Last Updated on March 25, 2025 by Arif Chowdhury

Ever feel like you’re stuck in a trading rut?

You’re searching for that perfect market condition but keep hitting dead ends.

Ranging markets can be frustrating, but they can also be your best friend if you know how to spot them.

Let’s dive into how the Choppiness Index and Adaptive Price Zones can transform your trading game.

Understanding Ranging Markets

Ranging markets are where prices move sideways within a defined range.

These aren’t your typical breakout scenarios.

Instead, they can seem stagnant, but they offer unique opportunities.

Here’s why recognizing a ranging market is crucial:

- Less Risk: Predictable price movements mean lower volatility.

- Consistent Entry Points: You can plan your trades more effectively.

- Increased Profit Potential: If you know how to play it right, you can cash in on small price fluctuations.

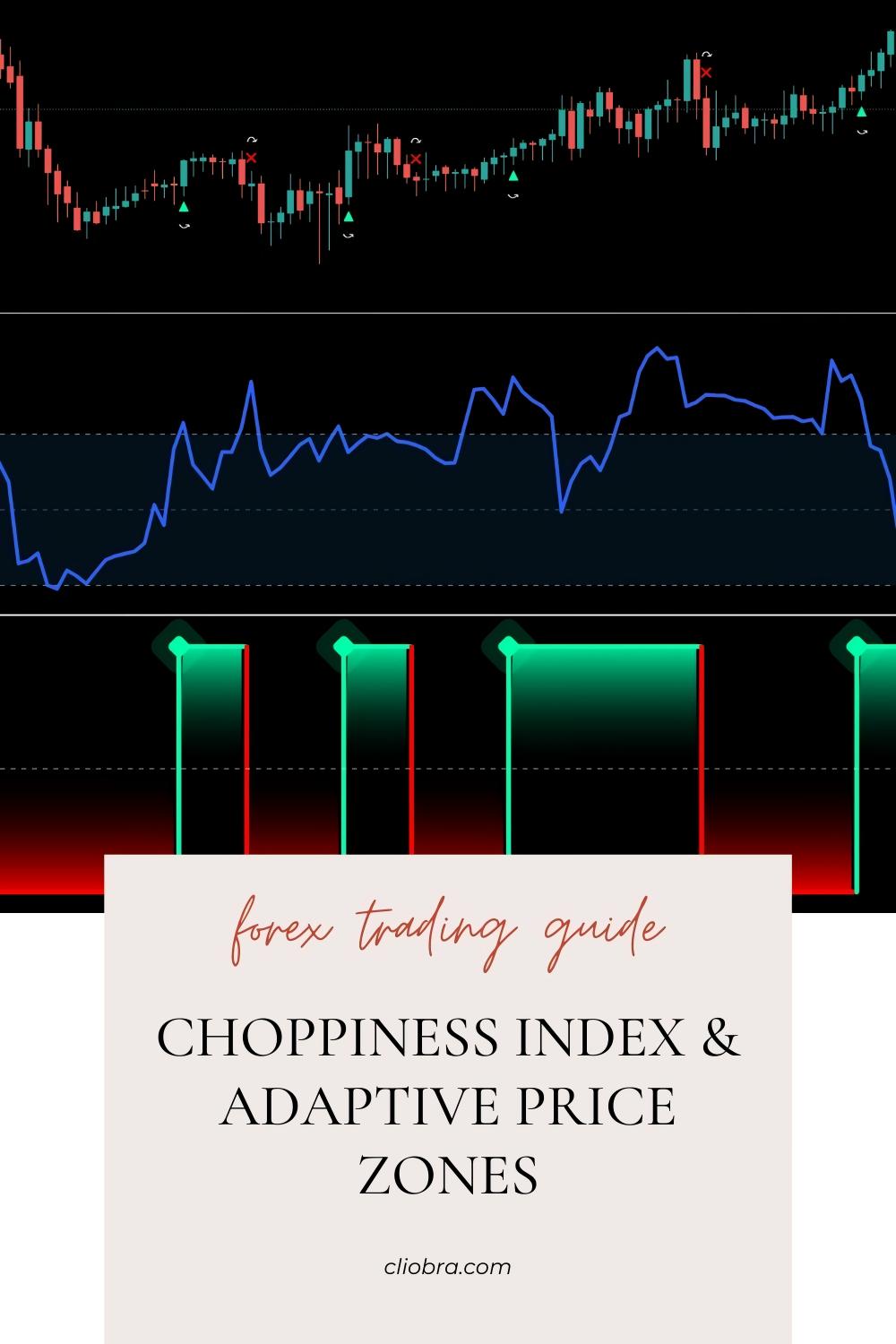

What is the Choppiness Index?

The Choppiness Index is like your best buddy in identifying ranging markets.

It quantifies market volatility, helping you determine whether the market is trending or ranging.

Here’s how it works:

- Scale of 0-100: A lower value indicates a trending market, while a higher value signifies a ranging market.

- Thresholds: Generally, values above 61 indicate a choppy market, perfect for applying range-bound strategies.

As a seasoned Forex trader since 2015, I rely on the Choppiness Index to filter out noise and focus on solid setups.

How to Use the Choppiness Index

- Set Up Your Chart: Add the Choppiness Index to your trading platform.

- Identify Ranges: Look for values above 61 consistently.

- Confirm with Price Action: Check if price movements are contained within certain levels.

What are Adaptive Price Zones?

Next up is Adaptive Price Zones.

These zones are dynamic levels that adapt to price movements, helping you pinpoint potential reversals or breakouts.

Why are they useful?

- Flexibility: Unlike static support and resistance levels, they adjust based on market conditions.

- Enhanced Accuracy: They increase your chances of entering at the right time.

How to Use Adaptive Price Zones

- Calculate Zones: Use a combination of moving averages and volatility measures to define your zones.

- Watch for Price Reactions: Look for price to react at these levels.

- Combine with Other Indicators: Pair these zones with the Choppiness Index for a robust strategy.

Merging Strategies for Success

Combining the Choppiness Index with Adaptive Price Zones can be a game-changer.

Here’s how to make it work:

- Identify Ranging Conditions: Use the Choppiness Index to confirm a ranging market.

- Set Up Adaptive Zones: Define your price zones based on recent price action.

- Plan Your Trades: Look for price to bounce within these zones for potential entry points.

My Trading Bots: A Helping Hand

Now, let’s talk about how my 16 trading bots can enhance your trading strategy.

Each bot is designed to operate under various conditions, including those identified by the Choppiness Index and Adaptive Price Zones.

Here’s what makes them special:

- Diverse Algorithms: Each currency pair has 3-4 bots, ensuring diversified risk.

- Long-Term Focus: Designed to trade for 200-350 pips, they excel in stable environments.

- Backtested Excellence: With 20 years of data, they’ve proven to perform well under pressure.

What’s even better?

I’m offering this EA portfolio completely FREE!

Check it out here: My Trading Bots Portfolio.

Choosing the Right Brokers

To make the most of your trades, you’ll need a trusted broker.

I’ve tested several, and I can confidently recommend the best.

Here’s what to look for:

- Tight Spreads: This can save you money in the long run.

- Fast Execution: You want your orders filled instantly, especially in volatile markets.

- Solid Support: Good customer service can save you a lot of headaches.

For a list of my top picks, check out Most Trusted Forex Brokers.

Conclusion

Identifying ranging markets doesn’t have to be a daunting task.

With the Choppiness Index and Adaptive Price Zones, you can navigate these waters with confidence.

And remember, leveraging my 16 trading bots can give you that extra edge.

Trading is a journey, and having the right tools can make all the difference.

Gear up and get ready to take your trading to the next level!