Last Updated on April 11, 2025 by Arif Chowdhury

Feeling lost in the sea of Forex indicators?

Wondering how to make sense of price movements?

Let’s talk about how to trade Forex using candlestick patterns.

As a seasoned Forex trader since 2015, I’ve found candlestick patterns to be one of the most effective tools in my trading arsenal.

They can give you insights into market sentiment and help you make informed trading decisions.

What Are Candlestick Patterns?

Candlestick patterns are visual representations of price movements over time.

Each candlestick shows:

- Open Price: Where the price started during the time frame.

- Close Price: Where the price ended.

- High Price: The highest price during that period.

- Low Price: The lowest price during that period.

Candlestick patterns can indicate potential reversals or continuations in the market.

Did you know that about 70% of traders use some form of candlestick analysis in their strategies?

Let’s explore how you can start trading with them.

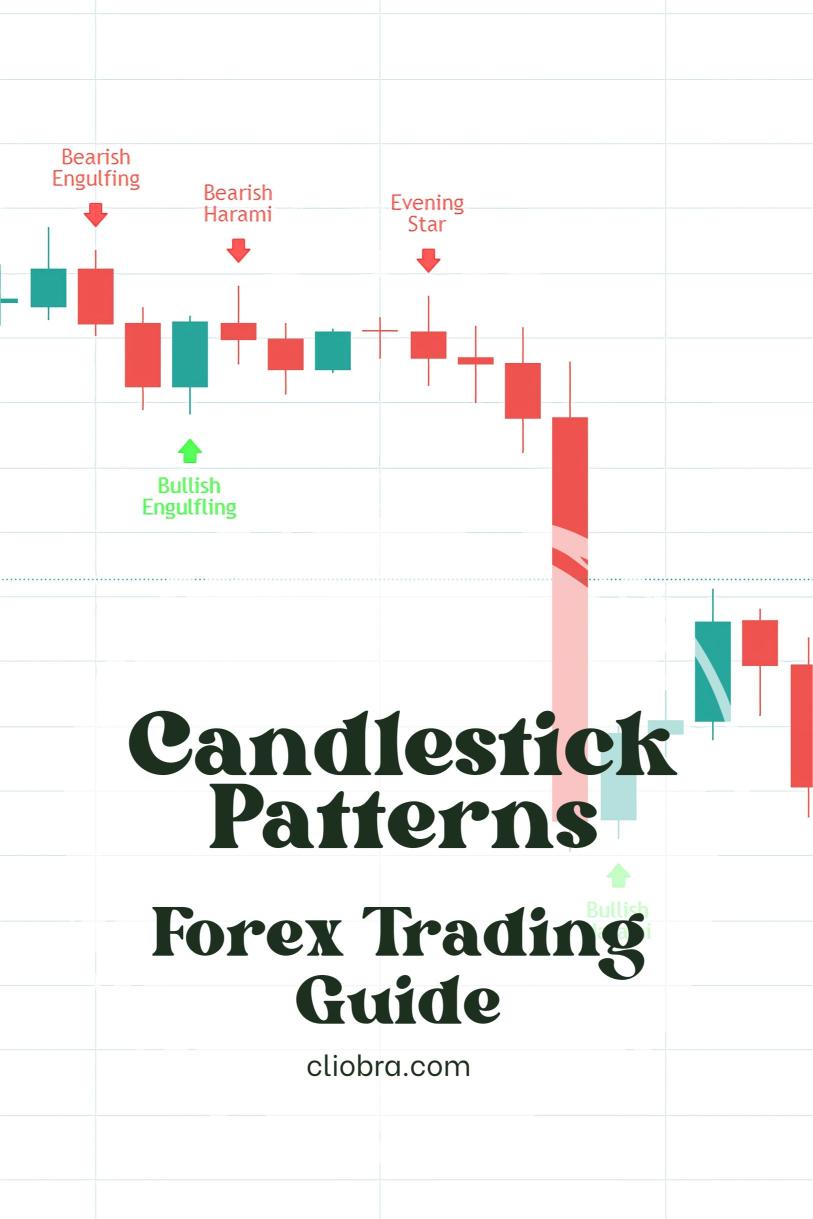

Key Candlestick Patterns to Know

Familiarize yourself with a few key patterns.

Here are some of the most common ones:

1. Bullish Engulfing

- What it is: A small bearish candle followed by a larger bullish candle that completely engulfs it.

- Indication: Potential reversal from a downtrend to an uptrend.

Example: I once spotted a bullish engulfing pattern on the GBP/USD. It marked a solid upward move, netting me over 100 pips. 📈

2. Bearish Engulfing

- What it is: A small bullish candle followed by a larger bearish candle that engulfs it.

- Indication: Potential reversal from an uptrend to a downtrend.

3. Doji

- What it is: A candle with a very small body, indicating indecision in the market.

- Indication: Could signal a reversal, especially after a strong trend.

4. Hammer and Hanging Man

- What it is: A candle with a small body and a long lower wick.

- Indication: A hammer suggests a potential bullish reversal, while a hanging man indicates a bearish reversal.

How to Trade Using Candlestick Patterns

Now that you know the patterns, let’s talk about how to trade with them.

Step 1: Identify the Trend

- Uptrend: Look for bullish patterns.

- Downtrend: Look for bearish patterns.

Understanding the market trend will help you make better trading decisions.

Step 2: Wait for Confirmation

- Don’t trade on patterns alone. Wait for confirmation from subsequent candles.

- For example, if you see a bullish engulfing pattern, wait for the next candle to close above the engulfing candle.

Step 3: Set Your Entry and Exit Points

- Entry: Enter the trade after confirmation.

- Stop-Loss: Place a stop-loss just below the candlestick pattern.

- Take Profit: Aim for a risk-to-reward ratio of at least 1:2.

Risk Management is Key

Even with a solid strategy, risk management is crucial.

Here’s what I do:

- Limit Risk to 1-2%: Never risk more than this amount on a single trade.

- Diversify Your Portfolio: Don’t rely on one pair.

Enhance Your Trading with Bots

If you’re looking for a way to complement your trading, consider my portfolio of 16 trading bots.

These bots are designed to analyze and trade based on candlestick patterns across major currency pairs like EUR/USD and USD/JPY.

Here’s what makes them special:

- Diversified Algorithms: Each major pair has 3-4 bots, reducing correlated losses.

- Long-Term Focus: They aim for 200-350 pips, allowing for sustainable gains.

- Backtested Success: I’ve tested them thoroughly, ensuring they perform well even in tough conditions.

Using trading bots can help automate some of your strategies, letting you focus on high-probability setups.

Finding the Right Broker

To trade effectively, you need a reliable broker.

Here’s what to look for:

- Low Spreads: Essential for maximizing profits from small price movements.

- Reliable Execution: Fast execution is crucial for trading candlestick patterns.

- Excellent Customer Support: You want a broker who’s there when you need help.

Conclusion

Trading Forex using candlestick patterns can simplify your decision-making process and enhance your profitability.

Understanding key patterns, waiting for confirmations, and managing your risks are essential steps to success.

Consider adding automated trading bots to your strategy for better efficiency and profitability.

Stay disciplined, trade smart, and watch your account grow.

Happy trading! 🚀