Last Updated on March 13, 2025 by Arif Chowdhury

Are you tired of struggling with Forex trading?

Do you find yourself second-guessing your decisions or missing out on profitable trades?

If yes, you’re in the right place.

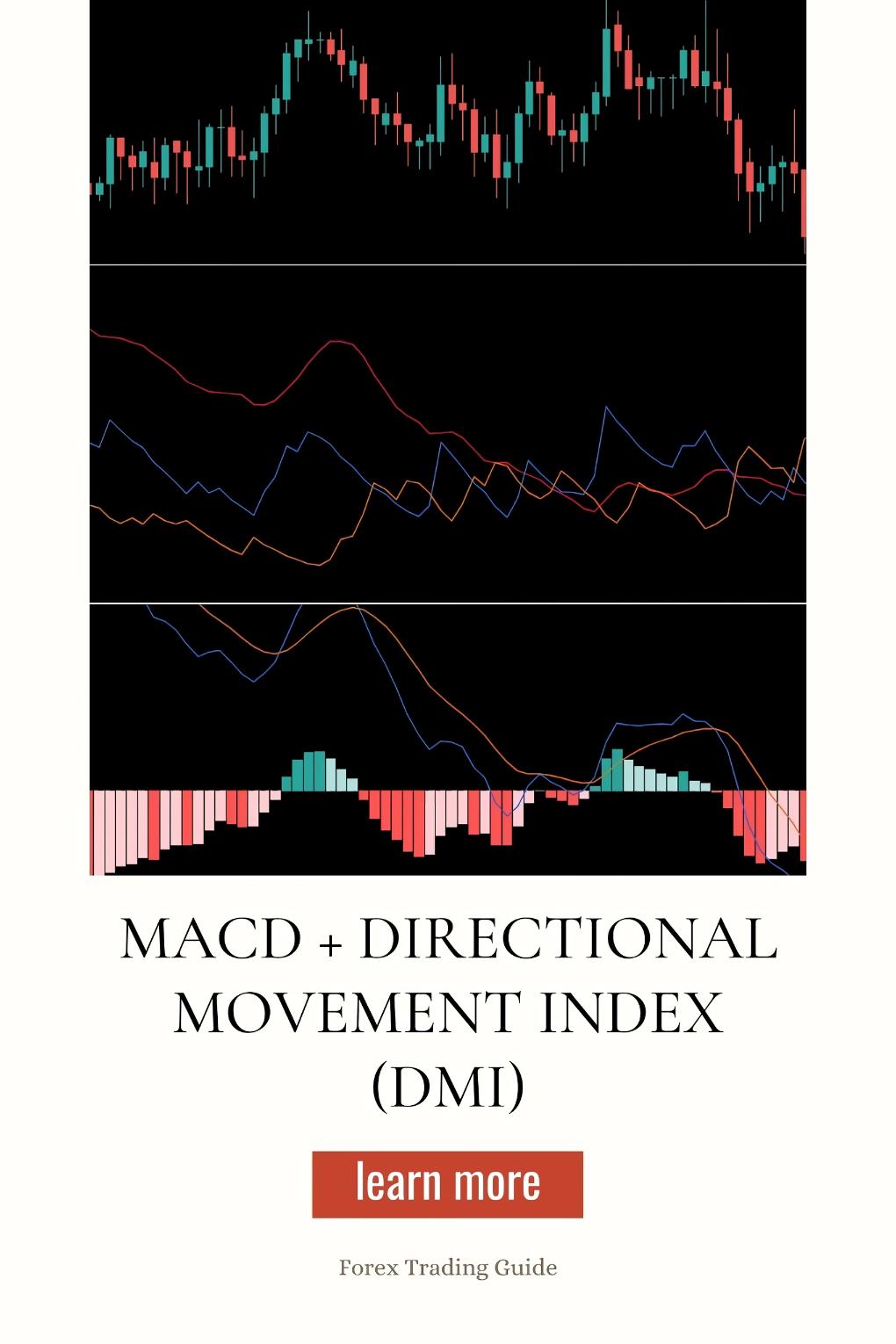

Let’s dive into a powerful strategy that combines the MACD and Directional Movement Index (DMI) to assess trend strength and boost your trading game.

I’ve been trading Forex since 2015, and trust me, mastering these indicators has been a game-changer.

Understanding MACD and DMI

First off, let’s break down what these indicators are and why they matter.

MACD (Moving Average Convergence Divergence) helps you spot potential buy and sell signals.

It shows the relationship between two moving averages of a security’s price.

- MACD Line: Difference between the 12-day and 26-day Exponential Moving Averages (EMAs).

- Signal Line: A 9-day EMA of the MACD Line.

- Histogram: The difference between the MACD Line and the Signal Line.

DMI (Directional Movement Index) helps you determine whether a trend is strong or weak.

It consists of three components:

- +DI (Positive Directional Indicator): Measures upward movement.

- -DI (Negative Directional Indicator): Measures downward movement.

- ADX (Average Directional Index): Measures the strength of the trend.

Why Use MACD + DMI Together?

Combining these two indicators can give you a clearer picture of the market.

Here’s why:

- Confirm Trends: MACD can signal potential trends, while DMI confirms whether they’re strong enough to act upon.

- Reduce False Signals: Using both helps filter out noise and avoid false breakouts.

- Enhanced Decision-Making: Together, they offer a more robust trading strategy.

How to Use MACD and DMI for Trading

Let’s get practical. Here’s how to implement this strategy:

- Set Up Your Charts:

- Use H4 charts for a longer-term perspective.

- Add the MACD indicator and the DMI to your chart.

- Identify Trends:

- Look for MACD crossovers:

- Bullish Crossover: When the MACD Line crosses above the Signal Line.

- Bearish Crossover: When the MACD Line crosses below the Signal Line.

- Check the DMI:

- If +DI is above -DI and ADX is above 20, it’s a strong uptrend.

- If -DI is above +DI and ADX is above 20, it’s a strong downtrend.

- Look for MACD crossovers:

- Enter Trades:

- Enter a buy position when:

- MACD shows a bullish crossover.

- +DI is above -DI.

- Enter a sell position when:

- MACD shows a bearish crossover.

- -DI is above +DI.

- Enter a buy position when:

- Set Stop Loss and Take Profit:

- Always use a stop loss to protect your account.

- Aim for a risk-reward ratio of at least 1:2.

My Secret Weapon: 16 Trading Bots

Now, here’s where it gets interesting.

I’ve developed a portfolio of 16 sophisticated trading bots that utilize the MACD and DMI strategy, among others, to maximize profitability while minimizing risks.

- These bots are diversified across major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

- Each currency pair has 3-4 bots, ensuring you’re not putting all your eggs in one basket.

- They’re designed for long-term trading, targeting 200-350 pips.

And the best part? I’m offering this entire EA portfolio for FREE!

You can start using these bots to enhance your trading experience and build a robust trading strategy without spending a dime.

Check it out here: my trading bots portfolio.

Stay Informed and Trade Smart

Remember, the Forex market is volatile.

So, consistent learning is key.

Keep an eye on market conditions and stay updated on global events that could impact your trades.

Also, ensure you’re trading with a reliable broker.

I’ve tested several, and you can find the best ones through this link: recommended Forex brokers.

Conclusion

Trading Forex can be daunting, but with the right tools and strategies, you can navigate the waters more confidently.

Using MACD and DMI together provides you with a solid framework for understanding trend strength and making informed trading decisions.

And don’t forget to leverage the power of automation with my 16 trading bots.

They’re designed to work seamlessly, allowing you to focus on strategy while the bots handle the execution.

Now, get out there and start trading smarter!