Last Updated on February 9, 2025 by Arif Chowdhury

Are you tired of losing trades and feeling like you’re guessing in the dark?

Ever felt overwhelmed by price movements that seem random?

If you’re nodding along, you’re not alone.

As a seasoned Forex trader since 2015, I’ve been in your shoes.

I’ve spent years diving deep into both fundamental and technical analysis, focusing on the latter.

One game-changing concept that has transformed my trading is liquidity mapping.

Let’s break it down.

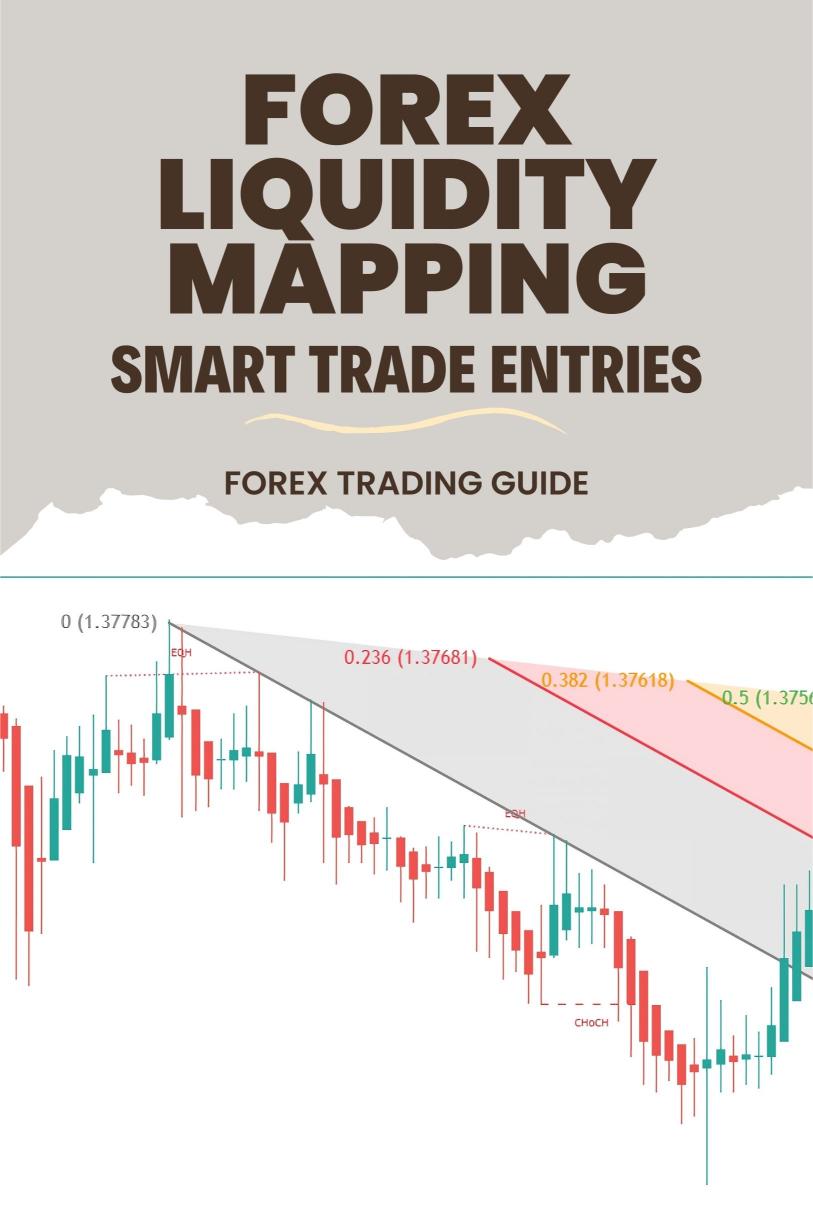

What Is Liquidity Mapping?

Liquidity mapping helps you identify where significant buy and sell orders are clustered.

Think of it as a map guiding you to the best spots for entering trades.

By understanding liquidity, you can make smarter entries and exits, reducing risk and increasing potential profits.

Why Is It Important?

Did you know that around $6.6 trillion is traded daily in the Forex market?

That’s a massive pool of money and liquidity is key.

When you know where liquidity lies, you can pinpoint potential reversal zones, breakout points, and the best times to enter trades.

Key Steps to Master Liquidity Mapping

- Understand Market Structure

Markets move in waves. Recognizing patterns helps you anticipate price movements. - Identify High-Volume Areas

Look for areas where price has previously reacted strongly. These are often where liquidity resides. - Use Technical Indicators

Tools like volume profile or order flow can provide insights into where orders are stacked. - Watch for Major News Events

Liquidity can dry up or spike around news releases. Be aware of economic calendars. - Stay Agile

Markets are constantly changing. Adapt your strategies based on real-time data.

Practical Tips for Effective Liquidity Mapping

- Use Multiple Time Frames

Check liquidity on higher time frames to set the stage for more precise entries on lower ones. - Look for Confluence

When multiple factors point to the same liquidity zone, it’s a stronger signal. - Avoid Overtrading

Focus on quality over quantity. Not every signal deserves a trade.

The Power of Diversification

One of the most effective strategies I’ve implemented is diversification.

I’ve developed a portfolio of 16 sophisticated trading bots, each designed to work across major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each bot is strategically diversified to minimize correlated losses.

This multi-layered approach creates a robust system.

It enhances profitability while reducing the likelihood of simultaneous losses.

How to Get Started with Liquidity Mapping

- Join a Reputable Broker

Start with a broker that offers tight spreads and excellent execution. Check out my top recommendations Best Forex Brokers. - Utilize Advanced Tools

Leverage tools that provide insights into market depths and order flows. - Practice, Practice, Practice

Use demo accounts to perfect your liquidity mapping skills before jumping in with real money.

The Benefits of Using My Trading Bots

While mastering liquidity mapping is crucial, having the right tools can make all the difference.

My 16 trading bots are designed to trade on H4 charts, focusing on long-term gains of 200-350 pips.

They’ve been backtested over the past 20 years, performing exceptionally in various market conditions.

Best of all, I’m offering access to this EA portfolio completely FREE.

If you want to elevate your trading game, check out the details of Trading Bots.

Final Thoughts

Mastering liquidity mapping is an essential skill for any serious trader.

With the right knowledge and tools, you can make smarter trade entries and improve your overall performance.

Remember, the Forex market is vast, but with the right strategies, you can navigate it successfully.

Now go out there and trade smart! 💪