Last Updated on February 9, 2025 by Arif Chowdhury

Ever feel like the market has it out for you? You place your trade, and suddenly, the price swings wildly against you.

Why does this happen?

It’s often because of institutional players conducting what we call high-frequency stop hunts.

These moves can leave retail traders bewildered and frustrated.

But don’t worry; I’ve got your back.

As a seasoned Forex trader since 2015, I’ve navigated these waters and honed my skills.

I want to share how you can spot these stop hunts and trade them effectively.

Understanding Stop Hunts

What is a stop hunt?

In simple terms, it’s when larger players push prices to trigger the stop-loss orders of retail traders.

Why would they do this?

To create liquidity for their larger trades.

Here’s a striking fact:

About 70% of retail traders lose money, often due to these market manipulations.

Identifying High-Frequency Stop Hunts

- Watch for Volatility Spikes

When you see sudden price spikes, it’s a red flag.

Institutional traders have the power to manipulate prices quickly.

Keep an eye on the 5-minute and 15-minute charts for these spikes. - Use Key Support and Resistance Levels

Markets love to test these levels.

When price approaches these zones, be alert.

Often, you’ll see a quick push below support or above resistance, triggering stop losses. - Monitor Liquidity Levels

Check the order book for liquidity.

If you see a cluster of stop orders, it’s a good bet they’ll try to hunt those.

Understanding order flow is crucial to anticipate these moves. - Spot the Patterns

Look for clear patterns in price action.

If you consistently see price moving back and forth around certain levels, it might be a sign of stop hunting.

Trading the Stop Hunts

So, how do you trade once you’ve identified a potential stop hunt?

- Wait for Confirmation

Don’t jump in right away.

Look for a reversal candle forming after the spike.

This signals that the hunt may be over. - Set Your Entry Point

Place your buy or sell order slightly beyond the stop hunt area.

This ensures you’re not getting caught in the false moves. - Use a Tight Stop Loss

Since these trades can be volatile, keep your stop loss tight.

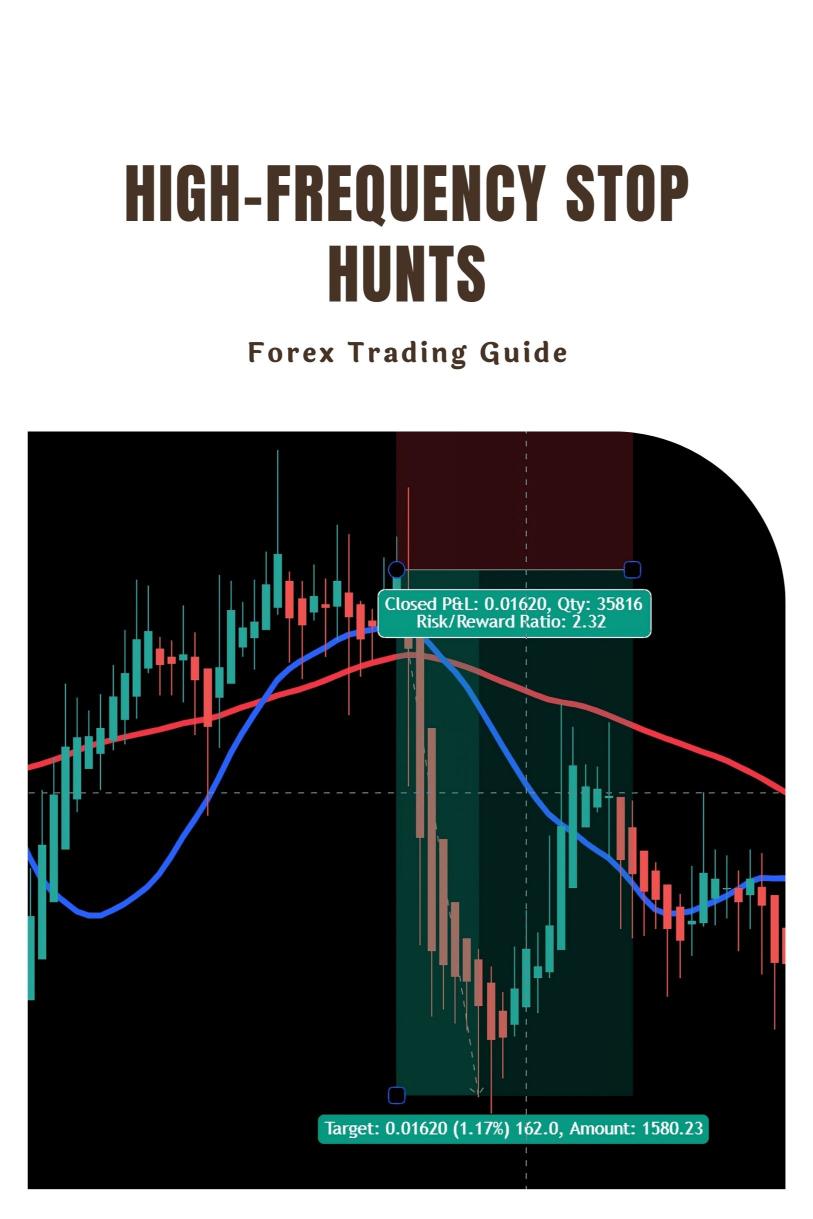

This protects your capital if the market doesn’t behave as expected. - Aim for a Good Risk-to-Reward Ratio

Ideally, look for at least a 1:2 or 1:3 risk-to-reward ratio.

This way, even if you lose a few trades, the winners will cover your losses.

Key Tools for Success

To navigate high-frequency trading effectively, you need the right tools.

- Charting Software

Invest in quality charting software.

This will help you spot patterns and volatility spikes quickly. - Economic Calendar

Keep an eye on major news events.

These can cause increased volatility, making stop hunts more likely.

Diversifying Your Strategy

I can’t stress enough the importance of diversification.

Having a robust trading strategy means you minimize risk while maximizing potential returns.

That’s why I’ve developed a unique portfolio of 16 trading bots.

These bots are strategically diversified across four major currency pairs: EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each pair has its own set of bots, ensuring that you’re not putting all your eggs in one basket.

This multi-layered approach significantly enhances overall profitability while reducing the risk of simultaneous losses.

And guess what? I’m offering this EA portfolio for FREE.

Final Thoughts

Trading in the Forex market comes with its challenges, but understanding how to identify and trade institutional stop hunts puts you in a better position.

Remember to stay vigilant, watch for volatility spikes, and always have a plan.

And if you’re looking for a reliable broker to execute your trades, I recommend checking out the best Forex brokers I’ve tested. You can find them here.

With the right strategies and tools, you can turn the tables on those high-frequency stop hunts and make the market work for you.