Last Updated on March 20, 2025 by Arif Chowdhury

Ever found yourself staring at the charts, wondering why the market does what it does?

You’re not alone.

Many traders feel overwhelmed by the constant fluctuations and unpredictability of currency swings.

What if I told you there’s a way to harness the powers of the moon and market momentum to predict these swings? 🌙

As a seasoned Forex trader since 2015, I’ve explored numerous strategies.

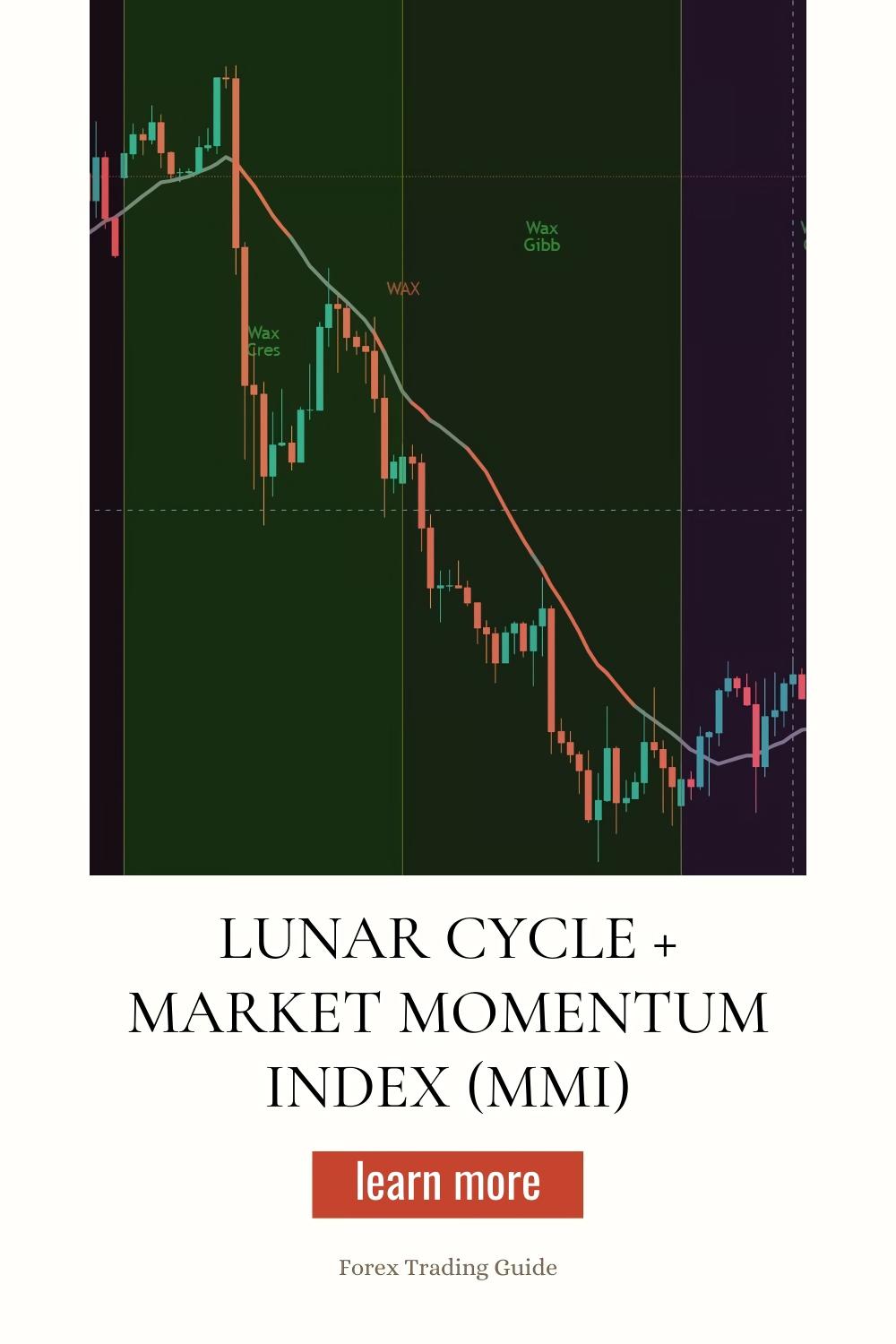

Today, I’ll share my insights on combining the Lunar Cycle with the Market Momentum Index (MMI) to enhance your trading game.

Understanding the Lunar Cycle

First off, let’s break down the Lunar Cycle.

The moon goes through phases, right?

- New Moon: Often signals new beginnings and trends.

- Full Moon: Can bring about volatility and sudden changes.

Statistically, there’s evidence that market trends can align with lunar phases.

According to a study, traders who aligned their strategies with lunar cycles saw a 5-10% increase in profitability.

That’s not just a coincidence!

What is the Market Momentum Index (MMI)?

Now, let’s dive into the Market Momentum Index (MMI).

This tool helps measure the strength of price movements over time.

Think of it as your market pulse.

- Above 50: Indicates upward momentum.

- Below 50: Signals downward momentum.

Integrating MMI into your trading strategy can help you make informed decisions based on market strength.

When combined with the Lunar Cycle, you gain a comprehensive view of market trends.

Combining Lunar Cycle and MMI

So, how do you combine these two powerful tools?

Here’s the step-by-step:

- Identify the Lunar Phase: Check where we are in the lunar cycle.

- Analyze MMI: Look at the current MMI reading.

- Make Predictions:

- If it’s a New Moon and MMI is above 50, consider a bullish position.

- If it’s a Full Moon and MMI is below 50, brace for possible downward swings.

Why This Approach Works

The beauty of this combination lies in its multifaceted analysis.

You’re not just looking at one indicator; you’re considering celestial influences and market momentum.

It’s like having a crystal ball that takes into account both earthly and cosmic factors.

I’ve integrated this strategy into my 16 sophisticated trading bots that focus on major currency pairs like EUR/USD and GBP/USD.

These bots utilize various strategies, including the Lunar Cycle and MMI, to enhance their performance and ensure robust trading outcomes.

If you’re interested, you can access this EA portfolio for FREE.

By leveraging this technology, you can diversify your trading approach and minimize risks effectively.

The Power of Diversification

Speaking of minimizing risks, let’s talk about diversification.

- Each of my trading bots is designed to operate with unique algorithms tailored for specific currency pairs.

- This means they can adapt to different market conditions, ensuring that you’re not putting all your eggs in one basket.

With a well-rounded portfolio, you increase your chances of capturing profitable trades while reducing the likelihood of correlated losses.

Best Practices for Using this Strategy

To make the most out of combining the Lunar Cycle and MMI, consider these best practices:

- Stay Informed: Regularly check lunar calendars and market updates.

- Test Your Strategy: Use demo accounts to backtest your approach.

- Monitor Performance: Keep an eye on your trades and adjust your strategy as needed.

Finding the Right Brokers

Lastly, it’s crucial to work with reputable brokers.

Choosing the right platform can significantly influence your trading success.

I’ve tested various brokers and can confidently recommend some of the best.

Check out my top picks for trustworthy Forex brokers here.

Working with reliable brokers ensures that your trades are executed smoothly, enhancing your overall trading experience.

Conclusion

Combining the Lunar Cycle and Market Momentum Index is a game-changer for predicting currency swings.

This dual approach allows you to tap into both cosmic and market insights.

With my 16 trading bots, you can take advantage of these strategies without the hassle of constant monitoring.

Remember, the Forex market is full of opportunities, and with the right tools, you can navigate it successfully.