Last Updated on February 3, 2025 by Arif Chowdhury

Ever blown up a trading account? Yeah, me too. It sucks. That’s why money management is everything in Forex. It’s not just about winning trades, it’s about surviving the losses and staying in the game.

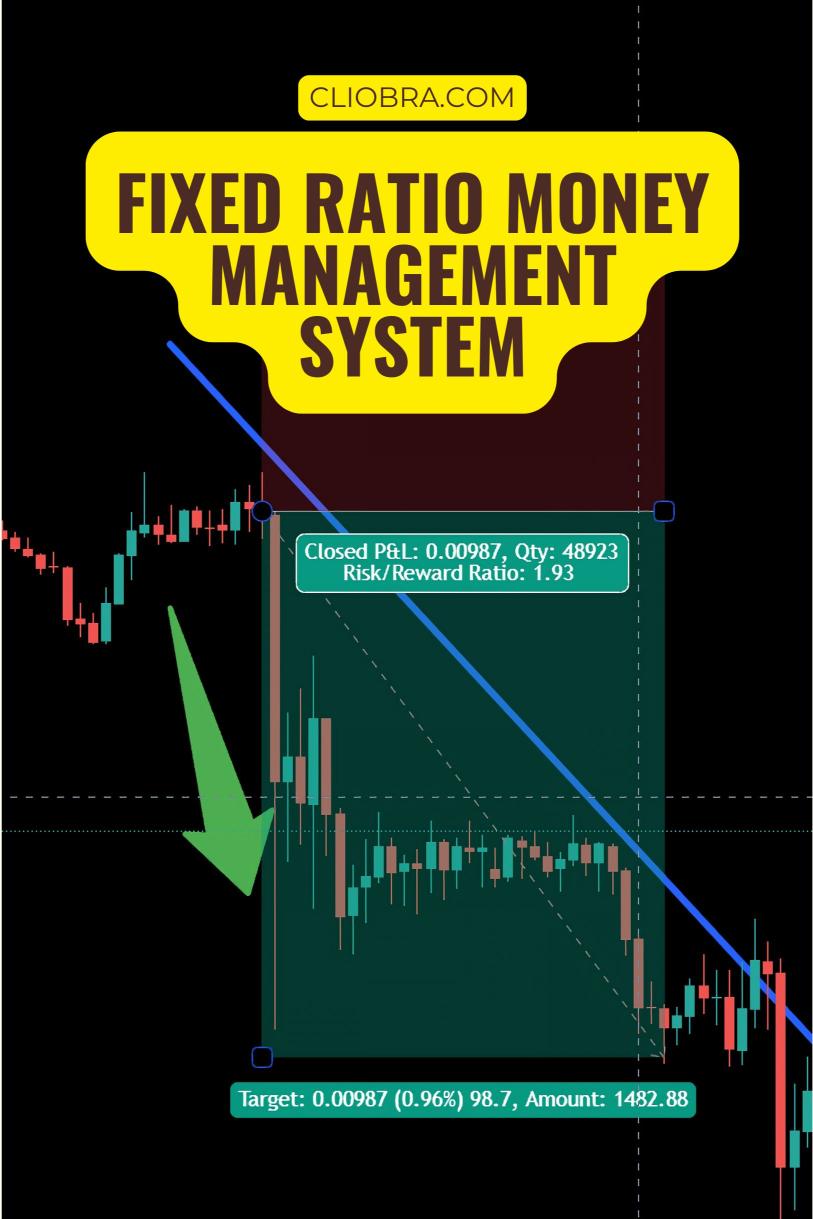

One system I’ve found incredibly useful is the fixed ratio money management system. Let’s break it down.

What is Fixed Ratio Money Management?

Fixed ratio money management is a strategy where you increase your trading lot size as your account equity grows.

Conversely, you decrease your lot size when your equity declines. It’s all about scaling with your success and protecting yourself during drawdowns.

Think of it like this: you start small, and as you make profits, you gradually increase the amount you risk on each trade. If you hit a rough patch, you scale back down, preserving your capital. It’s a dynamic approach that adapts to your performance.

How Does it Work?

The core of the fixed ratio system is the “delta,” a pre-determined profit amount that triggers an increase in your trading lot size.

Here’s the gist:

Set your delta: This is the profit target you need to reach before increasing your lot size. For example, let’s say your delta is $1,000.

Calculate your risk: Determine the percentage of your capital you’re willing to risk per trade. A common rule is 1-2%. As a seasoned Forex trader since 2015, I’ve honed my expertise through rigorous exploration of both fundamental and technical analysis, with a particular focus on the latter.

My journey has led to the development of a unique and proven trading strategy, resulting in consistent profitability. This success extends to the creation of 15 sophisticated trading bots strategically diversified across EUR/USD, GBP/USD, USD/CHF, and USD/JPY, forming a robust and exceptionally stable trading portfolio.

I actively share my knowledge and insights through my YouTube channel, where I provide valuable educational content and in-depth Forex trading analysis for aspiring traders.

Determine your lot size: Based on your risk percentage and the stop-loss level of your trade, calculate the appropriate lot size.

Increase lot size: Once you hit your delta ($1,000 in our example), increase your lot size. The increase is based on a fixed ratio. For instance, you might increase your lot size by one mini lot for every delta you achieve.

Decrease lot size: If you experience losses and your equity drops, reduce your lot size accordingly.

Example Time ☕

Let’s say you start with a $10,000 account and a delta of $1,000. You risk 2% per trade.

- Initial lot size: With a $10,000 account and 2% risk, you’d risk $200 per trade. Let’s assume this translates to 0.1 lots.

- First delta reached: You make $1,000 in profit. Your account is now $11,000.

- Increased lot size: You increase your lot size to 0.2 lots.

- Subsequent deltas: Every time you make another $1,000, you increase your lot size by another 0.1 lots.

- Drawdown: If you have a losing streak and your account dips below a certain threshold, you decrease your lot size accordingly, protecting your capital.

Why Use Fixed Ratio?

- Capital Preservation: It helps you manage risk and avoid blowing up your account.

- Profit Maximization: It allows you to capitalize on winning streaks by increasing your trading size.

- Disciplined Approach: It enforces a structured approach to money management.

Things to Consider 🧐

- Choosing the Right Delta: This is crucial. Too small, and you’ll be increasing your lot size too frequently. Too large, and you might miss out on potential profits or risk too much.

- Risk Tolerance: Your risk tolerance should determine your risk percentage. Don’t risk more than you can afford to lose. Remember, trading involves risk.

- Market Volatility: Be mindful of market conditions. During periods of high volatility, you might want to be more conservative with your lot sizes.

My Trading Journey and Bots 🤖

Over my years of trading, I’ve seen firsthand how crucial effective money management is. I’ve also developed 15 trading bots, each designed with a unique algorithm, that I use in my own trading.

These bots are diversified across four major currency pairs (EUR/USD, GBP/USD, USD/CHF, and USD/JPY), and each bot is internally diversified to minimize correlated losses.

They are designed to trade for long-term such as 200-350 pips and that’s why they do better performance in the long-term. I have backtested my bots for the past 20 years and they perform excellently under harsh conditions.

Finding the right broker is also essential. I’ve tested several, and I recommend checking out the brokers I personally use.

Fixed ratio money management is a powerful tool, but it’s not a magic bullet. It requires careful planning and disciplined execution. But with the right approach, it can significantly improve your trading performance and help you achieve your financial goals.