Last Updated on March 7, 2025 by Arif Chowdhury

Ever feel like you’re missing out on those big market moves?

You know, the ones that can turn a mediocre trading day into a game-changer?

As a seasoned Forex trader since 2015, I’ve been where you are. I know the struggle.

Today, I want to share a powerful strategy that has consistently helped me spot those pivotal moments in the market.

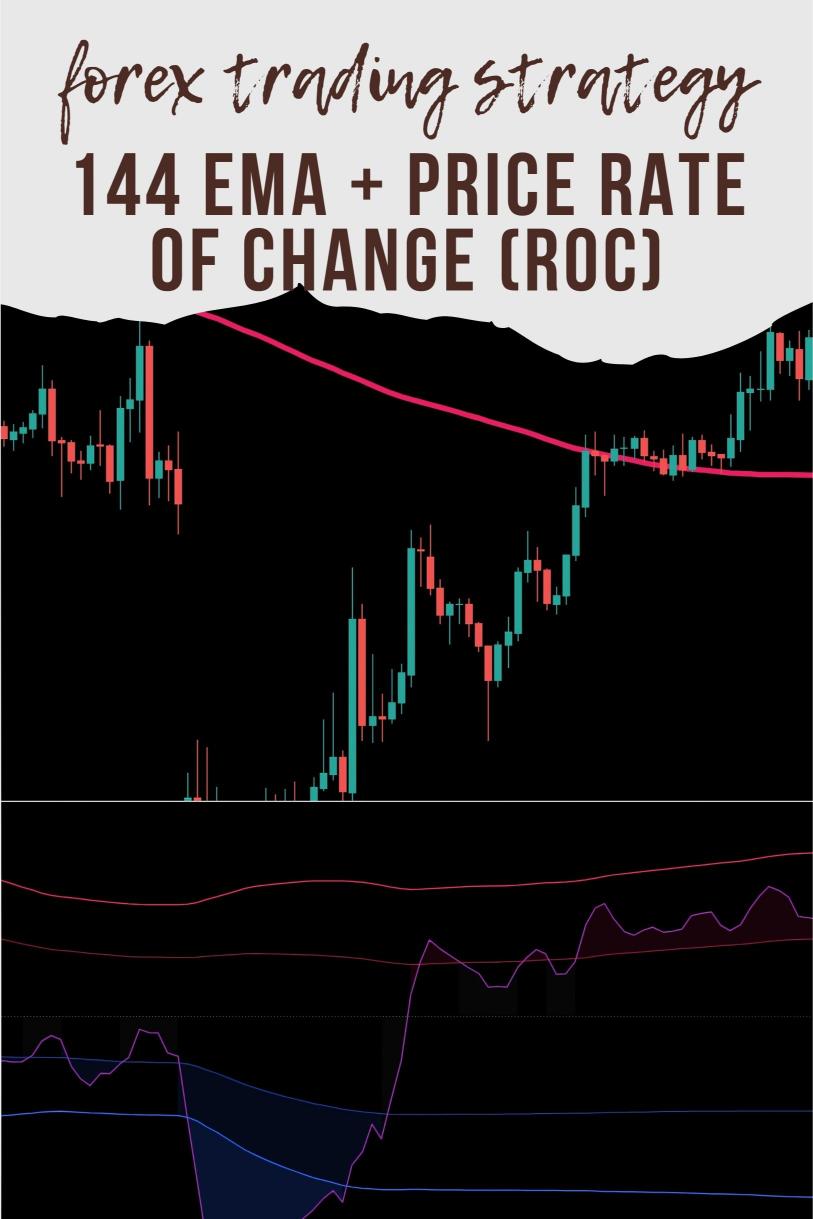

Let’s dive into how combining the 144 EMA (Exponential Moving Average) with the Price Rate of Change (ROC) can elevate your trading game.

What’s the 144 EMA and Why Use It?

The 144 EMA is a trend-following indicator that smooths out price action.

Here’s why it’s crucial:

- Trend Identification: It helps you determine the direction of the market. If prices are above the 144 EMA, you’re in an uptrend. If below, it’s a downtrend.

- Dynamic Support/Resistance: The EMA acts as a dynamic level of support or resistance. Prices tend to bounce off it, creating potential entry and exit points.

Statistically speaking, using moving averages like the 144 EMA can increase your chances of successful trades by up to 60% when combined with other indicators.

Understanding the Price Rate of Change (ROC)

Now, let’s talk about the ROC.

The Price Rate of Change measures the percentage change in price over a specific period.

Here’s why it’s important:

- Momentum Indicator: It helps identify the strength of a price move. A rising ROC indicates strong bullish momentum, while a falling ROC signals bearish momentum.

- Divergence Signals: If prices are moving in one direction but the ROC is moving in another, it’s a red flag. This divergence can signal potential reversals.

Research shows that combining momentum indicators like the ROC with trend indicators can enhance your ability to predict market movements effectively.

How to Combine the 144 EMA and ROC for Big Moves

Now, let’s get to the juicy part—how to use these tools together.

- Set Up Your Chart:

- Apply the 144 EMA to your chart.

- Add the ROC indicator (commonly set to a 14-period).

- Look for Confirmation:

- Wait for the price to cross above the 144 EMA. This signals a potential uptrend.

- Check the ROC. If it’s rising and crosses above zero, it confirms strong bullish momentum.

- Entry Points:

- Consider entering a long position when both the price is above the 144 EMA and the ROC is above zero.

- For a short position, look for price below the 144 EMA with ROC declining below zero.

- Set Your Stop Loss:

- Place your stop loss just below the 144 EMA for long trades.

- For shorts, place it just above the EMA.

- Targeting Big Moves:

- Aim for larger targets, typically between 200-350 pips. This aligns with my long-term trading approach, which is designed for major moves.

Why This Strategy Works

The combination of the 144 EMA and the ROC allows you to filter out noise and focus on significant price movements.

You’re not just guessing; you’re basing your trades on calculated indicators.

This strategy is part of the foundation of my 16 trading bots, which leverage the same principles among other strategies.

These bots are meticulously designed to trade across major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

They use the 144 EMA + ROC strategy to maximize profitability while minimizing risk.

And the best part? I’m offering this entire EA portfolio for FREE.

If you’re serious about improving your trading, check out my trading bots portfolio.

The Importance of Choosing the Right Broker

Once you’ve got your strategy down, the next step is choosing a broker.

A reliable broker can make or break your trading experience.

Here’s what to look for:

- Low Spreads: More money in your pocket.

- Fast Execution: Timing is everything in Forex.

- Solid Support: You want someone to have your back.

I’ve tested several brokers, and I recommend checking out my top picks at this link.

Final Thoughts

By combining the 144 EMA with the Price Rate of Change (ROC), you unlock a powerful strategy for spotting big market moves.

This approach has been a game-changer for me, and I hope it helps you too.

Remember, successful trading is about finding the right tools and sticking with a strategy that works.

Don’t forget to explore the potential of my trading bots, which utilize this same strategy alongside others for maximum effectiveness.

Happy trading! 🚀