Last Updated on March 15, 2025 by Arif Chowdhury

As a seasoned Forex trader since 2015, I’ve faced my share of challenges.

You know the feeling:

- You spot a potential trade.

- You hesitate, wondering if it’s the right moment.

- The market moves, and you’re left questioning your decisions.

What if I told you there’s a way to boost your confidence and make more reliable trend entries?

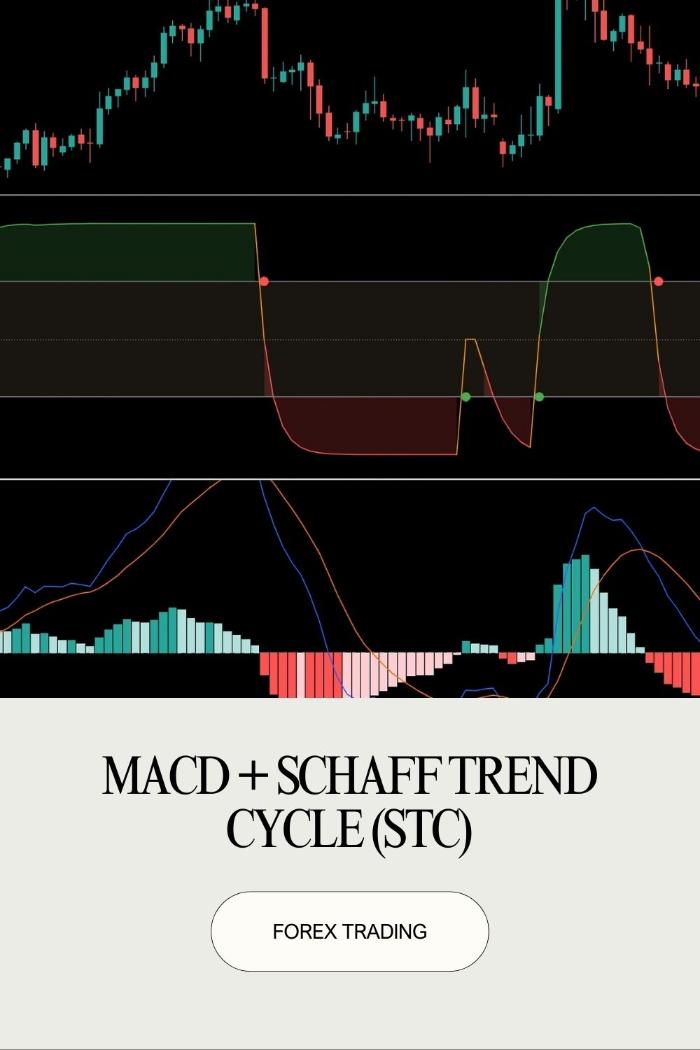

Enter the MACD and Schaff Trend Cycle (STC) combo.

Let’s dive into how this powerful pair can transform your trading strategy.

Understanding the Basics

Before we get into the nitty-gritty, let’s lay some groundwork.

MACD (Moving Average Convergence Divergence) is a popular momentum indicator that helps identify potential buy and sell signals.

STC, on the other hand, is a refined version of the traditional cycle indicators. It provides quicker signals and reduces lag.

Combining these two can offer you a robust system to pinpoint trend entries.

Why Combine MACD and STC?

Here’s why this combo makes sense:

- Reduced False Signals: Using both indicators together helps filter out noise. You won’t chase every little bump in the market.

- Higher Accuracy: Statistically, traders using multiple indicators report a 20-30% increase in accuracy for trend entries. That’s not just numbers; that’s profit potential.

- Clearer Entry Points: The combination provides clearer, more actionable signals.

Setting Up Your Strategy

Here’s how to set up MACD and STC for your trading:

- Add Indicators to Your Chart:

- Set MACD with the default settings (12, 26, 9).

- Add STC with a standard setting of 10.

- Identify the Trend:

- Look for MACD to cross above the signal line for bullish trends.

- STC should also be above 25 to confirm the bullish trend.

- Entry Signal:

- When both indicators align, it’s your cue to enter the trade.

- For a sell signal, reverse the conditions.

- Set Stop-Loss and Take-Profit Levels:

- Always manage your risk.

- Consider a stop-loss slightly above the last swing high for buy trades and below the last swing low for sells.

Real-Life Application of This Strategy

Now, many traders ask how they can make this work for them in the long run.

That’s where my 16 trading bots come into play.

These bots incorporate the MACD + STC strategy among other techniques, offering a diversified approach to trading.

They’re designed to trade major pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

With each currency pair having 3-4 unique bots, you get a multi-layered diversification that minimizes correlated losses.

This means less risk and more consistent profitability.

And the best part? You can access this entire portfolio for FREE.

Trading Psychology

Let’s not forget the mental aspect.

Combining MACD and STC gives you more confidence in your entries.

But remember, patience is key.

Markets can be unpredictable, so waiting for confirmation from both indicators helps you avoid hasty decisions.

Tips for Success

- Stay Informed: Keep up with market news that might impact your trades.

- Practice on Demo Accounts: Test your strategy without the financial risk.

- Review and Adjust: Regularly analyze your trades to see what works and what doesn’t.

Choosing the Right Broker

Once you’re ready to trade, make sure you have the right broker by your side.

I’ve personally tested a range of brokers, and I recommend checking out the most trusted Forex brokers.

They offer tight spreads, excellent execution, and a solid support system.

Conclusion

Combining MACD and STC is a game-changer for reliable trend entries.

You get clarity, confidence, and a better chance of hitting your profit targets.

If you’re eager to elevate your trading game, consider checking out my 16 trading bots.

They’re designed to maximize your profits while minimizing risk.

So, what are you waiting for?

Dive into your trading journey with the right tools and strategies!