Last Updated on March 2, 2025 by Arif Chowdhury

Are you tired of getting caught in the whirlwind of Forex breakouts that turn into fakeouts?

You’re not alone.

As a seasoned Forex trader since 2015, I’ve faced those frustrating moments.

One minute, you’re ready to celebrate a breakout, and the next, you’re watching your profits evaporate.

So, how do you navigate this tricky terrain?

Let’s dive in.

Understanding Breakouts and Fakeouts 🚀

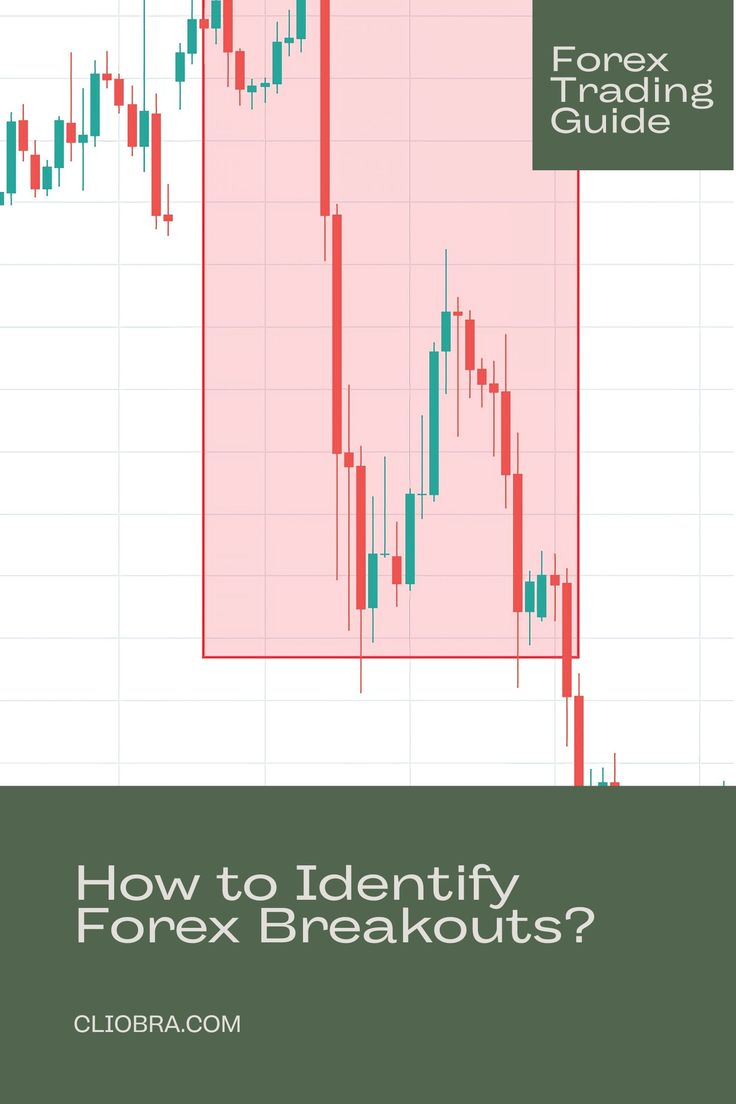

A breakout occurs when the price moves beyond a defined resistance or support level.

It’s like a runner breaking free from the starting line.

But then there’s the fakeout—a false signal that tricks traders into believing a breakout has happened.

Think of it as the runner who stumbles before the finish line.

Statistics show that about 70% of breakouts fail.

That’s a lot of potential losses if you’re not careful.

Key Indicators for Identifying Genuine Breakouts 🔍

- Volume:

- Look for increased trading volume during a breakout.

- Higher volume means more conviction behind the move.

- Price Action:

- Watch the candlestick patterns.

- A strong close beyond the resistance level is more reliable than a weak one.

- Market Sentiment:

- Use sentiment indicators to gauge trader confidence.

- If the majority is bullish and price breaks resistance, it’s more likely to stick.

- Timeframe:

- Stick to higher timeframes (H4 and above).

- Short-term charts can be more prone to noise and fakeouts.

Avoiding Fakeouts with a Solid Strategy 🛡️

So, how do you steer clear of those pesky fakeouts?

Here are my go-to tips:

- Wait for Confirmation:

- Don’t jump in immediately after a breakout.

- Wait for the next candle to confirm the move.

- Set Stop-Loss Orders:

- Always set a stop-loss just below the breakout point.

- This way, you limit potential losses if it turns out to be a fakeout.

- Use Trendlines:

- Draw trendlines to visualize support and resistance.

- Breakouts that align with trendlines carry more weight.

- Diversify Your Trades:

- Just like my portfolio of 16 trading bots, diversify your trades across different currency pairs.

- This helps mitigate risk.

Real-Life Example: My Breakout Journey 📈

Let me share a quick story.

A while back, I was trading EUR/USD.

I noticed a breakout above a strong resistance level.

Volume was high, and sentiment was bullish.

I hesitated, though.

I waited for the next candle to close.

When it confirmed the breakout, I entered with confidence.

I set my stop-loss just below the breakout point.

That trade turned into a solid win of 250 pips.

Had I rushed in, I might have caught a fakeout instead.

Tools to Enhance Your Trading 🛠️

Using the right tools can significantly improve your chances of identifying breakouts.

- Trading Bots: Consider using automated trading bots.

- My bots are designed to operate on H4 charts and focus on long-term trades, aiming for 200-350 pips. They’re backtested for 17 years, performing excellently even in tough market conditions.

- Reliable Brokers: Choose brokers that provide robust trading platforms with real-time data.

- I’ve tested several and can recommend some excellent options.

🚀Get this Forex EA Portfolio for FREE from here.

Final Thoughts 🥂

Trading Forex can be a thrilling ride, but it requires skill and strategy to avoid pitfalls like fakeouts.

By focusing on volume, price action, and market sentiment, you can better identify genuine breakouts.

Always wait for confirmation and use tools like trading bots to bolster your strategy.

Remember, successful trading isn’t just about making profits—it’s about managing risks effectively.

If you want to explore the best brokers and enhance your trading with sophisticated bots, check out my recommendations.

Happy trading!