Last Updated on April 6, 2025 by Arif Chowdhury

Ever found yourself staring at a chart, wondering if the trend is really your friend?

You’re not alone.

Many traders struggle to confirm trend strength, often second-guessing their instincts.

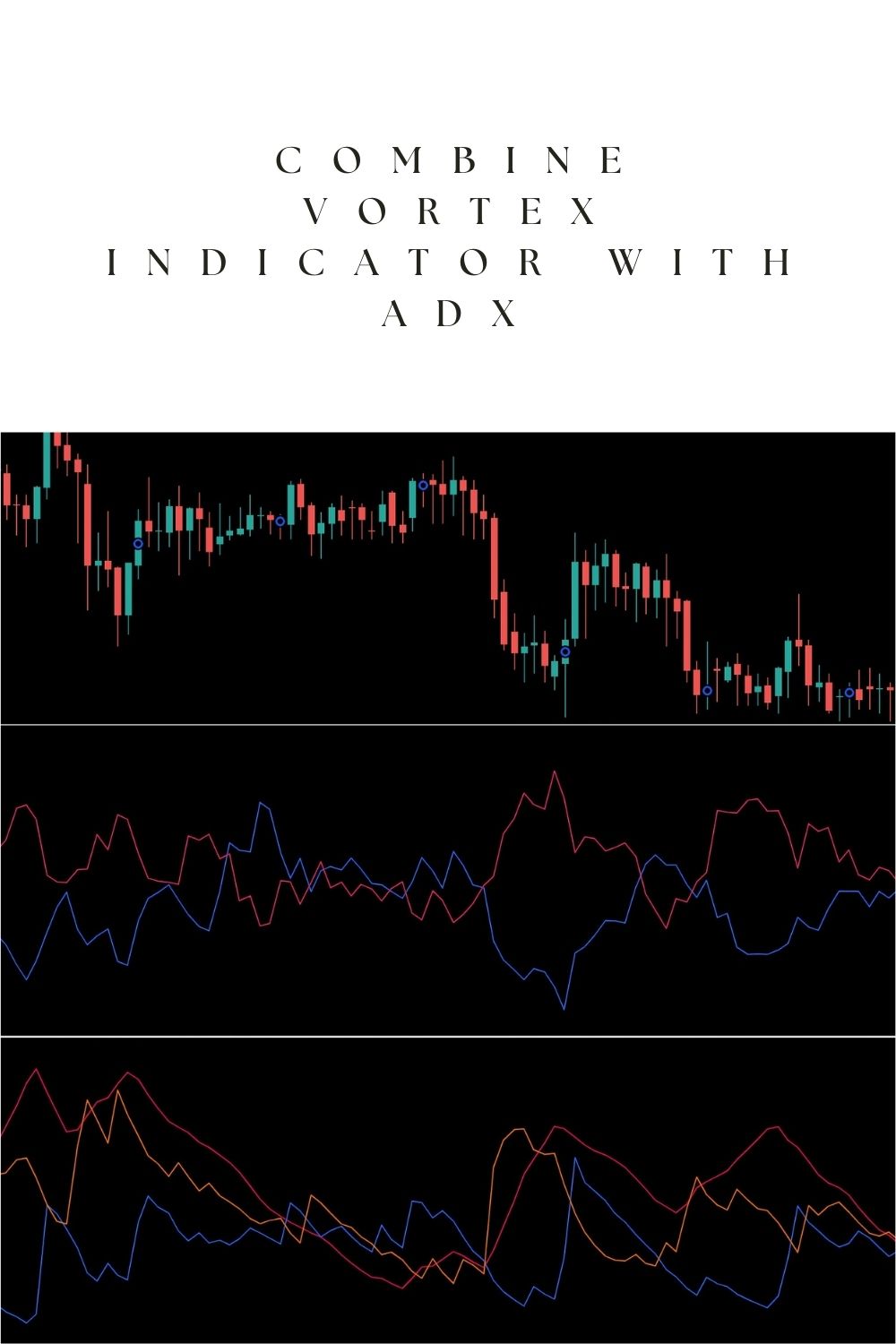

But what if I told you that using the Vortex Indicator alongside the Average Directional Index (ADX) can give you the clarity you need?

Let’s break it down.

Understanding the Vortex Indicator

The Vortex Indicator is designed to identify the direction of a trend and its strength.

Here’s how it works:

- Vortex Up (VI+): This line indicates upward movements.

- Vortex Down (VI-): This line shows downward movements.

When VI+ is above VI-, it signals a bullish trend.

Conversely, when VI- is above VI+, it indicates a bearish trend.

What’s the ADX?

The ADX measures the strength of a trend, regardless of its direction.

It ranges from 0 to 100:

- Above 20: Indicates a strong trend.

- Below 20: Suggests a weak trend.

This makes ADX a vital tool for confirming the strength of the trend identified by the Vortex Indicator.

Combining the Two Indicators

Now, let’s get into the meat of it.

Here’s a simple way to combine the Vortex Indicator with the ADX:

- Identify the Trend with Vortex:

- Look for VI+ crossing above VI- for a bullish signal.

- Look for VI- crossing above VI+ for a bearish signal.

- Confirm with ADX:

- Check the ADX value.

- If ADX is above 20, the trend is strong.

This combo gives you a powerful edge in your trading strategy.

Why This Works

Statistically speaking, using multiple indicators can improve your winning trade percentage.

Some studies suggest that traders using combined indicators could see an increase in accuracy by up to 30%.

The Vortex Indicator helps determine the trend direction, while the ADX confirms its strength.

This means you’re less likely to jump into trades that lack momentum.

A Quick Example

Let’s say you spot VI+ crossing above VI-.

At the same time, your ADX is sitting at 25.

This combination indicates a strong bullish trend.

You could then consider entering a trade with more confidence.

The Golden Grid Trading System

Now, while we’re talking about trends, let’s pivot a bit.

As a seasoned Forex trader since 2015, I’ve developed a system called Golden Grid.

It’s designed to capitalize on market volatility, and guess what?

It can work well with the trends identified by the Vortex Indicator and ADX.

With Golden Grid, I consistently achieve 2-5% daily ROI and an average of 60-150% monthly ROI.

The beauty of this system is its responsiveness.

It captures 20-40 pips in quick succession, allowing you to see results fast.

Plus, it’s completely free!

You can grab your own version of the Golden Grid EA here.

Best Practices with Your Indicators

To maximize your trading success, keep these tips in mind:

- Test on a Demo Account: Always practice with a demo account first.

- Use Tight Stop Losses: Manage your risk effectively.

- Stay Updated with Market News: Economic events can drastically affect trends.

Choosing the Right Broker

Let’s wrap this up with something crucial: your broker.

Having the right broker can make all the difference in your trading success.

I recommend checking out the best Forex brokers I’ve tested here.

These brokers offer tight spreads, excellent execution speeds, and fantastic customer support.

Conclusion

Combining the Vortex Indicator with the ADX can significantly enhance your ability to confirm trend strength.

With careful planning and the right tools, like my Golden Grid EA, you can navigate the Forex market with confidence.

Don’t forget to test strategies on demo accounts and ensure you’re trading with the best brokers.

Happy trading!