Last Updated on February 9, 2025 by Arif Chowdhury

Are you tired of the same old trading strategies that yield mediocre results?

Do you find yourself wondering how some traders seem to consistently profit while you struggle?

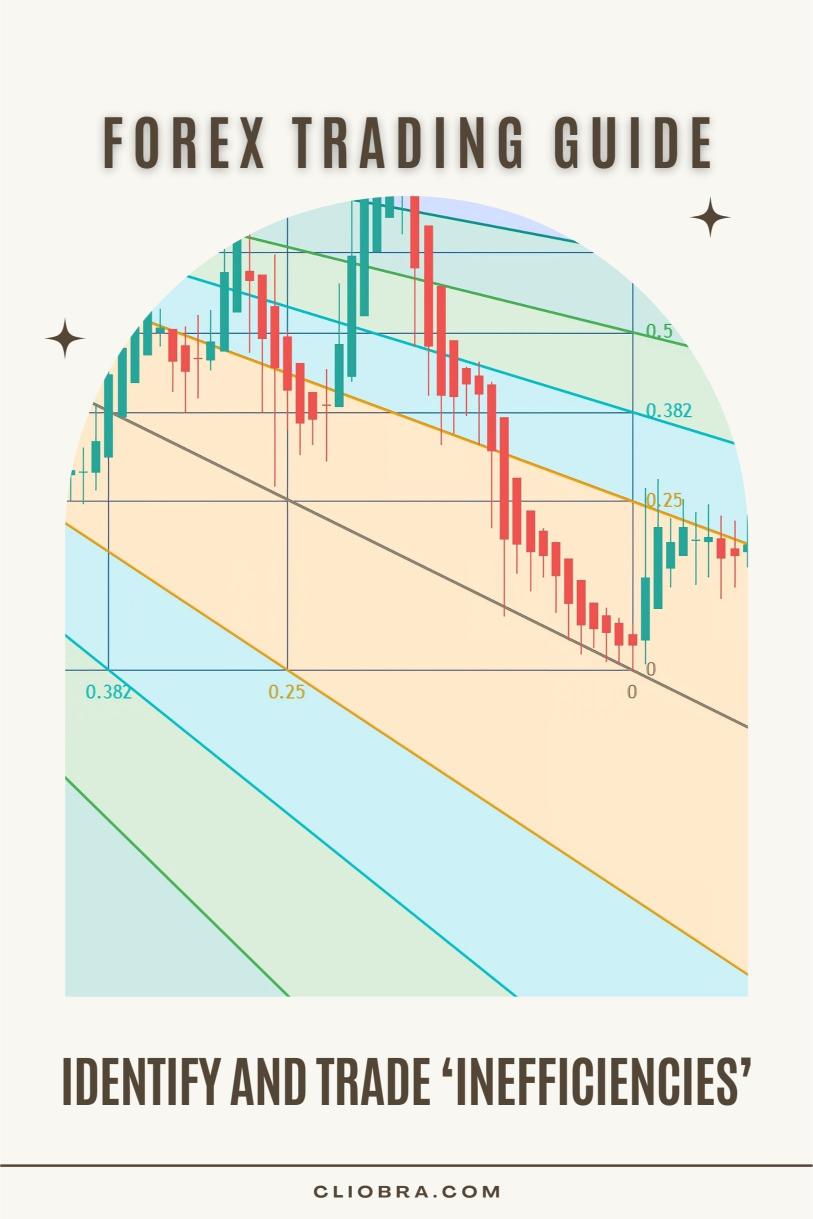

Let’s dive into a game-changing concept: identifying and trading inefficiencies in the Forex market.

As a seasoned Forex trader since 2015, I’ve seen firsthand how understanding these inefficiencies can elevate your trading game.

Let’s break it down.

What Are Market Inefficiencies?

Market inefficiencies occur when prices do not accurately reflect all available information.

This can happen for a variety of reasons:

- Delayed reactions: Sometimes, news impacts aren’t immediate.

- Overreactions: Traders might panic, causing price spikes.

- Insufficient information: Not everyone has access to the same data.

These gaps present opportunities for savvy traders willing to exploit them.

Why Should You Care?

Here’s why you should pay attention to inefficiencies:

- Profit Potential: Spotting these gaps can lead to lucrative trades.

- Consistency: By developing a strategy based on inefficiencies, you can achieve more reliable results.

- Market Knowledge: Understanding inefficiencies deepens your market insight.

Identifying Inefficiencies: The How-To

So, how do you identify these inefficiencies? Here’s what I’ve learned over the years:

1. Stay Informed

Keep up with economic news and reports.

Understanding market-moving events can help you anticipate price movements.

- Use Economic Calendars: Track important announcements.

- Follow Financial News: Be aware of global events affecting currencies.

2. Analyze Historical Data

Look for patterns in price movements.

- Chart Analysis: Use tools to identify previous inefficiencies.

- Backtesting: My trading bots have been backtested over the past 20 years, ensuring they perform even under harsh market conditions.

3. Utilize Technical Indicators

Leverage indicators to spot potential inefficiencies.

- Moving Averages: Can help highlight price trends.

- Bollinger Bands: Identify price volatility and potential reversals.

Trading Strategies for Inefficiencies

Once you spot an inefficiency, it’s time to act. Here are some strategies you can implement:

1. Arbitrage

Take advantage of price differences between brokers.

- Buy Low, Sell High: Execute trades simultaneously across different platforms.

2. News Trading

Capitalize on market reactions to news.

- Quick Execution: Be ready to trade immediately after a news release.

3. Scalping

Focus on small price changes over short periods.

- Fast Trades: Execute many trades throughout the day to accumulate profits.

The Power of Diversification

In trading, diversification can be your best friend.

I’ve developed a portfolio of 16 diverse trading bots, each designed to minimize risk across major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

This multi-layered approach enhances profitability while reducing the likelihood of correlated losses.

Each bot trades based on H4 charts and is geared for long-term gains of 200-350 pips.

Want to take your trading to the next level? Check out my trading bot portfolio—it’s completely FREE!

Best Practices for Success

- Stay Disciplined: Stick to your trading plan.

- Manage Risk: Use stop-loss orders strategically.

- Review Performance: Regularly analyze your trades to identify what works.

Final Thoughts

Identifying and trading inefficiencies in the Forex market can significantly boost your trading success.

Remember, the key is to stay informed, analyze data, and maintain a disciplined approach.

If you’re ready to explore the best Forex brokers, I recommend checking out some I’ve personally tested. They offer tight spreads and excellent support. Visit this link for more information.

In the end, trading is about finding your edge.

With the right tools and strategies, you can navigate the complexities of the Forex market like a pro.