Last Updated on March 15, 2025 by Arif Chowdhury

Ever felt like you’re missing the boat on big Forex moves?

Or maybe you’re tired of choppy markets and want a clearer way to spot breakouts?

I get it.

As a seasoned Forex trader since 2015, I’ve been through the ups and downs.

I’ve explored both fundamental and technical analysis, focusing on strategies that deliver consistent profits.

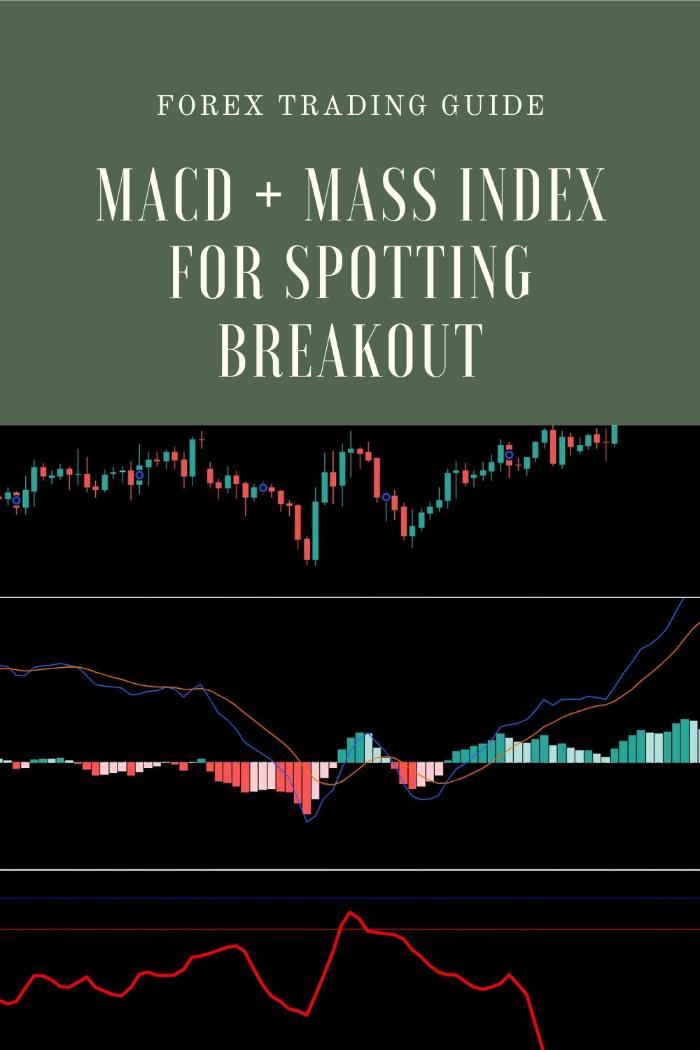

Today, I want to share a powerful combo: the MACD and Mass Index.

These tools can help you identify breakout opportunities like a pro.

Let’s dive in!

Understanding MACD and Mass Index

MACD (Moving Average Convergence Divergence) is a trend-following momentum indicator.

It shows the relationship between two moving averages of a security’s price.

Mass Index, on the other hand, helps identify potential reversals by measuring the volatility of price movements.

When combined, these tools can be a game-changer!

Why Use MACD + Mass Index Together?

- Enhanced Clarity: MACD gives you a clear view of the trend, while Mass Index alerts you to potential reversals.

- Spotting Breakouts: This combo helps you identify when a currency pair is ready to break out of its range.

- Risk Mitigation: With accurate signals, you can reduce the risk of entering trades too early or too late.

How to Spot Breakouts

Here’s a simple step-by-step guide:

- Step 1: Set up your chart with MACD and Mass Index.

- Step 2: Look for MACD line crossovers.

- When the MACD line crosses above the signal line, it’s a bullish signal.

- When it crosses below, that’s bearish.

- Step 3: Check the Mass Index.

- A reading above 27 indicates potential reversal points.

- Use this in conjunction with MACD signals.

- Step 4: Confirm with price action.

- Look for a breakout above resistance or below support.

Key Statistical Facts

Did you know that over 70% of successful traders use some form of technical analysis?

Or that incorporating multiple indicators can increase your win rate by up to 15%?

Using MACD and Mass Index can definitely give you that edge.

My Proven Strategy

I’ve developed a unique trading strategy that incorporates MACD + Mass Index among other methods.

This strategy has led to consistent profitability.

In fact, my exceptional trading bot portfolio features 16 diverse algorithms that utilize this approach.

These bots are strategically diversified across major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each pair has a unique set of bots designed to minimize correlated losses, enhancing overall profitability.

Why My Bots Work

- Long-Term Focus: My bots are designed to trade long-term, targeting 200-350 pips.

- Backtested for Success: I’ve rigorously backtested them for the past 20 years.

- Robust Performance: They perform excellently even under harsh market conditions.

And guess what? You can access this EA portfolio completely FREE!

Check out my 16 trading bots portfolio to get started on your journey to consistent profits.

Final Thoughts

Trading Forex doesn’t have to be complicated.

Using the MACD and Mass Index can simplify your decision-making process.

And if you want to really level up your trading, consider the best brokers I’ve tested.

Trading with a reliable broker can significantly enhance your trading experience.

Find your best fit by checking out the most trusted Forex brokers I recommend.