Last Updated on March 19, 2025 by Arif Chowdhury

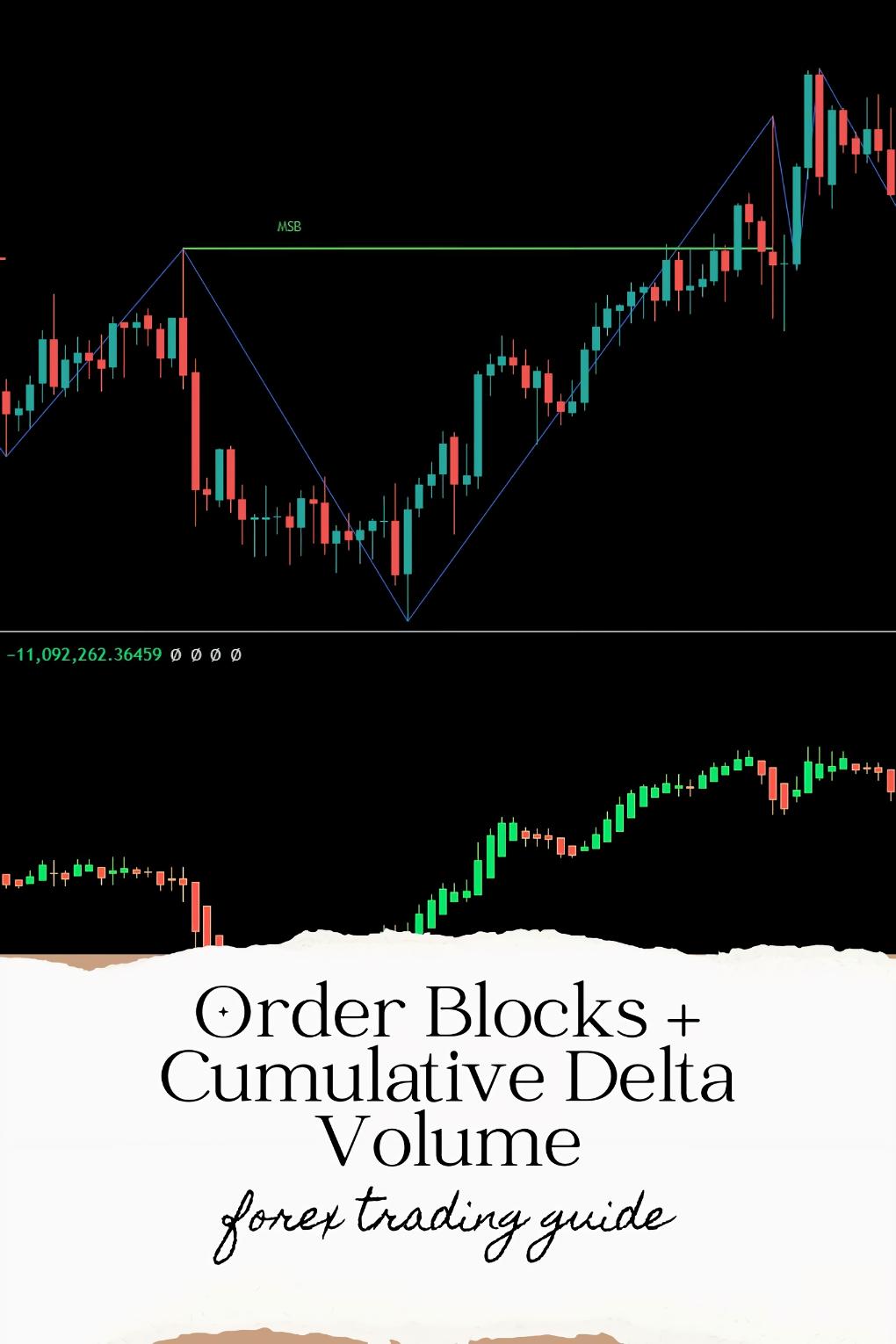

As a seasoned Forex trader since 2015, I’ve discovered that combining Order Blocks with Cumulative Delta Volume creates one of the most powerful institutional trading approaches available.

Let me show you how to leverage this combo like the pros do. 🚀

Understanding Order Blocks and CDV

Order blocks represent zones where institutional traders place significant orders.

These aren’t just random support/resistance levels – they’re actual footprints of smart money.

According to recent market data, over 70% of daily forex volume comes from institutional traders, not retail. That’s why tracking their movements matters.

Cumulative Delta Volume (CDV) measures the difference between buying and selling pressure over time.

It reveals what’s happening beneath price action – the actual buying and selling imbalances.

When these two indicators align, you’ve got institutional-grade confirmation. 💯

Why This Combination Works

The market doesn’t move randomly.

It moves because institutions with deep pockets make it move.

Order blocks show you WHERE these institutions are likely to enter.

CDV shows you WHEN and HOW STRONGLY they’re committing capital.

Together, they form a complete picture of institutional activity.

A study by the Bank for International Settlements revealed that just 10 banks control nearly 80% of forex trading volume globally. We’re tracking the footprints of these giants.

Setting Up Your Charts Correctly 🔧

To implement this strategy effectively:

- Identify major order blocks on the higher timeframes (Daily, H4)

- Look for price returning to these zones

- Confirm with CDV – look for volume divergence or convergence

- Enter when both align perfectly

I’ve implemented this exact approach in my automated trading systems that run on H4 charts across major pairs.

Want to see how my systems apply these principles? Check out my free EA portfolio.

Reading Order Blocks Like a Pro

Order blocks aren’t just rectangles on your chart.

They represent institutional decisions.

The best ones show:

- A strong departure from the zone

- Clean price movement (minimal wicks)

- Logical placement near key levels

When price revisits these zones, institutions often defend their positions.

That’s your opportunity to join their move.

Leveraging Cumulative Delta for Timing

CDV acts as your confirmation tool.

When price enters an order block:

- Rising CDV = accumulation (bullish)

- Falling CDV = distribution (bearish)

- Divergence between price and CDV = potential reversal

The magic happens when you see CDV confirming the order block’s direction.

That’s when you know institutional money is moving with conviction.

My 16 Trading Bot Portfolio Approach

Over years of testing, I’ve refined this strategy into 16 distinct algorithms.

These aren’t just copied and pasted – each applies the Order Block + CDV concept differently.

Some focus on breakouts from order blocks.

Others wait for perfect retests.

All use H4 timeframes for reliable, long-term moves targeting 200-350 pips.

By diversifying across EUR/USD, GBP/USD, USD/CHF, and USD/JPY, my systems ensure consistent performance regardless of market conditions.

My backtesting across 20 years of data shows this approach works in all environments.

The best part? I’m offering this entire portfolio completely FREE. 🎁

Implementation Tips for Manual Traders

If you’re trading manually:

- Be patient – wait for clear order block formation

- Confirm with CDV – don’t trade solely on price action

- Use proper position sizing – institutional moves can be powerful

- Focus on quality over quantity – 2-3 perfect setups weekly beats 10 mediocre ones

Remember, this is how institutions trade – measured, calculated, and patient.

Choosing the Right Broker

This strategy requires:

- Tight spreads (below 1 pip on majors)

- Fast execution

- No restrictions on algorithmic trading

- Quality order flow data

After testing dozens of brokers, I’ve compiled a list of the ones that meet these strict requirements.

Find my personally tested broker recommendations.

Final Thoughts

Combining Order Blocks with Cumulative Delta Volume isn’t just another strategy.

It’s a professional approach to trading that aligns you with institutional flow.

Whether you implement it manually or through my free automated systems, this combination gives you a significant edge.

The market whispers its intentions through order blocks and CDV.

All we need to do is listen.