Time Frame: I prefer using H4 charts, as they allow you to capture longer trends without the noise of lower time frames.

How to Trade with MACD and REI

Identifying Entry Points

- Look for MACD crossovers.

- When the MACD line crosses above the signal line, it’s a bullish signal.

- Conversely, a crossover below signals bearish momentum.

- Check the REI value:

- A value above 60 indicates a strong upward trend.

- Below 40 signals a potential downward trend.

Confirming Trends

- Use both indicators together.

- If MACD shows a bullish crossover and REI is above 60, it’s a strong buy signal.

- If MACD is bearish and REI dips below 40, consider selling.

Diversifying with Trading Bots

Now, let’s talk about the real secret sauce to my trading success: my 16 trading bots.

These bots utilize a variety of strategies, including the MACD + REI approach, to diversify risk and maximize profit across four major currency pairs: EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

- Each currency pair has 3-4 bots focused on long-term gains.

- They target 200-350 pips, which is why they perform better over time.

This multi-layered diversification minimizes correlated losses, making it a robust and resilient system.

And the best part? I’m offering this EA portfolio for FREE.

If you’re interested in stepping up your trading game, check out my trading bots here.

Managing Risk and Volatility

- Always use stop-loss orders to protect your capital.

- Keep an eye on economic news that can cause volatility spikes.

Statistically, about 70% of retail traders lose money, often due to poor risk management.

By using MACD and REI, you’re already ahead of the curve.

Final Thoughts

Trading Forex can be daunting, but you don’t have to do it alone.

By incorporating MACD and REI into your strategy, you’ll have a clearer view of market volatility and better trading opportunities.

Plus, with my 16 trading bots, you get a diversified approach that leverages proven strategies to enhance profitability.

Remember, the right Forex broker can make a significant difference in your trading experience.

I’ve tested the best, and you can explore them here.

Get ready to take your trading to the next level!