Last Updated on March 22, 2025 by Arif Chowdhury

Ever feel like the market’s just playing tricks on you?

You’re not alone.

Many traders struggle with understanding where the big players, the institutions, are placing their bets.

That’s where the Fair Value Gap (FVG) strategy comes into play.

It’s a game-changer for identifying institutional order blocks.

Let’s dive in.

What Are Institutional Order Blocks?

Institutional order blocks are price ranges where large institutions place significant buy or sell orders.

These blocks indicate strong levels of support or resistance.

Why should you care?

Because trading in these areas can lead to higher probability trades.

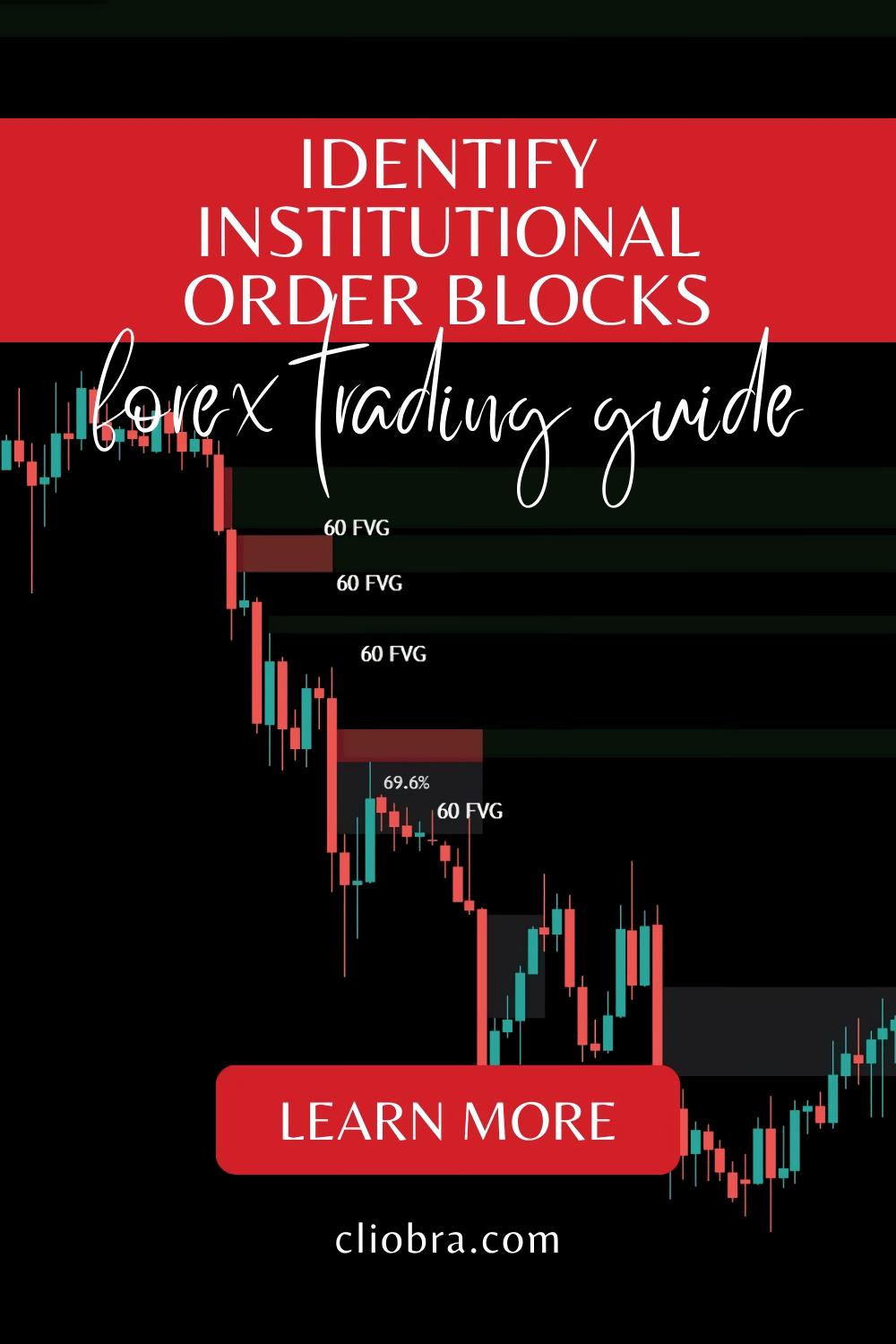

Understanding Fair Value Gaps (FVG)

A Fair Value Gap is simply a price range where there’s a lack of trading activity.

This gap often indicates where the market has moved too quickly, creating an opportunity for institutions to step in.

Here’s how to spot them:

- Look for a sharp price movement.

- Identify the gaps left in the price action.

- These gaps are often filled as the market returns to fair value.

Step-by-Step Guide to Identifying Order Blocks

- Identify Recent Highs and Lows

Start by marking recent swing highs and lows on your chart. These points are crucial for spotting potential order blocks. - Look for a Fair Value Gap

Check for gaps between price bars. When you see a large candle followed by a smaller one, that’s a potential FVG. - Confirm with Volume

Look at volume spikes. High volume at these gaps indicates institutional interest. - Draw the Order Block

Once you’ve identified an FVG, draw a box around the range. This will indicate where institutions are likely to enter or exit. - Watch for Price Action

See how price reacts when it approaches your identified order block. Look for rejection candles or reversal patterns.

Why This Matters

In a market where 80% of retail traders lose money, knowing how to identify these order blocks puts you ahead of the game.

Statistically, trading with the trend and aligning with institutional orders can increase your win rate significantly.

Think about it.

When you trade in the direction of the institutions, you’re more likely to see profits.

My Trading Bots and the FVG Strategy

As a seasoned Forex trader since 2015, I’ve developed a unique portfolio of 16 sophisticated trading bots.

These bots are strategically diversified across major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Here’s why they rock:

- Each currency pair has 3-4 different bots.

- They minimize correlated losses through internal diversification.

- Designed to trade long-term, aiming for 200-350 pips.

I’ve backtested these bots for the past 20 years, and they perform excellently even under tough market conditions.

Best of all? I’m offering this EA portfolio for FREE!

If you want to leverage the knowledge I’ve gained and the tools I’ve built, check out my trading bots portfolio.

Final Thoughts: Choosing the Right Broker

Now that you know how to spot institutional order blocks using the FVG strategy, it’s time to put this knowledge into action.

But don’t forget:

Choosing the right broker is crucial.

- Look for brokers with low spreads and fast execution.

- Ensure they offer the trading platforms you prefer, like MT4 or MT5.

I’ve tested some of the best brokers out there, and you can find my recommendations at Most Trusted Forex Brokers.

By aligning with the right broker and using the FVG strategy, you’re setting yourself up for success.