Last Updated on March 21, 2025 by Arif Chowdhury

Ever felt lost in the chaos of Forex trading?

You’re not alone.

Many traders struggle with noisy price action and unpredictable trends.

How can you filter out the noise and find solid trading opportunities?

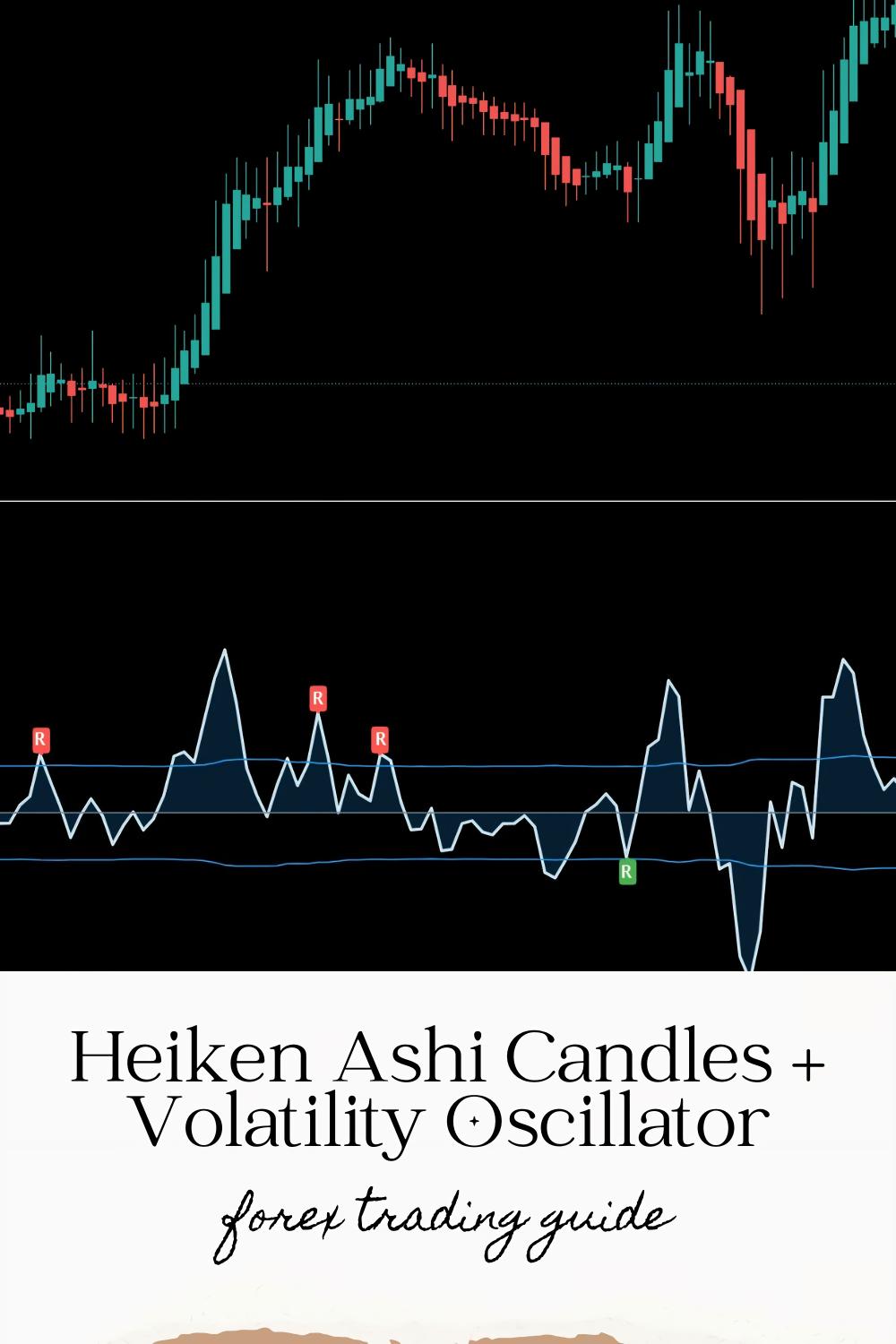

That’s where the Heiken Ashi candles and the Volatility Oscillator come into play.

What Are Heiken Ashi Candles?

Heiken Ashi candles are a fantastic tool for smoothing out price action.

They help you see trends more clearly by averaging the closing prices.

Here’s what makes them special:

- Smoother Visualization: They reduce market noise, making it easier to spot trends.

- Trend Confirmation: Green candles indicate an uptrend, while red candles signal a downtrend.

They’re like having a cheat sheet for market direction.

This clarity is crucial, especially when you’re navigating volatile markets.

Understanding the Volatility Oscillator

Now, let’s talk about the Volatility Oscillator.

This indicator measures market volatility and helps identify potential price reversals.

Why is this important?

- Risk Management: Knowing when the market is volatile can help you manage risk effectively.

- Entry and Exit Points: It assists in pinpointing the best times to enter or exit trades.

When combined with Heiken Ashi candles, you get a powerful duo that can enhance your trading strategy.

How to Combine Them Effectively

Now, let’s get into the nitty-gritty of how to combine these two tools.

- Set Up Your Charts

Use the Heiken Ashi candles for your price chart.

Add the Volatility Oscillator below your chart. - Identify Trends

Look for consistent green or red Heiken Ashi candles.

This indicates a strong trend. - Check Volatility

When the Volatility Oscillator is above the zero line, it indicates increased volatility.

Be cautious when it dips below zero, as this can signal potential reversals. - Confirm Your Trades

Only enter trades when both indicators align.

For example, if you see a series of green Heiken Ashi candles along with a rising Volatility Oscillator, that’s your signal to buy. - Manage Your Risk

Set your stop-loss based on volatility levels.

If the market is highly volatile, consider wider stops to avoid being stopped out prematurely.

My Trading Journey and the Power of Automation

As a seasoned Forex trader since 2015, I’ve tested countless strategies.

What I’ve found is that combining the Heiken Ashi candles with the Volatility Oscillator not only smooths out the chaos but also enhances profitability.

To take my trading to the next level, I developed a portfolio of 16 sophisticated trading bots.

These bots leverage various strategies, including the Heiken Ashi and Volatility Oscillator, to create a robust trading system.

Here’s why this portfolio stands out:

- Diverse Algorithms: Each currency pair has 3-4 unique bots, minimizing correlated losses.

- Long-Term Focus: Designed to target 200-350 pips, these bots excel in long-term performance.

- Free Access: I’m offering this EA portfolio completely FREE!

You can check it out here.

This blend of automation and strategic analysis has led to consistent profitability.

I’ve backtested these bots for over 20 years, and they perform excellently under various market conditions.

Tips for Choosing the Right Forex Broker

Finding the right broker is just as crucial as having the right strategy.

Here are a few tips to consider:

- Tight Spreads: Look for brokers that offer competitive spreads to maximize your profits.

- Fast Execution: Choose brokers with quick order execution to capitalize on market moves.

- Excellent Support: Consider brokers with outstanding customer support to assist you whenever needed.

I’ve tested a range of brokers and can confidently recommend the best ones.

Check out my top picks for best Forex brokers here.

Final Thoughts

Combining Heiken Ashi candles with the Volatility Oscillator can transform your trading strategy.

These tools help filter out noise and provide clearer market signals.

Don’t forget to leverage automation to enhance your trading efficiency.

With my portfolio of 16 trading bots, you can further amplify your trading results—completely free!

Ready to elevate your trading game?

Explore the tools and strategies that can lead you to success!