Last Updated on March 14, 2025 by Arif Chowdhury

Are you tired of guessing when to enter trades?

Wondering how to pinpoint those sweet spots in the market?

You’re not alone.

Many traders struggle with timing, leading to missed opportunities or worse, losses.

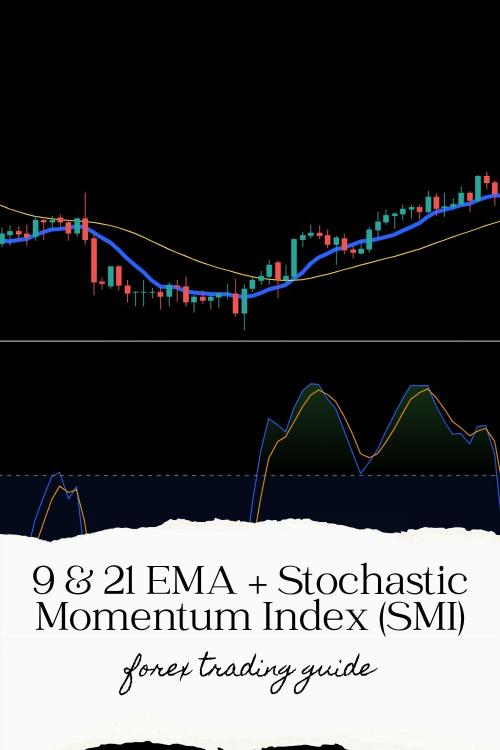

That’s where the dynamic duo of the 9 & 21 EMA combined with the Stochastic Momentum Index (SMI) comes in.

This strategy has been a game-changer for me since I started trading in 2015.

Let’s break it down, step by step, so you can start using it today.

Understanding the Basics

Exponential Moving Averages (EMAs) help smooth out price data.

The 9 EMA reacts faster to price changes, while the 21 EMA provides a more stable view.

When you see the 9 EMA cross above the 21 EMA, it signals a potential buying opportunity.

Conversely, a cross below suggests it might be time to sell.

Statistical fact: Studies show that traders using EMAs can improve their win rates by up to 70% when combined with momentum indicators, like the SMI.

The Stochastic Momentum Index adds another layer of insight.

It measures momentum based on the closing price relative to the price range over a set period.

When the SMI is above 0, it indicates bullish momentum; below 0 signals bearish momentum.

Setting Up Your Chart

- Add the Indicators:

- Apply the 9 EMA and 21 EMA to your chart.

- Add the Stochastic Momentum Index.

- Adjust Settings:

- For the SMI, a common setting is 14 periods.

- Choose Your Timeframe:

- I recommend using the H4 chart for clearer signals and less noise.

Identifying Entry Points

Here’s where it gets exciting.

- Watch for Crossovers:

- Look for the 9 EMA crossing the 21 EMA.

- Confirm with the SMI. If the SMI is above 0 during a crossover, it’s a strong buy signal.

- Check for Divergence:

- If prices are making new highs but the SMI isn’t, this could indicate a potential reversal.

- Conversely, if prices are making new lows while the SMI is rising, it might be time to buy.

- Set Your Stop Loss and Take Profit:

- Stop Loss: Place it just below the last swing low for buys or above the swing high for sells.

- Take Profit: Aim for a risk-to-reward ratio of at least 1:2.

Why This Strategy Works

The combination of EMAs and the SMI provides a robust framework for making informed decisions.

It’s not just about following the trend; it’s about understanding momentum, too.

When both indicators align, you increase your chances of success dramatically.

My Trading Bots: A Helping Hand

Now, if you want to take this strategy to the next level, consider using my 16 trading bots.

These bots utilize the 9 & 21 EMA + SMI strategy among many others to maximize profit while minimizing risk.

- Each bot is internally diversified across four major currency pairs: EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

- This multi-layered approach means you can expect better stability and performance over time.

I’ve rigorously backtested these bots for over 20 years, and they’ve proven effective even in harsh market conditions.

And the best part? You can access this entire portfolio for FREE!

If you’re curious, check out my trading bots here.

Finding the Right Broker

To effectively implement this strategy, you’ll need a reliable broker.

Here are a few standout options:

- FBS:

- Tight spreads from 0.7 pips.

- Minimum deposit starts at just $5.

- XM:

- Spreads as low as 0.8 pips with zero costs.

- They even offer $200,000 in cash prizes monthly.

- TickMill:

- Fast execution average of 0.20 seconds.

- Minimum deposit from $100.

Choosing the right broker can make a significant difference in your trading experience.

Check out my top recommendations for brokers here.

Conclusion

Combining the 9 & 21 EMA with the Stochastic Momentum Index can elevate your trading game.

You’ll gain better entry points and a clearer understanding of market momentum.

And if you want to automate your strategy, my 16 trading bots are designed to help you trade smarter, not harder.

Take the plunge today.

With the right tools and strategies, your trading success is just around the corner!