Last Updated on February 14, 2025 by Arif Chowdhury

Ever felt like the market is playing hide and seek?

You’re not alone.

Many traders struggle to pinpoint where the big players are making their moves.

That’s where ‘hidden institutional order blocks’ come into play.

Let’s break it down in a way that’s easy to digest.

I’ve been grinding in Forex since 2015, and trust me, understanding these order blocks has been a game changer.

What Are Hidden Institutional Order Blocks?

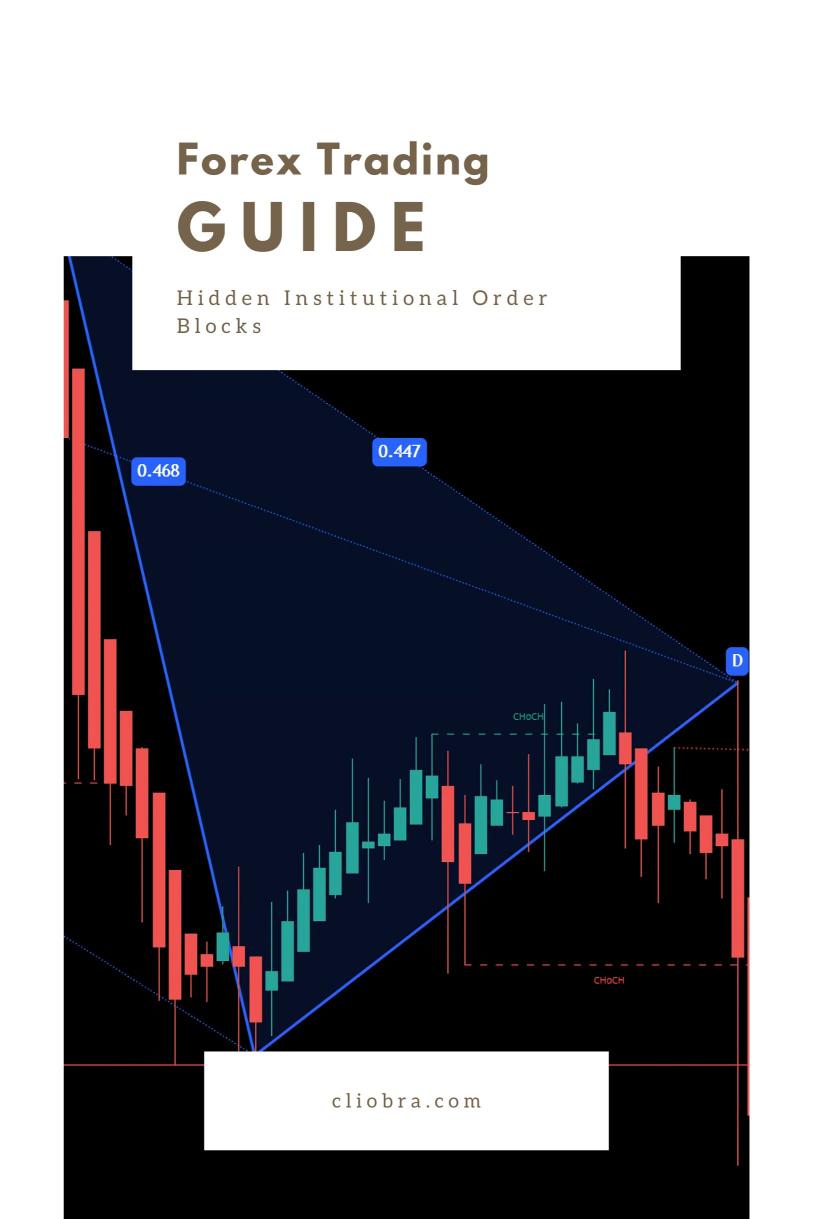

At its core, hidden institutional order blocks represent areas on the chart where large orders have been placed by institutional traders.

These are often not visible to the average trader but can provide critical insights into potential market movement.

Here’s why you should care:

- Market Movements: Institutions control a significant portion of the market.

- Buy/Sell Pressure: Their buying and selling create pressure that can lead to significant price shifts.

- Support and Resistance: These blocks can act as strong support or resistance levels.

Why Bother with Order Blocks?

Think about it:

If you can identify where the big money is flowing, you can position yourself to ride those waves.

- Statistical Insight: Studies show that institutional traders account for over 80% of market volume in Forex.

That’s a massive influence!

How to Spot Hidden Institutional Order Blocks

Okay, let’s get into the nitty-gritty.

Here’s how you can identify these hidden gems:

- Look for Imbalances: Check for areas where price has moved sharply.

- Volume Analysis: High volume at certain price levels can indicate institutional activity.

- Candlestick Patterns: Watch for specific patterns like engulfing candles around these levels.

- Use Higher Time Frames: H4 charts are golden for spotting these blocks.

The Strategy Behind Trading Order Blocks

Once you’ve located an order block, it’s time to put a plan into action.

Here’s a simple strategy:

- Wait for a Retest: After price hits the order block, wait for it to retest before entering.

- Set Your Stop Loss: Place it just beyond the block to minimize risk.

- Target Profits: Aim for at least 200-350 pips, which is where my trading bots excel.

My 16 trading bots are designed for this kind of long-term trading.

They intelligently navigate through these levels, maximizing your chances of a profitable trade.

Why My Trading Bots Rock

Now, let’s chat a bit about my portfolio.

I’ve crafted 16 sophisticated trading bots that are strategically diversified across four major currency pairs:

- EUR/USD

- GBP/USD

- USD/CHF

- USD/JPY

Each pair boasts 3-4 unique bots that minimize correlated losses.

This means you’ve got a robust system that enhances profitability while reducing risk.

- Backtested for Success: They’ve been backtested over 20 years, proving their resilience under various market conditions.

And the best part?

I’m offering this entire EA portfolio for FREE.

You can check it out here.

Final Thoughts on Trading with Confidence

Trading can feel like a rollercoaster.

But understanding where the big players are placing their bets can give you the confidence you need to make informed decisions.

- Best Brokers Matter: Don’t forget, the right broker can make a world of difference.

I recommend checking out the best Forex brokers I’ve tested for you.

You can find them here.

Stay Ahead of the Game

The Forex market is filled with opportunities if you know where to look.

By focusing on hidden institutional order blocks, you can enhance your trading strategy significantly.

Remember, it’s all about learning, adapting, and executing your strategy with confidence.

Happy trading! 🚀