Last Updated on February 8, 2025 by Arif Chowdhury

Ever wondered why some traders seem to thrive while others struggle?

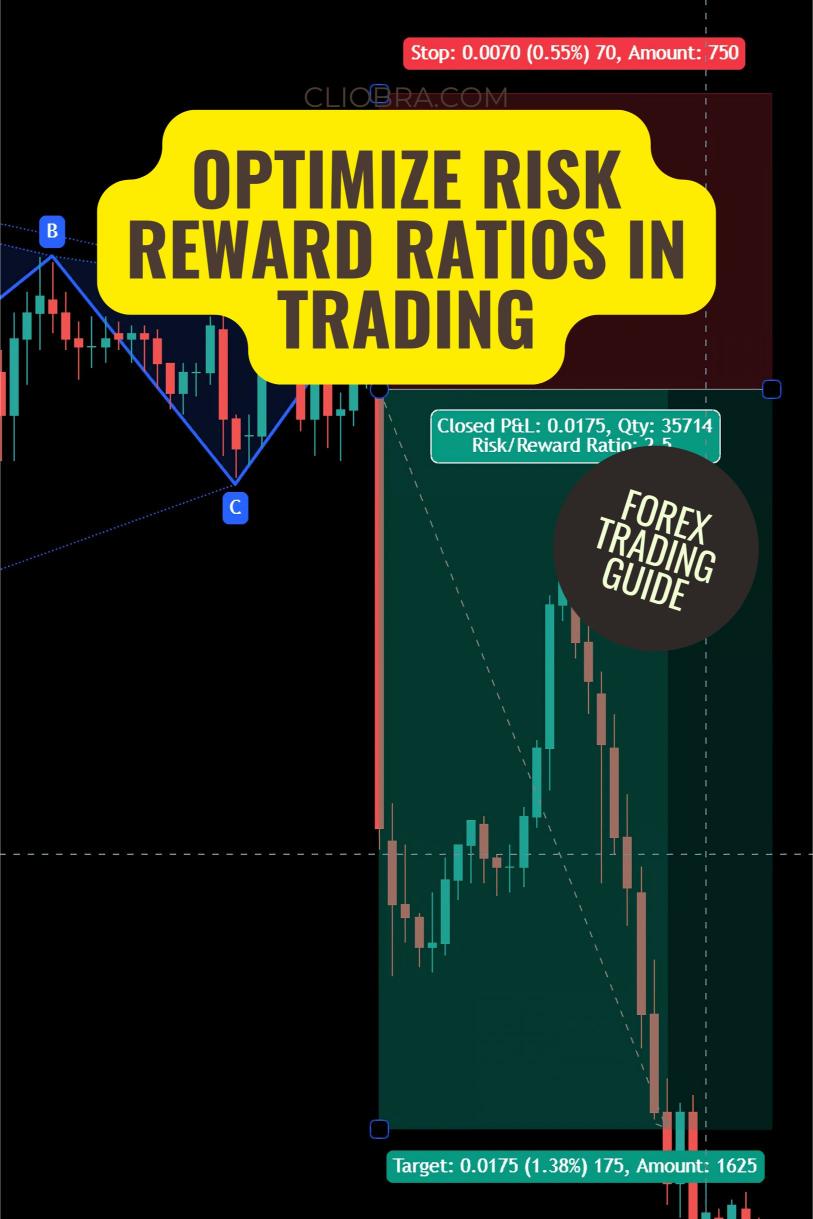

It’s often down to understanding and optimizing risk-reward ratios.

This concept is crucial in trading, especially in Forex, where every pip counts.

So, let’s dive into how to leverage risk-reward ratios for maximum profitability.

What Is a Risk-Reward Ratio?

Simply put, the risk-reward ratio measures the potential reward for every unit of risk taken.

For instance, if you risk $1 to potentially gain $3, your ratio is 1:3.

This means for every dollar you risk, you stand to gain three.

Why does this matter?

A solid understanding of risk-reward ratios can significantly improve your trading strategy.

Statistically, traders who maintain a favorable risk-reward ratio (like 1:2 or better) often see higher profitability over time.

Why Focus on Risk-Reward Ratios?

- Preserve Capital: Protecting your trading capital is vital.

- Enhance Decision-Making: Clear ratios help in making informed trading decisions.

- Boost Confidence: Knowing you’re managing risk well can boost your trading confidence.

How to Calculate Risk-Reward Ratios

Calculating your risk-reward ratio is straightforward.

- Identify Entry Point: Choose your entry price based on analysis.

- Set Stop Loss: Determine how much you’re willing to lose if the trade goes against you.

- Determine Take Profit: Identify your target price where you’d like to secure profits.

For example:

- Entry Price: 1.2000

- Stop Loss: 1.1950 (risking 50 pips)

- Take Profit: 1.2100 (targeting 100 pips)

Your risk-reward ratio would be 1:2 (50 pips risked for 100 pips potential gain).

Tips for Optimizing Risk-Reward Ratios

Now that you know the basics, let’s look at some actionable tips:

1. Use Technical Analysis

Leverage charts and indicators to identify key entry and exit points.

This helps you set more accurate stop-loss and take-profit levels.

2. Diversify Your Portfolio

Diversification can cushion losses.

By using my 16 trading bots that span major currency pairs like EUR/USD and GBP/USD, you can minimize correlated risks.

3. Adjust Your Ratios

Don’t stick to a fixed ratio.

Adapt based on market conditions.

Sometimes a 1:1 might be acceptable, while other times, aim for a higher ratio.

4. Stick to Your Plan

Once you establish a risk-reward framework, adhere to it.

Consistency is key.

5. Monitor Performance

Regularly review your trades.

Are you hitting your targets?

Adjust your strategies based on what the data tells you.

Understanding Market Psychology

Market psychology plays a huge role in trading.

Fear and greed can cloud judgment.

By having a clear risk-reward ratio, you can make decisions based on strategy, not emotions.

Remember: A well-defined plan helps you stay disciplined, even when the market gets volatile.

The Importance of Backtesting

Before diving into live trading, backtest your strategies.

This involves simulating trades based on historical data to see how your risk-reward ratios perform.

According to studies, traders who backtest their strategies can improve their success rates by up to 30%.

Choosing the Right Broker

A critical component of successful trading is selecting a trustworthy broker.

Look for brokers with tight spreads, low commissions, and solid customer support.

I’ve tested numerous brokers and recommend checking out the best Forex brokers that suit your trading needs.

Final Thoughts

Optimizing your risk-reward ratio is not just about numbers; it’s about strategic planning.

Using the right tools, like my 16 trading bots and a solid broker, can elevate your trading game.

Stay focused, stay disciplined, and remember:

In Forex trading, it’s not just about how much you can gain, but how well you manage your risks.